India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News May 12, 2020

Sovereign Gold Bonds, SGX Nifty Performance, ICICI Bank Q4 Result, and Top Cues in Focus Today Tue, 12 May Pre-Open

Indian share markets ended marginally lower yesterday.

Indian share markets surged in early trade yesterday, backed by strong global cues as investors shook off weak economic data and focused on the upcoming earnings season. Buying interest was also seen as investors were anticipating positive outcome from PM Modi's meet with all the Chief Ministers.

Meanwhile, finance minister Nirmala Sitharaman's discussion with PSU banks' chiefs, which was supposed to take place yesterday, has been postponed for later this week.

Speculations were that FM Sitharaman was about to review issues such as credit flow to key sectors like MSMEs and NBFCs, rate transmission to borrowers, and progress under the targeted long-term repo operations (TLTRO) before the second fiscal stimulus package is released.

At the closing bell yesterday, the BSE Sensex stood lower by 81 points and the NSE Nifty closed down by 12 points.

The BSE Mid Cap index ended up by 0.7%, while the BSE Small Cap index ended down by 0.1%.

Sectoral indices ended on a mixed note with stocks in the banking sector and finance sector witnessing selling pressure, while automobile stocks witnessed buying interest.

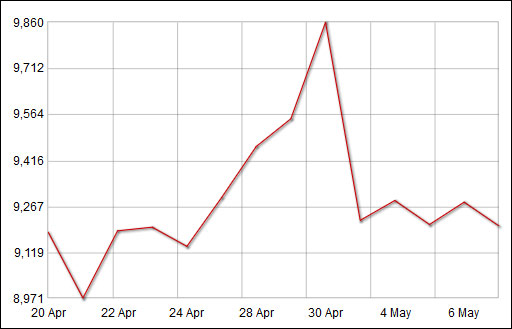

SGX Nifty was trading at 9,223, up by 0.1%, at the time of Indian market closing hours yesterday.

Here's how it has performed over the last few weeks...

SGX Nifty: Over the fortnight

SGX NIFTY is a derivative of NIFTY index traded officially in Singapore stock exchange.

How it performs this week and affects trades in Indian markets remains to be seen.

We will keep you updated about its movement in upcoming market commentaries. Stay tuned.

Speaking of the current stock market scenario, after a sharp rally in the past few weeks, the markets have turned volatile again.

Vijay Bhambwani, editor of Weekly Cash Alerts, has recorded a video about when he expects the stock market to bottom out.

You can check the same here - This is When the Stock Market Will Bottom Out

FPIs Come Back to Indian Equities

Moving on, reversing their two-month selling streak, overseas investors pumped in a net Rs 159.6 billion in the Indian capital markets in the first week of May.

As per latest depositories data, foreign portfolio investors (FPI) infused a net Rs 186.4 billion in equities but pulled out a net Rs 26.8 billion from the debt segment between May 1-8, taking the cumulative inflow to Rs 159.6 billion.

Despite uncertainty looming large over the severity of the possible impact of coronavirus pandemic on the global as well as Indian economy, foreign investors surprisingly changed their stance this week as they turned net buyers in the Indian markets.

Top Stocks in Focus Today

From the travel support services sector, shares of Indian Railway Catering and Tourism Corporation (IRCTC) will be in focus toady as the Ministry of Railways announced that the Indian Railways will gradually restart passenger train operations from today, May 12, initially with 15 pairs of trains.

Hero MotoCorp will be in focus today as the company said it has resumed operations across 1,500 touch-points, including authorised dealerships, across the country. The country's largest two-wheeler maker said that these outlets contribute to around 30% of the company's total domestic retail sales.

Apart from Hero MotoCorp, shares of Tata Motors will also be in focus as reports said that Jaguar Land Rover had restored three-fourth of its budgeted production in China.

Market participants will be tracking Sonata Software share price, Godrej Properties share price and Piramal Enterprises share price as these companies announced their March quarter results (Q4FY20) yesterday.

You can read our recently released Q4FY20 results of other companies here: Ambuja Cement, IndusInd Bank, Axis Bank, Tech Mahindra, Reliance Industries, Marico, Kansai Nerolac, NIIT Technologies, Persistent Systems, SKF India.

ICICI Bank March Quarter Result

ICICI Bank reported a 26% year-on-year increase in net profit to Rs 12.2 billion for the quarter ended March 2020 from Rs 9.7 billion in the same period a year ago.

Excluding COVID-19 related provisions, the net profit would have been Rs 32.6 billion, the bank stated.

The board of the bank approved a proposed to raise up to Rs 250 billion by way of issuances of debt securities, including non-convertible debentures in domestic markets by way of private placement.

It also accorded approval to issuances of bonds, notes or offshore certificate of deposits in overseas markets up to US$3 billion in single or multiple tranches in the next one year.

Gross non-performing assets (NPAs) declined to 5.5% of advances (Rs 414.1 billion) in Q4 of FY20 from 6.7% (Rs 462.9 billion) a year ago.

The year-on-year growth in domestic advances was 13% as of March 2020.

Total deposits increased by 18% YoY. Net interest income increased by 17% YoY in Q4FY20. During the quarter, the gross additions to NPAs were Rs 53.1 billion, while recoveries and upgrades, excluding write-offs, from non-performing loans were Rs 18.8 billion in Q4FY20.

Commodity Talk: Gold Prices in India and Sovereign Gold Bonds

Despite positive global rates, gold prices in India fell yesterday. Gold June futures on Multi Commodity Exchange (MCX) fell 0.2% to Rs 45,673 per 10 grams yesterday.

In global markets, gold prices were higher, holding above key US$ 1,700 per ounce level.

Despite firmer equities and a stronger dollar, gold held firm on worries about a new wave of coronavirus infections as many countries are gradually reopening their economies.

Meanwhile, the second tranche of government of India's gold bonds of this fiscal year opened for subscription yesterday. The subscription will close on May 15.

The price of per gram of gold has been fixed at Rs 4,590 while those applying online and making payment through digital mode will get a discount of Rs 50 per gram.

Sovereign Gold Bonds (SGBs) are government securities which are denominated in the form of grams of gold. They are issued by the RBI on behalf of the Government of India.

Speaking of gold prices, how lucrative has gold been as a long-term investment in India?

The chart below shows the annual returns on gold over the last 15 years...

Gold Has Been a Shining Long-Term Investment

As you can see, barring just two years - 2013 and 2015, gold has delivered positive returns in 13 of the last 15 years.

Here's what Ankit Shah wrote about this in one of the editions of The 5 Minute WrapUp...

- "In fact, gold has delivered double-digit gains in 10 of the last 15 years.

During the entire 15-year period, gold has shot up 555% (compounded annual return of 12.1%).

During the same period, the Sensex surged 511% (compounded annual return of 12.0%). If you include dividends, the Sensex returns would be higher than gold by a couple of percentage points.

One must note that the Sensex returns are not representative of the broader market returns. Moreover, gold was a no-brainer. You didn't have to study financial statements, business models and forecast future earnings growth to get a double-digit return on your investment."

Meanwhile, Apurva Sheth, lead chartist at Equitymaster, talks about a reliable investing signal, which is indicating that gold prices will go higher.

You can know more about it here: The Time to Buy Gold Has Arrived

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sovereign Gold Bonds, SGX Nifty Performance, ICICI Bank Q4 Result, and Top Cues in Focus Today". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!