India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 28, 2017

Sensex Opens Firm; Bank Stocks Gain Tue, 28 Mar 09:30 am

Asian equity markets are higher today as Japanese and Hong Kong shares show gains. The Nikkei 225 is up 1.07%, while the Hang Seng is up 0.43%. The Shanghai Composite is trading down by 0.26%. The US & European equities closed mostly lower in their previous trading session.

Meanwhile, share markets in India have opened the day on a firm note after the government on Monday introduced four Goods and Service Tax (GST) Bills in Lok Sabha as it aims to roll out the tax regime by July 1. The BSE Sensex is trading up by 148 points while the NSE Nifty is trading up by 50 points. The BSE Mid Cap index and BSE Small Cap index have opened up by 0.3% & 0.4% respectively.

Barring fast moving consumer goods sector, all sectoral indices have opened the day in green with realty sector and banking sector leading the pack of gainers. The rupee is trading at 65.09 to the US$.

Bank stocks are trading mixed with Punjab National Bank and UCO Bank being the most active stocks in this space. As per an article in a leading financial daily, the State Government has signed a memorandum of understanding (MoU) with the State Bank of India (SBI) with the aim to provide banking facilities to people in unbanked areas.

In the first phase, Self-help groups (SHGs) would be engaged as BCs in around 1,000 remote gram panchayats in scheduled areas having no banking facilities. Gradually, it would be extended to 4,000 non-banking GPs and later, it would be extended to the entire state as a supplement to the banking service.

Reportedly, Odisha has become the first state to facilitate financial inclusion and extend banking services in unbanked areas through SHGs formed under Odisha Livelihood Mission (OLM).

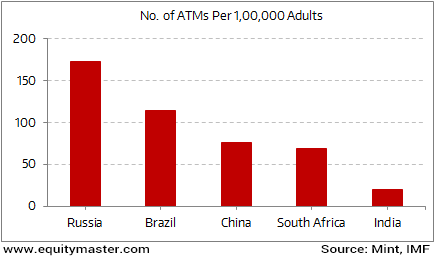

However, the number of ATMs in India are not enough for its huge population. The ratio of ATMs will fall further as more households come into the banking system via financial inclusion. Further, as per the survey was done by the RBI during May 2016, almost one-third of the ATMs in India have been found non-functional.

Banking Penetration a Major Challenge in India

As the above chart shows, during 2015 the penetration of ATMs was quite poor in India when compared to its peers. So apart from financial inclusion, it is critical that the RBI looks into the penetration of banking services as well.

We believe financial inclusion is a non-negotiable step to be taken on the road to becoming an economic power. According to SBI, the size of digital transactions (both PoS and mobile) in the country needs to go up multi-fold before India can even think of becoming cashless. Most banks are moving in that direction. The urban banks will be able to achieve their targets faster. But for a bank like SBI, which is a true reflection of India's financial inclusion, this will take time.

SBI share price opened the day up by 0.1%.

Moving on to the news from stocks in engineering sector. As per an article in The Economic Times, Larsen & Toubro in a joint venture with Shriram EPC has bagged orders worth Rs 7.1 billion in its water and effluent business in Tanzania.

According to the agreement with the Ministry of Water and Irrigation of the United Republic of Tanzania, the engineering, procurement and construction of water transmission pipeline extension will be from Lake Victoria water supply scheme to Igunga Towns, Tabora & Nzegain Tanzania.

The project involves survey, design, procurement, construction, installation of pumping systems, etc., to provide water facilities to Tabora town and other 33 villages. The announcement comes at a time when the construction business is slowly reviving itself and coming out of a three years' crisis.

Meanwhile, L&T's construction arm has also won orders worth Rs 24.9 billion from a premier government organization for the construction of the hospital building, a medical institute, a nursing college, a school for paramedics, an auditorium, hostels, residential quarters along with associated works, in New Delhi.

The scope includes construction of shell and core works. The business has also received additional orders from ongoing jobs.

Diversification continues to help L&T (Subscription Required) negotiate and get better terms and margins for projects. Apparently, this is because it is less desperate to win orders as compared to a company which are present in only a couple of sectors. Its reputation, extensive technical prowess, and large skilled workforce have enabled L&T to command a certain premium from customers and vendors alike.

Whether a further addition to these new projects provides a cushion to its profitability will be an interesting thing to watch out for going forward. Subscribers can access to L&T's latest result analysis and L&T stock analysis on our website.

L&T share price began trading up by 0.3%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Firm; Bank Stocks Gain". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!