India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News May 7, 2016

The Bear Grip Continues Sat, 7 May RoundUp

Stock markets around the world continued to remain weak over worries of continued slowdown. In the US, poor jobs data from the Labor department pulled down equity markets. Not only did the non-farm payrolls increase below economists' expectations, but the job gains also were the smallest since September. However, the US markets rebounded by the end of the week on hopes that the Fed rate hike may be postponed until September. Therefore, the weekly loss was capped at a mere 0.2%.

Even the European markets were beaten down for the week. The European Commission has forecast that the Eurozone will grow at a pace below expectations and inflation will remain subdued in 2016. The gross domestic product (GDP) of the 19 Eurozone countries is anticipated to increase by 1.6% this year. The projected increase is less than the 1.7% growth of 2015 and 0.1% less than its February predictions. While markets in UK and Germany were down by around 2% each, the France index fell by around 3% for the week.

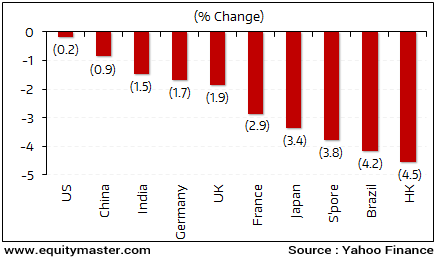

Weak manufacturing data, looming bond defaults and regulatory concerns in China kept Asian indices down. Markets in China and Japan were down by 0.9% and 3.4%, respectively. Back home, the S&P BSE Sensex index ended the week lower by 1.5%.

Key World Markets During the Week

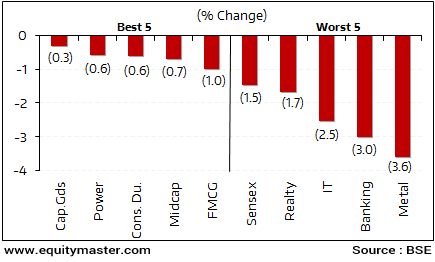

All major sectoral indices ended the week in the red. Maximum selling pressure was witnessed in metal, banking and IT stocks.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

The much awaited Insolvency and Bankruptcy Code, 2016 was passed by the Lok Sabha. Once approved by the Rajya Sabha, the law will arm banks with stringent measures to deal with corporate insolvency. The law will play a critical role in resolving the NPA crisis that has hit the Indian banking system. The law will also help improve India's position in the World Bank's Dong Business ranking.

Due to poor demand, India's gold imports fell by 67.3% YoY to 19.6 tonnes in April 2016 as per data from gold and silver refiner MMTC Pamp. Of the total imports, bullion shipments were at 13.14 tonnes in April this year, down from 54 tonnes in the year-ago period.

The fall in demand for the yellow metal was on account of the jewelers' strike opposing 1% excise duty on non-silver jewellery. The excise hike was proposed in the Union Budget 2016-17. Jewelers went on a strike on March 2, 2016. This lasted for nearly three weeks. The jewelers also protested against the mandatory quoting of the Permanent Account Number (PAN) for cash transactions of Rs 2 lakhs or more.

The credit offtake of scheduled commercial banks grew by 9.7% YoY in the quarter ended December 2015. But bad loans have increased further. The number of wilful defaulters, who have not repaid their loans to public sector banks (PSBs), shot up by 38% in 3 years. The number of wilful defaulters stood at 7,686 at the end of December 2015 as against 5,554 in December 2012. Further, the amount involved in these cases too shot up 2.4 times to Rs 661 billion, compared to around 277 billion earlier.

State Electricity Boards (SEBs) continued to remain saddled with huge debt. The outstanding dues of state utilities payable to central generating power stations increased 16% in the last one year. With this, the amount of dues has touched around Rs 222 billion. This was witnessed despite about 18 states agreeing to join Ujwal Discom Assurance Yojana (UDAY).

The UDAY scheme was brought up by the government to bring a turnaround in the SEBs that have been caught up in a vicious cycle of high debt and operational losses. The scheme allows power distribution companies (discoms) in select states to convert their debt into state bonds. Further, the part of debt not taken over the DISCOMs shall be converted by banks into bonds with a cap on the interest rates. The effect of this initiative is yet to reflect on the financial of power utilities.

Movers and Shakers During the Week

| Company | 29-Apr-16 | 6-May-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE A Group) | ||||

| Shriram Transport Finance | 944 | 1,051 | 11.4% | 1126/737 |

| UPL Ltd | 538 | 593 | 10.2% | 608/342 |

| United Spirits | 2,374 | 2,576 | 8.5% | 3870/2232 |

| Jain Irrigation | 61 | 66 | 7.8% | 79/47 |

| HDFC | 1,089 | 1,168 | 7.2% | 1371/1012 |

| Top Losers During the Week (BSE A Group) | ||||

| Adani Ports & SEZ | 238 | 195 | -18.2% | 375/170 |

| Lanco Infratech | 5 | 4 | -11.5% | 8/ 2/ |

| Adani Enterprise | 87 | 77 | -11.5% | 804/58 |

| SAIL | 47 | 42 | -10.8% | 72/34 |

| Hexaware Technologies | 241 | 217 | -10.2% | 298/203 |

Source: Equitymaster

Let's have a look at some quarterly results announced by companies this week.

Hero MotoCorp Ltd reported a strong financial performance for the quarter ended March 2016. The company's net profit grew by 29% YoY (excluding extraordinary items) during the quarter. The healthy growth was on account of higher sales of motorcycle coupled with several margin improvement measures taken during the period. The company witnessed the highest ever quarterly sales of 1,721,240 units. The company's total income grew by 10.6% YoY to Rs 75.1 billion during the quarter. The operating margins too expanded by 3.3% YoY to 15.7% during the quarter.

The management stated that while there has been a slight improvement in sentiment in the past couple of months, demand in rural India has remained sluggish. While urban market witnessed a growth of 5-7%, the rural markets grew marginally at 1-2%. Reportedly, as much as 30% of total two-wheeler sales come from rural India.

ICICI Bank posted a dismal earnings performance during the March 2016 quarter. While net interest income grew by 6.4% YoY, a steep 415% YoY jump in provisions pulled down net profits by 76% YoY for the quarter. Asset quality woes, particularly in terms of loan restructuring, continued to haunt ICICI Bank in FY16. The gross NPAs (non-performing assets) in absolute terms have gone up by 60% over the past 12 months. Net NPAs rose to 2.7% of advances in FY16, from 1.4% in FY15. The bank made provisions of Rs 36 billion in accordance with the RBI directive this quarter for additional slippages on restructured loans.

Even Axis Bank saw its earnings fall by 1.2% YoY during the March 2016 quarter. The bank's net interest income was up by 19.8% for the quarter. But a 64.6% YoY jump in provisioning led to a fall in net profits. The banks gross and net NPA ratios stood at 1.7% and 0.7%, respectively at the end of the quarter.

Now let us move on to some of the key corporate developments in the week gone by.

With an aim to expand its non-tobacco business, ITC has forayed into the super-premium chocolate segment with a luxury offering branded Fabelle. The chocolates would be sold through boutique stores in its luxury hotels. The box of the assorted chocolates will be sold at an average price of Rs 1,000 each. The chocolates will be manufactured in Bengaluru.

The company has recently shut its cigarette factories again in order to comply with new norms of pictorial health warnings on the pack. The development comes in the wake of the Supreme Court refusing to stay a government order mandating introduction of bigger pictorial warnings. The pictorial warnings will now cover at least 85% of the surface area of the packs, up from 40% and are likely to impact cigarette sales.

ICICI Bank has signed a Memorandum of Understanding (MoU) to establish a strategic partnership with the New Development Bank (NDB). NDB is a multilateral development bank established by the BRICS states namely Brazil, Russia, India, China and South Africa.

As per the terms of MoU, the two banks will consider each other as 'preferred' partners and will harness their respective resource advantages and professional expertise. By doing this, they will build a long-term, stable and mutually beneficial relationship in the areas of bond issuances, co-financing, treasury management and human resources.

Sun Pharmaceutical Industries along with its subsidiaries and International Centre for Genetic Engineering and Biotechnology (ICGEB) have signed an agreement to develop a novel botanical drug for treatment of dengue. Through this agreement, Sun Pharma will follow up on earlier pre-clinical collaboration between ICGEB and erstwhile Ranbaxy Laboratories. Sun Pharma will develop Cipa, a botanical drug following a drug registration process similar to a new chemical entity, consisting of all required in-vitro, in-vivo, pre-clinical and clinical studies meeting all regulatory standards of India and other regulatory agencies worldwide. Sun Pharma will pay royalties on sales post-commercialization.

Coal India Limited (CIL) has reported a 3.4% drop in provisional coal production at 40.09 million tonnes (MT) in April 2016, as against target of 44.48 MT. The company's total off-take for the month of April was down by 2.5% and stood at 42.45 MT as against a target of 51.46 MT. Coal India has decided to go slow on production till its full-to-brim stocks ease and it has enough space to store additional coal extracted from mines. Until demand picks up, the company has decided to expose coal seams and be prepared for increasing production when required.

The global markets are expected to remain volatile over concerns of global slowdown and rate hike by the US Fed. Back home, factors such as monsoons and the agricultural production, revival in rural demand and overall pick-up in the investment climate will also drive the equity markets. But instead of getting carried away by these short term developments, investors need to focus on fundamentals and moats of individual companies.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "The Bear Grip Continues". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!