India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News May 9, 2022

Sensex Down Over 500 Points, Nifty Below 16,250; IndusInd Bank, Tech Mahindra & Tata Motors Top Losers Mon, 9 May 10:30 am

Asian share markets fell today tracking a fall in US markets amid concerns over higher interest rates, with focus shifting to Japanese corporate earnings.

The Nikkei dropped 2.3% while the Hang Seng shed 3.8%. The Shanghai Composite is trading on a flat note.

In US stock markets, a turbulent week ended Friday with more losses and the stock market's fifth straight weekly decline.

Despite strong US jobs report, US markets fell on Friday amid worries the Federal Reserve may cause a recession in its drive to halt inflation.

The Dow Jones dropped 0.3% while the Nasdaq plunged 1.4%.

Back home, Indian share markets are trading deep in the red.

Benchmark indices started today's session with deep cuts as weak global sentiment continued to weigh on equities.

Market participants are tracking shares of UPL, PVR and Vedant Fashions as these companies will announce their March quarter results later today.

Meanwhile, Campus Activewear made its debut on the bourses today.

The IPO of India's largest sports and athleisure footwear brand was open for subscription between 26-28 April as the company raised Rs 14 bn by selling shares in the range of Rs 278-292.

The BSE Sensex is trading down by 572 points. Meanwhile, the NSE Nifty is trading lower by 164 points.

HCL Tech is among the top gainers today. IndusInd Bank and Tech Mahindra, on the other hand, are among the top losers today.

Both, the BSE Mid Cap index and the BSE Small Cap index are trading lower by 1.7%.

Barring IT, all sectoral indices are trading in red with stocks in the metal sector, energy sector and banking sector witnessing most of the selling.

Shares of Power Grid and Coromandel International hit their 52-week highs today.

The rupee is trading at 77.34 against the US$.

Gold prices are trading down by 0.1% at Rs 51,326 per 10 grams.

Crude oil prices are down as investors eyed talks at the European Union on a Russian oil embargo that is expected to tighten global supplies.

Speaking of stock markets, Co-head of Research at Equitymaster Tanushree Banerjee talks about how to create wealth from 1% of listed stocks, in her latest video.

Tune in to the below video to find out more:

Also, speaking of the current stock market scenario, to understand what our readers are thinking, we ran a poll on Equitymaster's Telegram Channel over the weekend.

Here's what we asked our readers...

The BSE Sensex is currently at 54,835. What's your best guesstimate of the Sensex level at close on 31st December 2022?

- 45,000

- 50,000

- 55,000

- 60,000

- 65,000

- Can't say

With a response from over 1,200 participants, here is the final result:

In news from the insurance sector, the government may infuse Rs 30-50 bn additional capital in the three public sector general insurance companies based on their performance and requirement during the year.

According to sources, the capital infusion would help improve the financial health of the general insurance firms National Insurance Company, Oriental Insurance Company and United India Insurance Company.

In the last financial year, the government made a capital infusion of Rs 50 bn to these companies. During 2020-21, Rs 99.5 bn was infused.

The three public sector general insurers are short of solvency margin and to improve operational efficiencies an external consultant will be appointed soon.

Note that the government has already announced its intention to privatise one general insurance company. To facilitate privatisation, the Parliament has already approved amendments to the General Insurance Business (Nationalisation) Act (GIBNA).

Finance Minister Nirmala Sitharaman had announced a big-ticket privatisation agenda in this year's budget, which included two public sector banks (PSB) and one general insurance company.

We will keep you updated on the latest developments from this space. Stay tuned.

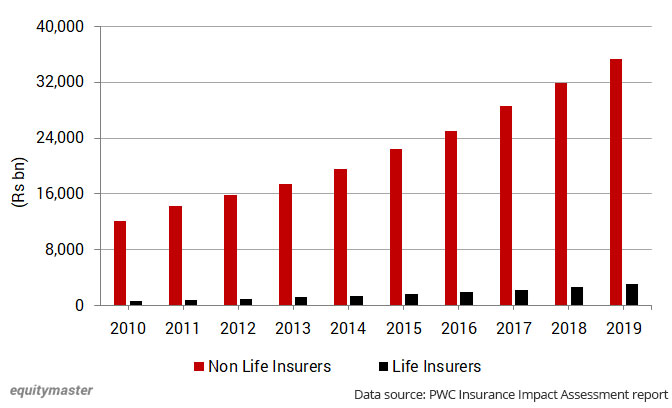

Speaking of the insurance sector, have a look at the chart below which shows the investment assets of non-life insurers and life insurers over the past 10 years:

Investment Assets of Non-Life Insurers 11x That of Life Insurers

As per Tanushree Banerjee, Co-Head of Research at Equitymaster, the above chart is enough proof of how big an earning opportunity is the zero-cost float to the non-life insurers. Their investment assets under management is nearly 11 times that of life insurers.

Moving on to stock specific news...

Federal Bank is among the top buzzing stocks today.

Federal Bank has reported a 13.1% jump in its net profit in the January - March quarter of 2022, aided by lower provisions.

The private lender's net profit in the quarter totaled to Rs 5.4 bn, which was also the highest in a quarter. This compared with Rs 4.8 bn in the year-ago period.

The bank's net interest income increased 7.4% to Rs 15.3 bn in the quarter under review as compared to Rs 14.2 bn in the year-ago period.

Other income dropped 2.6% during the same period to Rs 4.7 bn.

Net interest margin, a measure of profitability of banks, stood at 3.16%, a drop of 11 basis points sequentially. The bank management said other income was impacted by lower treasury gains and loss on revaluations of security receipts.

Provisions dropped to Rs 752.4 m in the reporting quarter compared to Rs 2,544.9 m in the year-ago period.

Federal Bank's asset quality improved with gross non-performing assets (NPAs) dropping 26 basis points to 2.80%. Net NPAs reduced 9 basis points to 0.96%.

Federal Bank share price is currently trading down by 0.8%.

To know more, check out Federal Bank's financial factsheet and its latest quarterly results.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Down Over 500 Points, Nifty Below 16,250; IndusInd Bank, Tech Mahindra & Tata Motors Top Losers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!