India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News April 26, 2017

Indian Indices Trade Near Record Highs; Auto Stocks Lead Gains Wed, 26 Apr 01:30 pm

After opening the day on a positive note, share markets in India have continued the momentum and are trading near their record high levels. Sectoral indices are trading on a mixed note, with stocks in the auto sector and the FMCG sector witnessing maximum buying interest. Stocks in the IT and the telecom sector are trading in the red.

The BSE Sensex is trading up by 155 points (up 0.5%), and the NSE Nifty is trading up by 43 points (up 0.5%). Meanwhile, the BSE Mid Cap index is trading up by 0.2%, while the BSE Small Cap index is trading up by 0.1%. The rupee is trading at 64.07 to the US$.

In news from stocks in the banking sector, India's newest full commercial lender, IDFC Bank's share price soared by as much as 6% in intra-day trade today after the bank reported better than expected numbers in its fourth quarter results.

IDFC bank posted a net profit growth of 7% at Rs 1760 million for the fourth quarter ended March. The corresponding figure in the previous fiscal stood at Rs 1651 million. Income during the quarter grew by a marginal 1% to Rs 5584 million, as against Rs 5,545 million.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

For the whole of 2016-17, profit came in at Rs 10.2 billion, marking completion of the bank's first full year of operations.

Operating income stood at Rs 30.3 billion for the fiscal ended March 2017. The bank had started off in October 2015. So, the year-on-year comparable figure has been annualised.

On asset quality, gross non-performing assets (NPAs) or bad loans and net NPAs at the end of March 2017 were Rs 15.4 billion and Rs 5.8 billion, respectively. Gross NPAs as a percentage of gross advances stood at 3% and net bad loans as a percentage of net advances 1.1%.

Gross non-performing assets during the January-March period declined 57% sequentially to Rs 15.4 billion as against Rs 35.9 billion during the previous quarter. In percentage terms, the asset quality improved to 2.9% for the fourth quarter compared to 7% during the October-December period.

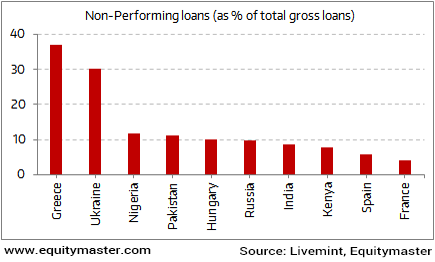

India is Near the Bottom of the Global NPA List

IDFC bank bucked the trend of rising NPAs in India's banking sector. During the quarter, the bank net sold 14 large corporate loans worth Rs 20 billion to asset reconstruction companies (ARCs).

India is going through a severe bad loan problem. Major banks have reported poor numbers in the recent earnings season.

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

Out of the ten major economies facing NPA problems, India is ranked seventh.

Further, according a leading financial daily, a comparison of the NPAs of 25 large Asia-Pacific banks shows that the large Indian banks have the worst NPA ratio when compared to their large cap peers in the region. For FY16, India has been the worst performer with NPAs of 4.6%. Thailand has been the second performer with NPAs of 3.2%.

The overhang of bad debts has not only hit the bank's profitability, but has also restricted their loan book growth. Given the scale of the bad loan problem, the bankers may remain cautious in granting new loans and approving new projects. This may delay India's investment cycle.

At the time of writing, IDFC Bank share price was trading up by 4%.

In news from stocks in the telecom sector. According to an article in The Economic Times, the price wars in the telecom sector are set to sustain in the near term. Reliance Jio is expected to pursue its pricing strategy of sharp discounts and complimentary services for the next 12-18 months in a bid to garner about 15% of India's wireless subscribers, a move that will continue to hurt rivals.

The tactic would lead to pressure on the average revenue per user (ARPU) of incumbent operators. ARPU for Bharti Airtel, Idea Cellular and Vodafone India has been effectively capped at about Rs 300, thanks to Jio's current offers.

In March, Jio set a target of capturing about half of the industry revenue market share by 2020-2021. Airtel had a revenue market share of 33.1%, Vodafone India 23.5% and Idea Cellular 18.7% in the December quarter, while Jio's share stood at 6% of the country's subscribers.

Jio's rate of subscriber addition has dipped, which would be all the more reason for the newcomer to maintain its aggressive pricing.

The company reached the 100 million user mark in the first 170 days, adding consumers at an average of 600,000 a day. By March 31, the subscriber base had risen to 109 million, an incremental 9 million in 40 days or an average of 225,000 per day.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Trade Near Record Highs; Auto Stocks Lead Gains". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!