India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News May 9, 2017

Sensex Opens in Green; Bharti Airtel In Red Ahead of Q4 Results Tue, 9 May 09:30 am

Asian stock markets were mostly muted in early trade with market participants focused on presidential election in South Korea. The Nikkei 225 is off 0.08%, while the Hang Seng is up 0.34%. The Shanghai Composite is down 0.12%. Stock markets in Europe ended their previous session in red. Meanwhile, US markets notched new all-time highs despite a narrow trading range on Emmanuel Macron's victory over Marine Le Pen in the French presidential election.

Meanwhile, Indian share markets have opened the day on a positive note. The BSE Sensex is trading higher by 60 points and the NSE Nifty is trading higher by 20 points. Meanwhile, S&P BSE Mid Cap and S&P BSE Small Cap are trading higher by 0.2% and 0.5% respectively. Gains are largely seen in realty' stocks, metal stocks and power stocks.

The rupee is trading at 64.21 against the US$.

As per a leading financial daily, Industry body- the Associated Chambers of Commerce and Industry of India (ASSOCHAM) welcoming the government's move to amend the Banking Regulation Act, along with enabling changes in other related laws, has proposed the formation of 'Stressed Assets Funds' (SAFs) with active participation of the cash rich public sector companies to deal with the problem of rising non-performing assets (NPAs) in the banking system.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

As per Industry body, the formation of SAFs will help in the revival of the assets under high leverage and once these assets are brought back to shape, the pay-backs to the SAF can take place. It has further suggested that different forms of the SAFs can be thought of, including some which can be neutral to creating a hole in the government finances.

It further said that some of the cash-rich public sector companies can be encouraged to participate either in the SAFs or take over some of the assets where the present promoter wants to exit and with the green shoots in several of the sectors, this could even be an opportunity for the government or Special Purpose Vehicles to buy assets at much lower valuations.

ASSOCHAM also recommended that adequate working capital should be extended to the existing promoters in cases where the stressed assets or NPAs can be turned back into healthy assets.

Bank stocks are trading strong with Vijaya Bank and Axis Bank share price leading the gains.

Moving on to news from the oil & gas sector. As per an article in The Economic Times, Indian Oil Corporation is in initial talks with Saudi Aramco on downstream investments. This also includes a mega project on its west coast, that could help the OPEC member lock-in customers amid an oil supply glut.

Saudi Aramco is beefing up its overseas portfolio by investing in refineries in major markets to secure an outlet for its crude oil ahead of its initial public offering next year. IOCL plans to invest about US$ 30 billion in five years with the bulk of that meant for fuel upgradation projects and petrochemicals.

Oil producers are targeting growing demand in Asia to boost market share after rising US shale oil output has displaced some of their supplies. India is the world's third biggest oil consumer and plans to build 1.2 million barrels per day (bpd) refinery to petrochemical project in the country's west coast to feed its growing fuel demand.

Reportedly, Indian refiners are raising the share of spot crude in their overall crude intake to benefit from changing market dynamics and quickly capture cheap distress and arbitrage barrels.

IOC share price began the day up 0.9%.

In news from the telecom sector, Bharti Infratel on Monday reported a 17% decline in its net profit at Rs 5.97 billion on a consolidated basis for the fourth quarter ended March 2017. Consolidated Ebitda, however rose by 8% year-on-year at Rs 15.85 billion during the same period.

The company posted a 11% growth in revenue at Rs 35.2 billion for the January-March quarter of 2016-17 fiscal against Rs 31.82 billion in the year-ago period.

Bharti Infratel share price opened up 1.3% on the BSE.

Meanwhile, Bharti Airtel share price is trading down by 0.6% ahead of the Q4 results to be announced later in the day. Analysts expect the company to report a decline in net profit for the quarter impacted by the free services offered from Reliance Jio on the higher subscriber-base.

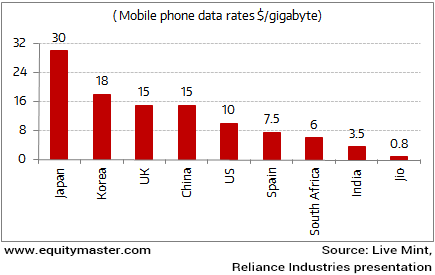

Jio's Data Pricing to Disrupt the Telecom Apple Cart

India Ratings & Research (Ind-Ra) has downgraded the telecom services industry outlook to negative in FY18 on expectations that carriers will be hit harder and for longer spans by Reliance Jio Infocomm's free services.

The rating company said telcos would continue to lose market share to Jio and suffer from poor profitability in FY18 and their debt burden would continue to mount due to spectrum-linked payouts and network-related expenditure.

So how can one make money in a rising market, with little support from earning trends and with brokerages getting it all wrong?

We believe a few super investors could provide the clue. These are the guys who've beaten the markets black and blue and have an eye for multi bagger stocks irrespective of the macro environment.

With respect to which super investors to follow, our Research analysts Kunal and Rohan have could be of great help courtesy their project, The Superinvestors of India.

To know more about these superinvestors and their stock picking approach, download a free copy of - The Super Investors Of India.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens in Green; Bharti Airtel In Red Ahead of Q4 Results". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!