India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News April 13, 2016

Buybacks: Good Enough Reason to Invest in a Stock? Wed, 13 Apr Pre-Open

As reported by Business Standard, share buybacks saw an uptick in FY16. During the year, the benchmark indices witnessed a decline of 10%.

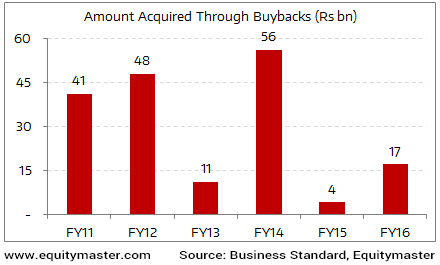

A total of sixteen companies went in for buybacks in FY16. The count a year before stood at ten - when the Sensex rallied by as much as 25%. The chart below shows the value of shares purchased through buybacks over the years. FY16 was comparatively a poor year in this regard. But on a YoY basis, the figure was higher by about 4x.

FY16 Sees an Uptick in Buyback of Shares

Moving on promoter activity, the total value of promoter buying stood at Rs 194 billion between April-December of FY16; during the same period, promoter selling stood at Rs 141 billion.

Clearly, there was an uptick in promoter driven action. But does this uptick in buyback and promoter buying signal higher business confidence? Let us better understand how buyback and promoter holding actually works.

In a buyback, the company purchases its own shares from the market; the result of which is that the number of shares outstanding for the company is brought down. The general perception is that companies tend to buyback their shares when they are available at cheap prices.

Logically, the same should be the case for goes for promoter buying. In bear markets, promoters tend to raise stakes. In bull markets, they tend to shed a portion of their stake by taking advantages of the market forces.

Both this moves - the buyback and promoter buying - are seen as positive signs. Buyback of shares allows a company to use its adequate cash to buy its own shares, thereby lowering the equity base, which leads to higher profit per share for the balance. This tends to bring about an improvement in financial ratios.

Similarly, rising promoter stake in a company reflects his confidence and commitment towards the business. When promoters buy shares of their own companies, they do so because they believe their shares are mispriced and that the outlook looks promising.

This brings us to the focal question on whether such companies are always buying opportunities.

We believe that forming your investment decisions by simply relying on the above activities can be risky. Buyback of shares can be seen as a healthy development for that particular company. However, that should be only one of the criterion that investors should consider. This we say because there could be instances of promoters buying shares to mislead the market. One has to be prudent and diligent in separating the wheat from the chaff and invest only in fundamentally sound businesses run by a committed managements.

Ultimately, it boils down to management integrity, the nature of the business as well as the health of the company's balance sheet. In case these are not as per one's comfort levels, investors would do well to exercise caution while investing in such companies.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Buybacks: Good Enough Reason to Invest in a Stock?". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!