Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News June 2, 2017

Sensex Opens Firm; Healthcare & Metal Stocks Lead Fri, 2 Jun 09:30 am

Asian equity markets are higher today as Chinese and Hong Kong shares show gains. The Shanghai Composite is up 0.43% while the Hang Seng is up 0.22%. The Nikkei 225 is trading up by 1.39%. US stocks rallied on Thursday with each major of the US indexes touched record highs, after a batch of economic data suggested the economy was picking up speed.

Meanwhile, share markets in India have opened the day on a firm note. The BSE Sensex is trading higher by 151 points while the NSE Nifty is trading higher by 51 points. The BSE Mid Cap and BSE Small Cap index have opened the day up by 0.7% & 0.6% respectively.

All sectoral indices have opened the day in green with healthcare stocks and metal stocks leading the gainers. The rupee is trading at 64.47 to the US$.

Oil & gas stocks opened the day on a mixed note with Hindustan Oil Exploration and Gujarat State Petronet leading the gainers. As per an article in a leading financial daily, the government is planning to combine Hindustan Petroleum Corp Ltd (HPCL) with Oil and Natural Gas Corp (ONGC) by December this year by selling its 51.1% stake in the former to the latter for US$4.5 billion (about Rs 290 billion).

The stake sale is part of India's plan to create a state-held oil giant. ONGC will take majority control of HPCL as part of the government's plan to create an oil major capable of competing with Big Oil.

However, Is Integration of State Run Oil Companies a Good Idea? Richa Agarwal, our oil & gas sector analyst has written a few implications of a merger plan (subscription required) in one of the premium editions of The 5Minute WrapUp. She is of the opinion that until the fine print is out, one should not consider any upsides from this announcement while investing in oil and gas companies.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Although the initial plan was a merger of the two state-owned companies, the current thinking is to let ONGC take over HPCL so that the sale consideration flows to the exchequer in a year the Union budget has set a disinvestment target of Rs 725 billion.

Based on Wednesday's closing price, the 51.1% stake in HPCL is worth nearly US$4.5 billion, the equivalent of 287.7 billion Indian rupees. This will help India to meet 40% of its targeted proceeds from asset sales by the end of the financial year to March 2018, the reports noted.

ONGC share price and HPCL share price opened the day up by 0.6% & 0.5% respectively.

In another development, a leading financial daily reported that, Tata Sons Chairman N. Chandrasekaran is planning to consolidate group firms to weed out duplication and increase efficiency.

Tata Group has nearly 100 companies in its fold. Tata group has diversified into multiple businesses that range from chemicals and fertilisers to auto components and therapeutics over the last 110 years.

Some of these are underperforming, some are not contributing to profits and in some cases, two or more businesses are doing similar things. These are the ones that Chandrasekaran is expected to take a hard look at.

Reportedly, the group has started a process to sell drug discovery services company Advinus Therapeutics drawing interests from private equity funds Kedaara Capital and True North as well as from strategic players, GVK Biosciences and Lambda.

Chandrasekaran is also capping capital exposure in Tata Ceramics, Tata Business Support Services, Tata Asset Management, Tata Autocomp Systems and Tata Chemicals' fertilizer unit, and is increasing investments in high-growth and industry leading businesses. While some assets like Advinus Therapeutics and fertilizer unit will be outright divested, it could be a partial sale or a merger in others like Tata AutoComp and Tata Asset Management.

Tatas High on Control, Low on Equity Stake

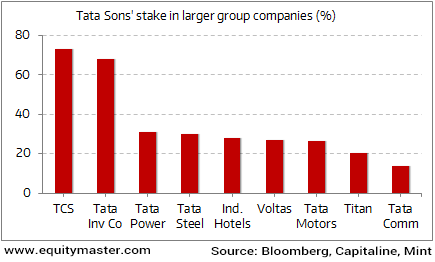

Notably, apart from Tata Consultancy Services and Tata Investment Corp., Tata Sons seems to be very low on direct equity stake holdings. Its stake in most seems to be in the 20% range, which is quite a low number.

Through its low holdings and large cross holdings, the group has for long relied on being high on control but low on actual equity stake.

However, the Tata Group too has some legacy business operations that are struggling. These businesses operate in a hyper-competitive environment and have generated sub-par returns for all stakeholders.

This is exactly what India's super investors look for. And that's when smart money slowly and steadily starts flowing in.

How does one track those superinvestors who patiently wait on the sidelines for such an opportunity? I think, our research analysts Kunal and Rohan might be able to help you out.

Right from promoter activity to bulk and block deals, they'll be tracking the well-known and successful names in the Indian stock markets. To know more about these super investors, download a free copy of - The Super Investors Of India.

Tata group stocks opened on a mixed note with Tata Elxsi and Tata Coffee leading the gains.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Firm; Healthcare & Metal Stocks Lead". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!