Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News May 30, 2017

Sensex Opens Marginally Lower; BHEL Falls Over 7% Tue, 30 May 09:30 am

Asian equity markets are mostly trading in red today. Japanese index Nikkei 225 plunged 106 points, while stocks in Australia retreated and South Korean markets fluctuated. The European markets ended Monday's session with mixed results.

Meanwhile, share markets in India have opened the day on a flat note with a negative bias. The BSE Sensex is trading lower by 28 points while the NSE Nifty is trading lower by 19 points. The BSE Mid Cap and BSE Small Cap index have opened the day up by 0.6% & 0.7% respectively.

Barring healthcare stocks and automobile stocks, all sectoral indices have opened the day in red with PSU stocks and realty stocks leading the losses. The rupee is trading at 64.56 to the US$.

Aurobindo pharma reported a 4% dip in consolidated net profit at Rs 5.32 billion for the fourth quarter ended March 2017. For the full year, the company saw net profit rising 13.7% at Rs 23.01 billion, while total income was up 7.3% to Rs 152.06 billion over the previous fiscal.

Aurobindo pharma share price opened up by 5%.

Engineering stocks opened the day on a negative note with BHEL and EMCO Ltd leading the losses. L&T share price opened the day marginally down after it reported a 29.50% year-on-year (YoY) jump in consolidated profit after tax (PAT) at Rs 30.25 billion for March quarter compared with Rs 23.35 billion for the corresponding quarter of the previous year.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The consolidated gross revenue stood at Rs 368.28 billion, an increase of 12% over last year. Further, the order intake for the quarter at Rs 472.89 billion grew 9.6% over last year, with international orders accounting for 19% of the amount at Rs 90.44 billion.

Additionally, L&T brought cheer to shareholders by declaring a 1:2 bonus issue. The company also raised the dividend to Rs 21 per share from Rs 18.25 declared last year.

However, the company missed the guidance despite lowering it during the course of the year as new orders from the government, particularly from the defence sector, continued to get deferred and execution of existing orders was slowed due to a severe cash crunch.

Going ahead, the company expects government backed infrastructure projects, defence and hydrocarbon orders to drive growth.

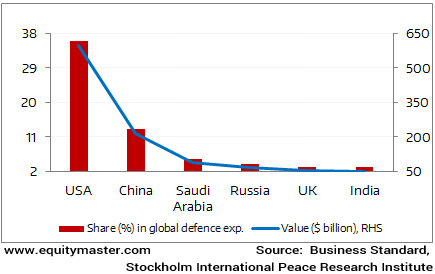

Notably, the defence sector in India is a sunrise sector. India was among the top ten spenders on military expenditure in 2015, ahead of countries such as France, Japan and Germany. The total expenditure of US$ 51.3 billion during the year constituted 3% of the global military expenditure.

India Among Top Defence Spenders in the World in 2015

However, a significant share of the country's defence requirement is still imported. To encourage domestic production of defence equipment, as part of the initiative to boost manufacturing, the government has implemented a number of measures.

Further, L&T expects country's economy to see steady improvement in the current year backed by structural reforms and overcoming of short term demonetisation effects in India. It also believed that supportive monetary policy aided by normal monsoon and contained inflation will provide the requisite stimulus.

BHEL share price fell over 6% after reporting a 57% fall in fourth-quarter net profit on Monday, missing analysts' estimates.

Net profit was 2.16 billion rupees (US$33.47 million) in the quarter ended March 31, compared with 5.06 billion rupees a year earlier.

In the meanwhile, Coal India share price fell 1.7% in early trades after it posted a lower-than-expected fourth-quarter consolidated profit, hurt by higher costs.

Coal India's consolidated profit fell 38% to Rs 27.16 billion (US$421.18 million) in the quarter ended March 31, from Rs 43.98 billion a year earlier. The sharp decline is partly attributed to rise in employee cost due to provisioning for the forthcoming wage settlement for workers and officers which will be effective from last fiscal.

Coal production of the Kolkata-based company, which accounts for more than 80% of the country's output, rose to 176.37 million tonnes in the fourth quarter from 165.24 million tonnes a year earlier.

Further, the world's largest coal miner recently cut its production target by about a 10th to 600 million tonne for the 2017-18.

To know more about the company's financial performance, subscribers can access Coal India's latest result analysis and Coal India stock analysis on our website.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Marginally Lower; BHEL Falls Over 7%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!