India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News April 17, 2017

Sensex Opens Flat; Sun Pharma Loses Mon, 17 Apr 09:30 am

Most Asian equity markets opened lower today. Stocks fell as soft US economic data added to investor concerns. The Shanghai Composite is off 0.94% while the Hang Seng is down 0.21%. The Nikkei 225 is trading lower by 0.31%. The US equities were lower across the board in their previous trading session amid the geopolitical concern.

Meanwhile, share markets in India have opened the day on a flat note. The BSE Sensex is trading up by 19 points while the NSE Nifty is trading down by 7 points. The BSE Mid Cap index and BSE Small Cap index have opened the day up by 0.2% & 0.3% respectively.

Sectoral indices have opened the day on a mixed note with energy sector and realty sector leading the pack of gainers. While fast moving consumer goods stocks and metal stocks have opened the day in red. The rupee is trading at 64.32 to the US$.

Indian Oil Corporation share price surged by 1.6% after it was reported that a memorandum of understanding was signed for the capacity expansion of the Numaligarh Refinery in Assam. The MoU was signed among Paradip Port Trust, Indian Oil Corporation Limited and Numaligarh Refinery Limited.

Under the expansion project, a 28-inch diameter and 1400-kilometre-long crude oil pipeline of 1 MMTPA capacity will be laid for transporting 6 mmtpa of imported crude oil from Paradip Port in Odisha to Numaligarh in Assam.

Mining stocks opened the day on a mixed note with NMDC Ltd and Hindustan Zinc leading the losses. According to an article in a leading financial daily, the national coal quality watchdog has downgraded 177 of Coal India Ltd's (CIL) 413 mines, potentially impairing the monopoly miner's profitability, starting from the current year. The downgrades took effect 1 April.

Owing to this, thermal power companies would be paying less for their coal requirement this month onwards. While the financial impact of this major exercise, both on CIL as well as its customers, is still being worked out, there could be significant monetary loss to CIL and an equivalent gain to its consumers as downgrade of quality means prices would be revised downward.

After years of bickering between power producers and Coal India over grades and quality slippages, the union government agreed to start a process of independent inspection of coal for quality.

From the financial year 2017-18 onwards, the sampling and analysis for the grades of all the seams of the mines will be done by outsourcing mode through government organisations and academic institutions by taking dispatch samples only in presence of Coal Controller officials, the reports noted.

Power shortage is one of the biggest problems faced by the country. Shortage of coal had led to poor electricity generation in the recent past. Distribution of cheap power to attract voters as well as rampant power theft has hit the financials of SEBs over the years.

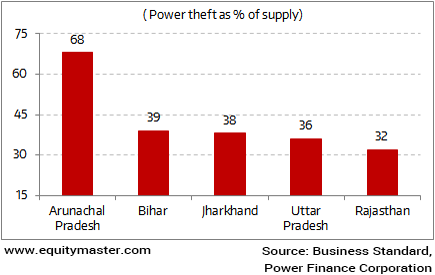

Top 5 States Grappling with Power Thefts

As per a survey by Power Finance Corporation, states that had higher incidence of power thefts as well as consumer complaints faced greater power deficits. States such as Bihar and Uttar Pradesh that have been grappling with huge power cuts incidentally also rank high on power thefts and pending consumer complaints. Therefore, the country's power woes will not come to an end unless SEBs pull up their socks and bring in more efficiency in their operations.

Vivek Kaul has explained the anomaly in the power sector in an interesting piece in his Diary - In Power-Surplus India, Why Power-Cuts are Still the Norm.

Coal India share price opened the day down by 0.5%.

Moving on to the news from stocks in pharma sector. As per an article in a leading financial daily, Cipla said that its joint venture pact with Iranian firm Ahran Tejarat Company has been terminated.

Cipla had announced in December 2016, that Cipla Holding BV had entered into a JV agreement with Ahran Tejarat Company As part of the pact, Cipla Netherlands was to hold a 75% stake in JV firm in Iran while the JV partner was to hold the remaining 25%.

The JV agreement had lapsed as the condition was not met and has been terminated by the mutual consent of the parties. The JV undertook manufacturing and marketing of the pharmaceutical products in Iran.

However, foreign pharmaceutical companies are aggressively targeting opportunities to acquire both businesses and new products, including medicines at different stages in the developmental pipeline.

As the M&A activity has been heating up globally, the M&A activity in the Indian pharma space has been on the rise in recent times. At the end of the day, whether the company is able to derive value from the acquisitions and augment the overall performance will be the key thing to watch out for going forward.

To know more about the company's financial performance, subscribers can access to Cipla's latest result analysis and Cipla stock analysis on our website.

Meanwhile, Dr. Reddy's laboratories share price surged by 2.6% after it was reported that, US drug regulator has completed the audit of active pharmaceutical ingredients (APIs) manufacturing plant at Srikakulam special economic zone in Andhra Pradesh with no observations.

The USFDA has recently issued Form 483 with two observations to DRL's another API facility at Srikakulam. The facility is used for filing new products and is also earmarked for transferring manufacturing of certain existing products.

In another development, Sun pharma share price fell 2.1% after the US FDA issued 11 observations as part of audit to its Dadra unit, the biggest unit after Halol for the company for US supplies.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat; Sun Pharma Loses". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!