India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 29, 2017

Sensex Continues Momentum; Telecom Stocks Witness Buying Wed, 29 Mar 11:30 am

After opening the day on a firm note, Indian share markets have continued their momentum and are presently trading in the green. Sectoral indices are trading on a positive note with stocks in the telecom sector and capital goods sector witnessing maximum buying interest.

The BSE Sensex is trading up 84 points (up 0.3%) and the NSE Nifty is trading up 24 points (up 0.3%). The BSE Mid Cap index is trading up by 0.2%, while the BSE Small Cap index is trading up by 0.4%. The rupee is trading at 64.93 to the US$.

In the news from the telecom sector, Bharti Airtel has sold 10.3% of its tower arm to a consortium of KKR and Canada Pension Plan Investment Board (CPPIB).

With the above development, the company has concluded the secondary sale of over 190 million shares of its subsidiary, Bharti Infratel, to a consortium of funds advised by KKR and CPPIB for a total consideration of US$ 952 million.

The move is undertaken to slash some of the company's huge debt and bind up for the competition faced by Reliance Jio's low entry tariffs.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Please note that many players in the telecom sector are facing the brunt after Reliance Jio's entry into this space. To catch up the competition, they have started offering similar services. But the aggressive pricing has rarely helped the overall health of these telecom companies.

You can check the financial health of telecom companies by running a query in the Stock Screener section. This gives you the option to run a sector-wise query for top 10 stocks.

Also, Apurva Seth, at Profit Hunter, took a look at the telecom sector recently. And it doesn't look good. Here's Apurva's conclusion after studying the charts...

- Some stocks, like Idea, will fit perfectly into the model and move in a rhythmic fashion...from one phase to another. Keep these stocks on your radar. On the other hand, some stocks may never see the light of the day after going through a downtrend. Avoid these stocks.

If you want to know more about which stocks to keep on radar and which to avoid, it's worth reading Apurva's piece in its entirety. In the news from global financial markets, Britain Prime Minister Theresa May is said to trigger Britain's withdrawal from the European Union (EU) under Article 50 of the EU treaty. This comes as the PM has signed formal Brexit divorce papers today. The development follows June's referendum which resulted in a vote to leave the EU by Britain.

Giving official notice under Article 50 of the Lisbon Treaty, the letter will now be delivered to European Council president Donald Tusk later.

Market participants are gauging how the above negotiations between the Britain and the European Union (EU) will pan out.

While many expect the negotiations unlikely to start soon, there remain concerns about what effect the delay may have on global trade and the Eurozone.

Many are of the view that the delay would eat into the two-year negotiation window for Britain to reach a deal with the EU or crash out on WTO terms, which include tariffs on UK imports to the continent.

Asad Dossani, editor, Daily Profit Hunter, is of the opinion that Brexit will never happen. He's written that British politicians are employing standard delay tactics and their aim is to prevent the Brexit from ever taking place. He's also written on how one can successfully trade political events such as Brexit.

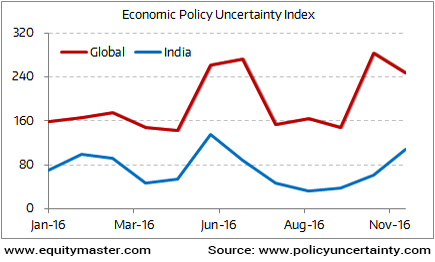

But if Britain divorces from the EU bloc, it'll have major implications for financial markets and exchange rates in the days to come. It will also lead to more global economic uncertainty which, by the way, stood at its all-time high during the start of this year as seen from the chart below:

Global Economic Uncertainty Index at All-Time High

But apart from above, Brexit can alsoaffect the sustainability of India's long term growth story as it will hamper global trade.

Here's a snip from one of the recent editions of Vivek Kaul's Inner Circle (requires subscription) that explains why the EU is the epicenter of de-globalization and shows how it could affect Asia as well:

- The mood is clearly turning in Europe, away from globalisation and towards nationalism. Should even one more country leave the EU, it could trigger a domino effect that quickly leaves the regional bloc standing on shaky ground. And Asia could stand to lose from that

Also, Rahul Shah, editor at Equitymaster, has explained how you should prepare for a post Brexit world.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Continues Momentum; Telecom Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!