India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News May 2, 2017

Sensex Opens Firm; Maruti Suzuki Hits 52-Week High on Strong Sales Data Tue, 2 May 09:30 am

Asian shares advanced in morning trade helped by rising optimism on the technology industry in Wall Street. US$ also edged up to one-month high versus the yen. The Shanghai Composite is up 0.32% while the Hang Seng is up 0.27%. The Nikkei 225 is trading up by 0.70%. Meanwhile, US markets closed on a positive note and pushed the Nasdaq Composite to another record high.

Meanwhile, share markets in India have opened the day higher tracking Asian markets. The BSE Sensex is trading up by 103 points while the NSE Nifty is trading up by 25 points. The BSE Mid Cap index opened up by 0.3% while BSE Small Cap index has opened the day up by 0.6%.

All sectoral indices have opened the day in green with stocks from metal sector and realty sector leading the gains. The rupee is trading at 64.22 to the US$.

Maruti Suzuki share price surged 2% after the company posted the best domestic monthly sales in April, selling 144,492 units and registering a 23.4% growth over 117,045 units of April 2016.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Bank stocks opened the day higher with Central Bank and United Bank of India leading the gainers. As per an article in a leading financial daily, State Bank of India (SBI) and Bank of Baroda and private sector lender Axis Bank have reduced interest on fixed deposits on various maturities from the end of April as the banking system is flush with liquidity.

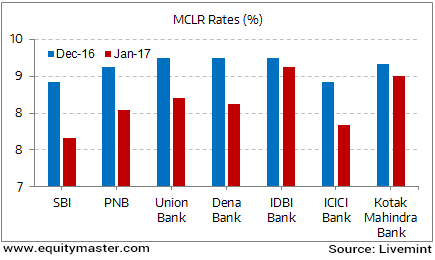

SBI has cut interest rates on term deposits by up to 50 basis points. The revision in interest rates came into effect from April 29 and takes into account the growth in deposits following the merger of associate banks. The bank has also not changed its key lending rates. Its one year marginal cost of lending rate (MCLR) stands at 8%.

Interest Rates Finally Headed Down South?

Since SBI is the largest bank with a market share of close to a fourth of total bank deposits, the reduction in deposit rates could result in other banks following suit.

Subsequently, another public-sector lender, Bank of Baroda, reduced the deposit rate by 10-25 bps on various maturities. The one-year deposit rate will now be 6.9% as compared with 7% earlier. Private sector lender Axis Bank has also revised deposit rate with effect from last Friday.

After the demonetisation move in November, banks have seen a phenomenal jump in saving deposits. However, banks are lowering deposits rates to discourage inflow deposits since the demand for loans has almost dried up.

According to Reserve Bank of India, the surplus liquidity in the banking system was Rs 4.8 trillion in March, though it has come down from its peak of Rs 8 trillion in January.

SBI share price and Bank of Baroda share price opened the day up by 0.7% & 0.5% respectively.

Moving on to the news from stocks in oil & gas sector. As per an article in a leading financial daily, Indian Oil Corporation (IOC) will invest Rs 100 billion over a period of 4 years to make Bharat Stage VI or Euro-6 standard fuel in its Haldia refinery.

Since the Supreme Court has directed the use of Bharat stage VI grade fuel in all the vehicles by 2021, Indian Oil will have to upgrade it quality of production.

In this regard, the entire investment would be divided into phases. The first-phase investment would go in setting up a hydro cracker unit crucial for making superior grade fuel. Further, the unit would augment production capacity from 7.5 million tonne per annum to 8 mtpa.

In the meanwhile, IOC has marginally hiked the price of transport fuels. Petrol price has been hiked by Rs 0.1 a litre and diesel by Rs 0.44 a litre following the fluctuations in crude prices which have been swinging between the push and pull from coordinated output cuts by major producers on one side, and rising US stockpiles on the other.

One must note that, prices were last hiked on April 16 with a Rs 1.39 per litre increase in petrol and Rs 1.04 a litre raise in diesel rates.

State-run oil marketers will roll out a dynamic fuel pricing pilot project from May 1 in five cities where the price of transport fuels would be changed daily so as to better cope with volatility in global crude oil prices. Petrol and diesel prices are currently revised on a fortnightly basis.

Indian oil Corp share price opened the day up by 0.4%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Firm; Maruti Suzuki Hits 52-Week High on Strong Sales Data". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!