Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News May 19, 2017

Sensex Erases Gains; IT Stocks Drag Fri, 19 May 01:30 pm

After opening the day on a flat note, the Indian share markets have managed to make marginal gains and are trading above the dotted line. Sectoral indices are trading mixed, with stocks in the FMCG sector leading the gains, while stocks in the IT sector are trading in red.

The BSE Sensex is trading down by 32 points (down 0.1%) and the NSE Nifty is trading down by 19 points (down 0.2%). Meanwhile, the BSE Mid Cap index is trading down by 1.1%, while the BSE Small Cap index is trading down by 0.8%. The rupee is trading at 64.92 to the US$.

In news from the banking sector. The Reserve Bank of India (RBI) announced easing up of the branch authorization policy.

In a bid to take banking services to the remote locations of the country, the Reserve Bank of India has permitted the opening of mini branches or banking outlets across the country for all domestic scheduled commercial banks except Regional Rural Banks without having to take permission from the regulator on a case by case basis.

In a fresh set of guidelines released yesterday the central bank said that banks need to open at least 25% of their banking outlets in a year in unbanked rural centers.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The RBI has clarified that ATM kiosks, cash depositing counters and mobile branches will not be treated as banking outlets. They have to be left open for at least 4 hours per day for 5 days in a week manned either by business correspondents or by bank officials.

Further the RBI also widened the role of bank boards, making them responsible for complying with the new guidelines.

Meanwhile, the RBI urged banks to appoint qualified chiefs to head the critical finance and technology functions. The central bank also came out with minimum qualifications for the chief financial officers (CFOs) and chief technology officers (CTOs).

While these are steps in the right direction for better accountability in the sector, the RBI has a lot to do if it plans to strengthen India's banking sector, which is reeling under large non-performing assets (NPAs).

India is going through a severe bad loan problem. Major banks have reported poor numbers in the recent earnings season.

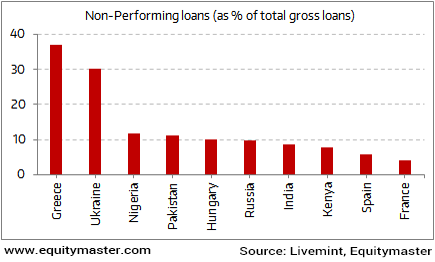

India is Near the Bottom of the Global NPA List

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

Out of the ten major economies facing NPA problems, India is ranked seventh.

The overhang of bad debts has not only hit the bank's profitability, but has also restricted their loan book growth.

The current push by the government and the RBI would go a long way to solve the crisis the country's lenders now find themselves in.

A significant reduction in the number of NPAs will help banks grant new loans and spur the investment cycle. Effectively pushing India's GDP growth.

So how can one take advantage of this opportunity?

We believe a few super investors could provide the clue. These are the guys who've beaten the markets black and blue and have an eye for multi bagger stocks irrespective of the macro environment.

With respect to which super investors to follow, our Research analysts Kunal and Rohan could be of great help courtesy their project, The Superinvestors of India.

To know more about these superinvestors and their stock picking approach, download a free copy of -The Super Investors Of India.

Moving on to news from stocks in the auto sector... According to an article in The Economic Times, Maruti Suzuki's parent, Suzuki plans to invest over Rs 60 billion in its Gujarat factory over the next two years.

The company is planning to double the factory's production capacity and set up a facility for engines through the capital outlay.

The fresh funding - to be made within two years - will ramp up the company's investments in the state to nearly Rs 90 billion, and enhance installed capacity to 500,000 units annually.

This will also enable Maruti and Suzuki's cumulative annual production capacity in India to move beyond 2 million units -1.5 million units at Maruti's two factories in Haryana and 500,000 units at Suzuki's plants in Gujarat.

The management expects to chart double-digit growth 2017-18 on the back of demand for new models and expansion of the Indian economy.

The company sold 1.6 million vehicles last fiscal at a growth of 10% over the last year.

India is the biggest market for Suzuki, which owns 56 % of Maruti Suzuki India - the country's biggest automaker controlling nearly half of the market.

The company has been boosting investment in the country over the past few years and aims to sell over 2 million cars by 2020.

At the time of writing, Maruti Suzuki share price was trading down by 1.4%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Erases Gains; IT Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!