India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News May 10, 2017

Sensex at Record High; HUL Leads Gains Wed, 10 May 01:30 pm

After opening the day on a positive note, share markets in India have continued the momentum and gone on to reach a lifetime high, comfortably above the 30,000 level. Sectoral indices are trading on a mixed note with stocks in the FMCG sector and stocks in the pharma sector trading in green, while stocks in the realty sector are leading the losses.

The BSE Sensex is trading up by 245 points (up 0.8%), and the NSE Nifty is trading up by 62 points (up 0.7%). Meanwhile, the BSE Mid Cap index is trading up by 0.7%, while the BSE Small Cap index is trading up by 0.8% The rupee is trading at 64.69 to the US$.

In news from stocks in the telecom sector. Bharti Airtel share price jumped 4.3% intraday today despite posting weak March quarter results.

Dragged down by rival Reliance Jio's aggressive pricing strategy, telecom major Bharti Airtel reported a 72% fall in net profits at Rs 3.7 billion for the fourth quarter ended March 31, a second consecutive quarterly decline.

The company had earned net profits of Rs 13.2 billion in the corresponding quarter of 2015-16.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

India's leading telecom operator blamed the predatory pricing by Reliance Jio as a prime reason for decline in revenue and profits.

Revenue fell over 12% to Rs 219.4 billion from a year earlier as data and voice rates fell.

Bharti Airtel's average revenue per user (ARPU) declined 18% to Rs 158 in the period, against Rs 194 in the same period in the previous financial year. Net subscriber additions by Airtel too dropped nearly 1.5% to 7.8 million as of March 31 from 7.9 million in the corresponding period of 2015-16.

However, the telcom major turned a profit in Africa for the first time ever, reporting a net income of US$ 6 million compared with a net loss of US$ 57 million, helped by growth in the data customer base and consumption, with revenue growing 2.6% amid stable currencies in most markets.

The entry of Reliance Jio and the fierce tariff war it has triggered have set off brisk activity in the industry for fundraising and consolidation, as the incumbents look for ways and means to fend off the competition.

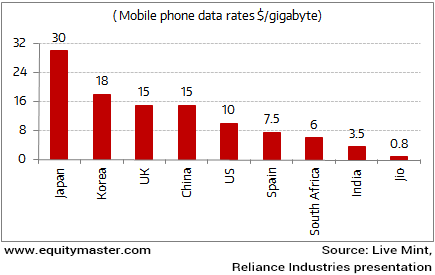

Jio's Data Pricing Disrupts the Telecom Apple Cart

Reliance Jio's disruptive pricing has put immense pressure on the incumbents, as evident from Airtel's results. The telecom industry as a whole also witnessed a revenue decline for the first time ever on a full year basis.

At the time of writing, Airtel share price was trading up by 3.6%.

Moving on to news from stocks in the FMCG sector. Hindustan Unilever (HUL) share price is among the top gainers on the BSE Sensex today. The scrip surged as much as 4.5% to hit record highs after the company's parent Unilever PLC recieved a rating upgrade from a global brokerage firm.

Jefferies raised target price of Unilever PLC to 4,750 GBP from 4490 GBP. Unilever PLC holds over 67% controlling interest in the FMCG major HUL.

Further, market participants expect HUL to improve its operating margins in line with parent, Unilever PLCs margins push for all its subsidiaries.

Unilever has set a target of 3.5-4% operating margin growth over the next 5 years, with the expansion for the CY17 set at 0.8%.

Since India contributes a significant portion of Unilever's profitability, market participants expect HUL to improve its margins as well. However, the market fears that Hindustan Unilever may cut back on marketing costs in the next few quarters to boost margins and profitability.

At the time of writing, HUL share price was trading up by 3.9%, close to its record high.

With stocks hitting their record highs, how can one expect to make money in rising markets?

We believe a few super investors could provide the clue. These are the guys who've beaten the markets black and blue and have an eye for multi bagger stocks irrespective of the macro environment.

With respect to which super investors to follow, our Research analysts Kunal and Rohan have could be of great help courtesy their project, The Superinvestors of India.

To know more about these superinvestors and their stock picking approach, download a free copy of -The Super Investors Of India.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex at Record High; HUL Leads Gains". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!