India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News April 19, 2017

Sensex Trades Flat; NTPC Among Top Gainers Wed, 19 Apr 01:30 pm

After opening the day on a flat note, share markets in India witnessed volatile trading activity and are trading on a flat note with a negative bias. Sectoral indices are trading on a mixed note with stocks in the realty sector and stocks in the power sector trading in green, while stocks in the IT sector are leading the losses.

The BSE Sensex is trading down by 42 points (down 0.2%), and the NSE Nifty is trading down by 14 points (down 0.2%). Meanwhile, the BSE Mid Cap index is trading up by 0.6%, while the BSE Small Cap index is trading up by 0.5% The rupee is trading at 64.50 to the US$.

In news from stocks in the telecom sector. Bharti Airtel share price and Idea cellular share price have continued to reel under pressure from the new entrant Reliance Jio.

Mobile subscriber additions by the incumbents have seen a steady decline since the launch of Jio in September 2016.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

According to the Cellular Operators' Association of India, Airtel witnessed a 5% drop in monthly subscriber additions in October. In November, subscriber additions by Airtel fell to 1.1 million from 2.3 million in the previous month.

Airtel's subscriber additions in December-January revived with a plethora of offers, but declined to 1.3 million in February from 3.6 million in the previous month.

Idea Cellular, too, announced higher data use limits in select unlimited calling plans and is offering additional mobile broadband data for customers who upgrade to 4G handsets.

These offers by the incumbents were designed to counter Reliance Jio's Happy New Year offer announced in December, an extension of its Welcome offer announced in September.

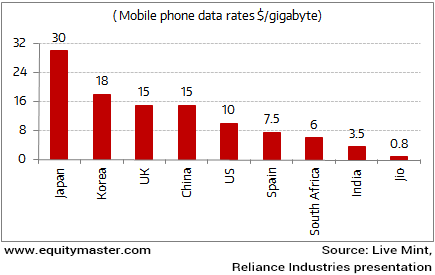

Jio's Data Pricing Disrupts the Telecom Apple Cart

The entry of Reliance Jio and the fierce tariff war it has triggered have set off brisk activity in the industry for fundraising and consolidation, as the incumbents look for ways and means to fend off the competition.

The subscriber decline however is set to slow down as Jio has now started to bill its customers, as opposed to free service in the preceding months. This will take some pressure off the incumbents, which are competing aggressively on price. This should stabilise the market to some extent and help slow the drop in the incumbents' subscriber additions.

Moving on to news from stocks in the power sector. India's largest power producer NTPC has managed to bring down its cost of electricity generation by an average 39.5 paise to below Rs 2 per unit. Whereas cost savings for its Mauda project, came up to Rs 1.65 per unit, mainly because of improvement in coal quality and supply.

Data available with NTPC showed that the overall cost of power generation has come down to below Rs 2 last fiscal, driven by improved quality of coal and its supplies. The overall cost of power generation of the company has come down by 39.5 paise. It does not include taxes and cess primarily imposed to finance protection of environment, the official explained. According to the data, the overall cost of power production for the company stood at Rs 2.01 per unit in 2014- 15, which has declined to Rs 1.94 in April-February of 2016- 17.

The data further showed that NTPC's Mauda project registered an overall fall in cost of power generation at Rs 1.65 per unit, taking into account the impact of revision in levies and charges.

The other plants which gained due to improved quality and supplies of coal are Barh Stage-II (Rs 1.24 per unit), Badarpur (Rs 1.16) and Tanda (93.6 paise). NTPC plants represent a quarter of thermal power generation projects in the country and indicate an encouraging trend in power generation cost.

Meanwhile, the state-owned power generator is considering pooling fixed charges for all its coal and gas-based projects in a move to help maximize output from stations generating low cost electricity, and to reduce consumer tariffs.

Fixed charges of all NTPC coal and gas-based stations shall be pooled, which means all states would pay at the same rate of fixed charges.

NTPC said the proposal will result in lower power purchase cost of all the states. Post pooling, NTPC proposes to put its low-cost stations on optimum utilisation and use its costlier power plants sparingly in reserve shut down.

At the time of writing, NTPC share price was trading up by 1.9%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Flat; NTPC Among Top Gainers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!