India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News April 23, 2016

A Good Week for Global Markets Sat, 23 Apr RoundUp

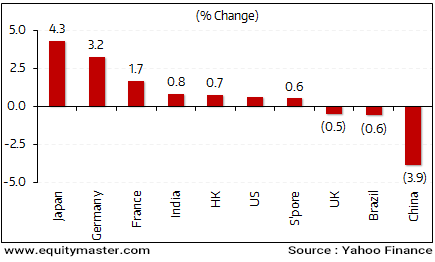

It was a good week for stock markets around the world. The surge in crude prices has boosted sentiment. Despite the failure of the talks between members of OPEC to cap global oil supply, the commodity has continued to rally.

The US market (DJIA) was up 0.6% for the week. However, there is apprehension about the earnings season in the US. Expectation are quite low and many large corporations could report disappointing numbers. The US Fed will meet on 26th - 27th this week. The Fed is expected to keep interest rates unchanged.

The European markets did well this week as the ECB vowed to maintain its accommodative monetary policy. Except the British FTSE, most European indices ended the week in the green. However, fears of Britain leaving the EU are growing bigger every week.

The Indian markets also continued their rally. The BSE Sensex was up 0.8% this week.

Most sectoral indices ended on a positive note. Maximum buying interest was witnessed in metal, and banking stocks.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

India's crude oil production fell for the fourth straight year in 2015-16. This was witnessed even as oil consumption surged 11% in the same period on a YoY basis. A collapse in oil prices coupled with a rapid economic growth has helped push up oil consumption in domestic markets. It was noted that more vehicle purchases, increased use of diesel for irrigation due to weak monsoon and rising air traffic mainly drove up consumption to 183.5 million metric tonne (mmt), compared to 165.5 mmt in the previous year.

However, in contrast, India produced only 36.9 mmt of crude oil in 2015-16, lower than 37.5 mmt in the previous year. These low levels of production coupled with a global supply glut has meant increased oil imports for India in recent times. Also, the country has resumed its unrestricted import of oil from Iran with international nuclear sanctions on Iran being lifted in the last financial year. All of these developments have meant India being more dependent on imports of oil.

India's import dependence on oil rose to 81% in 2015-16 from 78.5% in the previous year. One shall note that last year Prime Minister Narendra Modi has set a target of bringing this down to 67% by 2022.

What one should keep in mind is that increasing import dependence does not bode well for India in the longer term. This is because the increasing oil imports will add constant pressure on the Indian rupee and could have major implications in terms of managing trade balances. We believe that India now needs to focus on becoming self-reliant as far as its energy needs are concerned.

To keep a regular tab on the movements in crude oil prices, you can read weekly updates from the Daily Profit Hunter team here. Their roundup tracks the developments in the global economy as well as currency and commodity markets.

As per an article in Economic Times, the Reserve Bank of India (RBI) has eased the pressure on banks by pruning the list of companies whose loans need to be provided for against the risk of default. This comes as a breather for banks, especially PSUs, that have heavy exposure to highly indebted corporate firms.

This decision is as against the Asset Quality Review (AQR) ordered by the RBI in the December quarter. The central bank had ordered that lenders have to set aside funds against loans given to the corporate firms. On the back of this, many leading state-owned banks reported their highest ever quarterly losses totaling over Rs 120 billion on the back of mounting bad loans during the quarter ended December last year. However, the above development has provided some relief and can aid the results of banks in the March quarter.

The Employee Provident Fund Organization (EPFO) rolled back its decision to tighten provident fund (PF) withdrawal norms. The government had revised the employees provident fund (EPF) norms a few months back. The contribution to the EPF account is done by both parties: the employer as well as the employee.

Earlier, before the revision took place, the employee could withdraw the amount contributed by the employer before the age of retirement. However, with the introduction of new rules the employee was barred to withdraw the amount contributed by the employer before retirement.

This led to huge protests by the trade unions leading to government retracting the new provisions. Earlier the government also rolled back a key budget proposal for only 40% tax exemption of the total corpus of EPF withdrawn at the time of retirement. This would have made the remaining 60% of the EPF's incremental corpus from fiscal year 2017 taxable unless the amount was invested in an annuity product.

Movers and Shakers During the Week

| Company | 42475 | 42482 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE A Group) | ||||

| J&K Bank | 59 | 73 | 23.0% | 118/57 |

| Bhushan Steel | 37 | 43 | 15.0% | 76/33 |

| Future Retail | 134 | 150 | 11.4% | 173/94 |

| Punjab National Bank | 83 | 90 | 9.2% | 181/69 |

| Bank of Baroda | 148 | 162 | 9.1% | 216/109 |

| Top Losers During the Week (BSE A Group) | ||||

| Apollo Tyres | 173 | 163 | -6.1% | 223/128 |

| Wipro | 589 | 558 | -5.3% | 613/509 |

| LIC Housing Finance | 485 | 461 | -5.0% | 526/389 |

| Sriram Transport Finance | 998 | 952 | -4.5% | 1,060/737 |

| Financial Technologies | 91 | 87 | -4.5% | 182/71 |

Source: Equitymaster

Now let us move on to some of the key corporate developments in the week gone by.

Nestle India has reported that its noodle brand Maggi has managed to garner 50% market share in five months of its relaunch. This marks a major upside for the FMCG major that had been hit last year after the ban on Maggi noodles due to alleged presence of excessive lead content.

Further, the company has relaunched vegetable atta noodles and oats variants of Maggi in its efforts to claw back its market share in instant noodles segment. The company's management stated that with this relaunch the company is aiming to provide more choices to suit consumer preferences, driving greater volumes and building back the company's market share.

The company has also partnered e-commerce marketplace Snapdeal for an exclusive preview sale of a special kit for four packs each.

We believe that the above efforts can strengthen the company's portfolio and help the company to further regain its brand image in the coming days.

As we had stated in one of our editions of The 5 Minute WrapUp titled Stop eating 'Maggi'! But don't stop owning it... 'Nestle's Maggi is a very big brand that has ruled the instant food market for decades. Of course, there may be temporary setbacks and the company may have to go into overdrive to protect its image. Competitors like ITC will try to make the best of this controversy and to grab market share from Nestle. But the long term impact of this controversy would be very limited.

Given its immensely strong brand equity, market penetration across the length and breadth of India and financial muscle, it has the essential ingredients to deal with such shocks, take corrective actions and resurrect its brand image.'

The board of Housing Development Finance Corporation (HDFC) has approved a proposal to sell shares of its unit HDFC Standard Life Insurance Corporation (HSLI) to the public for the first time. HSLI is a joint venture between HDFC and Standard Life.

Further, the board has approved to sell up-to 10% stake in HSLI. The divestment is scheduled to take place in the second half of this calendar year. HDFC owns around 61.65% in this joint venture.

Earlier this month, HDFC had sold a 9% stake to Standard Life for Rs 17 billion. This led to Standard Life's holdings increasing to 35%. The proceeds will allow HDFC to free up capital.

State-run GAIL (India) Ltd has been seeking to swap some of its contracted gas supplies from Sabine Pass Liquefaction in the United States to reduce shipping costs. The company wants to swap LNG on a FOB basis with firms that have customers in countries in which LNG trade is not prohibited by US law and sanctions.

In exchange GAIL is seeking equivalent supplies on a delivered basis at Indian regasification terminals at Dahej and Dabhol in western India. GAIL has a contract to buy 3.5 million tonne a year of liquefied natural gas from Sabine Pass on a FOB basis for 20 years. The supplies are expected to begin from the first quarter of 2018.

The company has two US deals - one with Cheniere Energy Partners to buy 3.5 million tonnes a year of LNG from Sabine Pass Liquefaction, a subsidiary of Cheniere, and another a 20-year sales and purchase agreement with Dominion Resources for supply of 2.3 million tonnes per annum. Supplies from both deals begin in 2018. Reportedly, GAIL also holds a 20% stake in Carrizo's Eagle Ford Shale acreage in the US. Of the US volumes, the company has sold 2 million tonnes of LNG to overseas users.

Also, GAIL has successfully completed the first phase of replacement of pipelines in the KG Basin regional network by investing Rs 9.96 billion. The company had suffered a major setback in 2014 following a blast at Nagaram of Mamidikudu Mandal in East Godavari district that resulted in snapping of gas supply to all private power plants in Andhra Pradesh and the AP Power Generation Corporation.

The UK government is ready to take a minority stake of as much as 25% in Tata Steel's UK business. This will be in order to support the sale and offer hundreds of millions of pounds in debt relief as the government is making an urgent bid to stop the Britain's largest steel maker from shutting down.

One must note that Tata Steel has announced to sell its UK operations, called Tata Steel Europe Ltd. The company bought it as part of the takeover of Corus at the height of the commodity boom in 2007 for US$12.1 billion. The business has suffered almost a decade of losses amid poor demand and cheap Chinese imports. Even the Tata's have failed to turn around this business and are finally giving up in it.

My colleague Radhika Pandit, Managing Editor, ValuePro has written a piece on this matter in one of the editions of The 5 Minute WrapUp titled The Perils of Big Acquisitions Spare No One...Not Even the Tata's that makes for an interesting read.

Let's have a look at some quarterly results announced by companies this week

Infosys reported its results for the quarter ended March 2016. The results were above the street expectations. The company posted a revenue growth of 13.3% YoY to US$ 2.4 billion during the quarter. On Quarter on Quarter (QoQ) basis revenues were up by 1.6%. Further, net profits witnessed a growth of 7% YoY and 1.7% QoQ. The operating margins too improved by 0.6% YoY to 25.5%.

The attrition rate too improved to 12.6% from 13.4% at the end of the December quarter. However, the big takeaway from the results was the solid guidance the management forecasted. The management expects its dollar revenue to expand between 11.8% and 13.8% in the year ended March 2017.

Further, the company added 89 clients during the quarter, taking the total number of customers to 1,092. Reportedly, company won large deals during the quarter. These deals are pegged at US$ 757 million, registering a 45% growth over the previous year.

Wipro Ltd announced its results for the fourth quarter and the full fiscal year 2015-16. The actual numbers for the company came in below expectations with the topline of its IT services business growing by 3.7% YoY to US$ 7.35 billion. This was marked as the company's slowest pace of growth since 2009-10.

Revenue of the company grew 9% YoY in FY16 while net income grew 3% YoY. Further, IT Services Revenue grew by 11% on a YoY basis and EBIT grew 2% YoY. For the FY16, the IT services segment revenue grew by 11% on a YoY basis while EBIT in this space grew 2% YoY. For the quarter ended March 2016, revenue of the company grew 12% YoY.

Further, the company said it would buy back up to 40 million shares at Rs 625 a piece, spending up to Rs 25 billion. The company's board also recommended a final dividend of Rs 1 per share, taking the total dividend to Rs 6.

The company's management has set a revenue goal of US$ 15 billion by 2020. To achieve this the company will anchor its efforts on six broad themes. The key themes, as the management stated, include focusing on digital technologies, improving its ability to generate more business from existing clients, hiring more local talent in geographies it operates and hyper-automation. The company will also focus on using its own platforms such as Holmes to boost employee productivity and partner more with start-ups.

IndusInd Bank reported its results for the quarter ended March 2016. The bank posted a higher than the industry growth rate in terms of loan growth, which grew by 29%. Reportedly, growth came in equally from both corporate and consumer loan books that grew close to 29%.

Slippages on account of bad loans increased by around 8% on a sequential basis to Rs 2.7 billion. Reportedly, gross bad loans at 0.87% of advances at the end of March quarter are marginally up from 0.82% at the end of December quarter.

Net Interest income (NII) grew by 37% to Rs 12.6 billion in the March quarter. Strong treasury and trading gains led to a sharp surge in other income, which grew by 31%. The net profits of the company grew by 25% to Rs 6.2 billion

Going forward, India Inc's quarterly earnings will be a key factor influencing investor's sentiments. There seems to be no major triggers from the global markets. However, investors would be best served if they focus on the long-term and invest only in fundamentally strong companies trading at attractive valuations.

And here's an update from our friends at Daily Profit Hunter...

The index opened the week with a gap but has failed to make any headwind after that. It ended the session on a very flattish note every day this week. This indicates that the index may be losing out on momentum as the resistance at 8,000 kicks in. For the week 8,000 remains a strong barrier which the bulls will find difficult to cross. You can read the detailed market update here...

Indian Indices Book Marginal Gains

By the way, we are in a celebratory mood. Yesterday 22nd April 2016, we commemorated Equitymaster's 20th Anniversary!

Our founder, Ajit Dayal, recently wrote about what this achievement and your continued support means to all of us at Equitymaster. Please do read the note Ajit penned for our 20th birthday.

Also, Ankit Shah, in a recent edition of The 5 Minute WrapUp, interviewed Ajit to get some colour on Equitymaster's 20-year journey.

Ajit gave a fascinating glimpse into the long-term vision behind the launch of Equitymaster...and the early stumbling blocks, including the event that nearly killed the company!

Here's a snippet:

- We were part of the evolution of the capital markets. We always wished to be the thoughtful, sensible unemotional view on what was happening in the Indian economy, the global economy, or company earnings and its eventual impact on share prices. We were trying to protect the retail Indian investor from their own emotions of fear and greed and from a well-trained army of financial foot soldiers who were out to grab their wallets.

We believed then that a better informed investor, a well-educated investor, can make sensible returns on their investments in stock markets. We still believe that but with one modification. There is a saying that you can lead a horse to water, but you cannot force it to drink.

In a similar way, I believe that there are many people out there who wish to stay thirsty: They have no desire to learn and understand. They work hard, they save money, then - at some dinner party - they are sold some story and they give away their savings to a smooth-talking financial intermediary. And their wallet is gone. In a bad world, Equitymaster is an open oasis: Those who wish to seek shelter and shade are welcome.

This is just a taster. If you have not read this interview already, we urge you to do so right away...

Our Special 20th Anniversary Gift!

Last but not the least, as we celebrate two decades of guiding investors to smarter investments, we have an exceptional gift for you...

In fact, it is something we've never offered before...

Something that has made Equitymaster one of the most trusted research houses of this country.

Something that could guide you towards benefitting from our long, unparalleled experience in stock market research.

And something, we hope, would be right there with you as long as you are investing in the Indian stock market.

Do click here to know what this gift is all about.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "A Good Week for Global Markets". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!