India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News April 24, 2017

Sensex Opens in Green; Realty Sector Up by 2.4% Mon, 24 Apr 09:30 am

Stock markets in Asia are mixed today following the widely-expected results of the first round of presidential elections in France. The Shanghai Composite is off 1.50%, while the Hang Seng is down 0.29%. The Nikkei 225 is trading higher by 1.32%. The US stocks closed lower in choppy trade on Friday after Trump told the Associated Press he would be releasing a massive tax cut package in the coming week.

Meanwhile, share markets in India have opened the day on a positive note. The BSE Sensex is trading up by 82 points while the NSE Nifty is trading up by 15 points. The BSE Mid Cap index and BSE Small Cap index have opened the day up by 0.4% & 0.5% respectively.

Barring stocks from information technology sector and healthcare sector, all the sectoral indices have opened the day in green with stocks from realty sector, capital goods sector and banking sector leading the gains. The rupee is trading at 64.57 to the US$.

Pharma stocks opened the day on a mixed note with Elder Pharma and Panacea Biotech witnessing maximum buying interest. As per an article in The Economic Times, Dr. Reddy's Laboratories Ltd announced that it has launched Progesterone Capsules, 100 mg and 200 mg. The capsules are a therapeutic equivalent generic version of Prometrium (Progesterone) Capsules in the United States market.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The product has been approved by the US health regulator, United States Food and Drug Administration (USFDA). Prometrium is a registered trademark of Abbvie Products LLC in the US.

According to the IMS Health sales data, the Prometrium brand and its generic capsules had sales valued at US$153 million across the US in 12 months ending February.

In the meanwhile, the USFDA has issued a Warning Letter for Divi's Laboratories Limited's Unit-II at Visakhapatnam. Divi's has responded to the observations with an appropriate remediation process to overcome the deficiencies observed, and also provided periodic updates to the agency, the reports noted.

The USFDA had earlier had issued form 483 with five observations after inspecting the Visakhapatnam unit between 29 November 2016 and 6 December 2016.

However, the company said that it will continue to supply these active ingredients to meet its obligations to the customers.

Speaking of pharma space in India, according to a report by The Hindu Business Line, in spite of the prevailing challenges, the Indian pharma sector is expected to grow up to 45% by 2025 and 58,000 additional employment opportunities are likely to be created in the industry amid the job crisis in India.

Despite the capping of prices, notebandi and GST implementation, all of which are perceived to impact the pharma sector adversely, the industry will continue to grow. In fact, by 2020, the pharma market will be touching US$ 55 billion, with a CAGR of about 15.9%.

Dr. Reddy's Lab share price opened the day up by 0.3%, while Divi's Lab share price opened down by 1.6%.

Moving on to the news from stocks in engineering sector. As per an article in a leading financial daily, Larsen & Toubro (L&T) has signed a deal with South Korea's Hanwha Techwin to supply artillery guns to the Indian army. The deal is estimated to be Rs 4.5 billion (US$696.38 million).

As per the agreement, the first 10 guns will be imported from South Korea and the rest would be manufactured by L&T in India. L&T said that the first 10 guns would be manufactured at the L&T facility at Talegon near Pune. Moreover, the company is setting up a greenfield manufacturing facility at Hazira in Gujarat.

This is the second major deal for artillery guns concluded by the Army recently. Last year India signed a deal for 145 Ultra-Light Howitzers with the US under the Foreign Military Sales program.

This contract marks an important milestone in L&T's defence business (subscription required). It will create synergies not only for this programme but also for upcoming Indian and global programmes. Further, A larger collaboration between the two companies could include future orders from the Army for mobile air defence systems and similar artillery requirements, the reports noted.

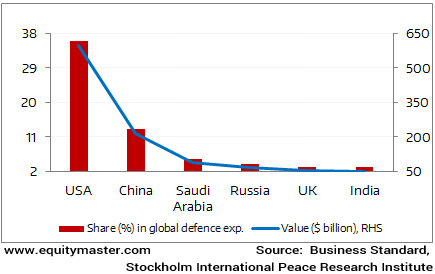

The defence sector in India is a sunrise sector. India was among the top ten spenders on military expenditure in 2015, ahead of countries such as France, Japan and Germany. The total expenditure of $ 51.3 billion during the year constituted 3% of the global military expenditure.

However, a significant share of the country's defence requirement is still imported. To encourage domestic production of defence equipment, as part of the initiative to boost manufacturing, the government has implemented a number of measures.

L&T share price opened the day up by 0.9%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens in Green; Realty Sector Up by 2.4%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!