Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News May 26, 2017

Share Markets in India Open Flat; Cipla Plunges on Poor Q4 Results Fri, 26 May 09:30 am

Stock markets in Asia are lower today as after major oil producers agreed to extend output cut for an additional nine months at an Opec meeting in Vienna. The Shanghai Composite is off 0.03%, while the Hang Seng is down 0.14%. The Nikkei 225 is trading down by 0.26%. US stocks closed in positive territory on Thursday registering 6th straight session of gains with S&P 500 and the Nasdaq Composite notching record close.

Meanwhile, share markets in India have opened the day on a positive note. The BSE Sensex is trading higher by 34 points while the NSE Nifty is trading lower by 11 points. The BSE Mid Cap and BSE Small Cap index both have opened the day up by 0.4%.

Sectoral indices have opened the day on a mixed note with FMCG stocks and consumer durables stocks leading the gains. While, oil & gas stocks and PSU stocks are witnessing selling pressure. The rupee is trading at 64.51 to the US$.

Pharma stocks opened the day on a mixed note with Cipla and Cadila Healthcare leading the losses. As per an article in a leading financial daily, the United States Food and Drug Administration (USFDA) completed an audit of one of Dr. Reddy's Laboratories Ltd.'s formulation Plant (SEZ) Unit II in Srikakulum, Andhra Pradesh with zero observations.

In April, the US drug regulator had inspected Dr. Reddy's active pharmaceutical ingredients (APIs) manufacturing unit at the same SEZ plant in Srikakulam with no observations.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

After the inspection of yet another API facility at Srikakulam in the month of April, the USFDA had issued Form 483 after making two observations.

In another development, Cipla reported a smaller quarterly loss, in the fourth quarter of the financial year 2016-17. The company's net loss in Q4 narrowed to Rs 0.62 billion (US$9.56 million) from a loss of Rs 0.93 billion in the corresponding period of the previous FY.

Consolidated total revenue of the company increased 6.84% to Rs 3605 billion in the quarter under review, as against Rs 33.74 billion in the corresponding quarter.

Further, the quarter includes a one-off non-cash impairment charge of Rs 21.42 billion related to litigation expenses, and the company also took a provision of Rs 0.56 billion related to its unit Cipla Biotech in the quarter.

Cipla paid back the debt of about Rs 10 billion during the fourth quarter and has forecast research and development expenses of 8-9% of sales in the ongoing financial year.

To know more about the company's financial performance, subscribers can access to Cipla's latest result analysis and Cipla stock analysis on our website.

Moving on to the news from the stocks in aluminium sector. As per an article in a leading financial daily, National Aluminium Company Ltd (Nalco) has signed a memorandum of understanding (MoU) with the Union ministry of mines for setting higher targets in production, turnover and capital expenditure for the current financial year.

As per the MoU, the target for revenue from operations has been fixed at Rs 81 billion (net of excise) which is Rs 7 billion more than the previous year.

Further, 100% targets have been set for the production of both bauxite and alumina i.e. 6.825 million tonne and 2.1 million tonne, respectively. Aluminium production target of Nalco is set at 0.44 million tonnes for 2017-18.

Additionally, the company has a Capex target of Rs 11.58 billion against Rs 8.73 billion achieved in 2016-17. The target is at an all-time high for the company and is expected to push the profitability of NALCO despite an increase in expenses on account of enhanced electricity duty, the reports noted.

Speaking of the aluminum industry, aluminium demand in India has been growing at a decent rate. This is on the back of increased usage of aluminium and its alloys in the automobile sector. However, the aluminium industry has been plagued by a massive oversupply that has put pressure on prices.

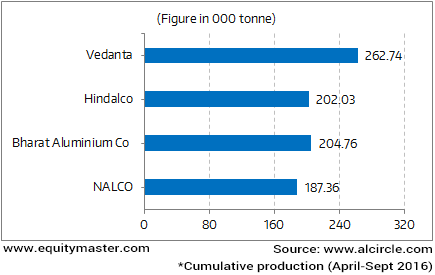

Aluminium Production in 2016

Reportedly, India's aluminium consumption is rising steadily and is estimated to reach eight million tonnes per annum over the next ten years driven by growth in automobile, electricity, building & construction and packaging sectors. The aluminium that is produced here has to meet the costs and environment challenges.

NALCO share price opened the day up by 1.9%

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Share Markets in India Open Flat; Cipla Plunges on Poor Q4 Results". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!