India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News May 3, 2017

Sensex Opens Marginally Higher; Realty Sector Gains the Most Wed, 3 May 09:30 am

Most of the Asian equity markets are trading in positive territory today. Japan's Nikkei 225 trading higher by 135 points and Hong Kong's Hang Seng surged 81 points. While bucking the trend China's Shanghai Composite slipped 3 points. The European markets eked out gains on Tuesday, as investors sentiment received a lift from the news that Greece agreed to a bailout deal, while US stocks ended their previous session with modest gains.

Meanwhile, share markets in India have opened the day marginally higher following positive global cues from Wall Street. The BSE Sensex is trading up by 62 points while the NSE Nifty is trading up by 27 points. The BSE Mid Cap index opened up by 0.9% while BSE Small Cap index has opened the day up by 0.4%.

Barring FMCG stocks, all sectoral indices have opened the day in green with stocks from power sector and realty sector leading the gains. The rupee is trading at 64.21 to the US$.

In the latest development, it was reported that, global rating agency Fitch Ratings has kept India's sovereign rating unchanged at 'BBB-', the lowest investment grade with a stable outlook, citing a weak fiscal position and difficult business environment.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

According to the report, India is not immune to external shocks, but country's strong external finances make it less vulnerable than many of its peers, but weak public finances continue to constrain India's ratings.

Fitch Ratings, at the same time, acknowledged India's positive GDP growth outlook that stands out among peers. It said that the country's real Gross Domestic Product (GDP) is expected to accelerate to 7.7% in 2017-18.

Meanwhile, the government and some commentators in India have been questioning ratings assigned by global rating agencies arguing the country's fundamentals have improved significantly over the last few years, but this had not been taken into account by the rating firms.

However, according to Fitch, the impact of the reforms programme on investment and real GDP growth will depend on how it is implemented and the extent to which the government continues its strong drive to improve the still-weak business environment.

The agency also expects India's current-account balance to narrow to -0.9% in FY17, and foreign reserves to build up to 8.4 months of current external payments.

Moving on to the news from stocks in steel sector. As per an article in a leading financial daily, Tata Steel UK has completed the sale of its Specialty Steels business to Liberty House Group for a total consideration of 100 million British Pounds.

Reportedly, the acquisition is going to protect 1,700 jobs at three major sites at Rotherham, Stocksbridge and Brinsworth in South Yorkshire, smaller sites in Bolton, Lancashire and Wednesbury in the West Midlands and two distribution centres in China.

The purchase comes after Tata started a wholesale disposal of its loss-making UK steel businesses, including the giant Port Talbot plant - last year as the crisis in the UK steel industry resulted in thousands of job losses. Tata later did a U-turn, instead deciding to hive off parts of the business piecemeal.

Further, Liberty said it will invest up to 20 million British Pounds in new plant and equipment in the first year, which is being relaunched as Liberty Speciality Steels. Liberty House Group has been on an acquisition spree for a while. The company also has plans to make an investment in India though it has not zeroed down any asset so far, the reports noted.

Notably, Tata Steel has invested about British Pound 1.5 billion in its UK business since acquiring Corus in 2007. As per Mr. Tata, in every situation, the capital allocation decisions are always based on maximizing long-term shareholder returns, viz. return on capital employed, return on equity and free cash flows.

So, there has always been, and will continue to be, a strong alignment of interests between the company and the minority shareholders.

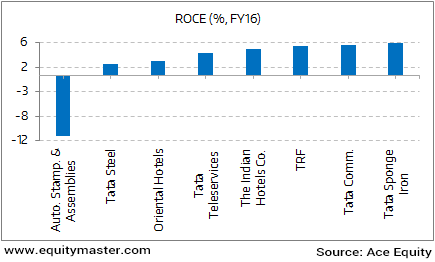

Tata Group: Some Losing Propositions

However, the real reflection of an efficient and competent management is cash flows and returns. If the management does not walk the talk, the company does not make the cut. As you can see in the chart, Tata Steel's UK operations, and a lot of other projects, offer little to support the group's claim regarding the interests of minority shareholders.

Tata Steel share price opened the day up by 0.8%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Marginally Higher; Realty Sector Gains the Most". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!