India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 22, 2017

Sensex Continues Downtrend; Telecom Stocks Witness Selling Wed, 22 Mar 11:30 am

After opening the day on a negative note, the Indian share markets have continued their downtrend. Sectoral indices are trading on a negative note with stocks in the consumer durables sector, telecom sector and metals sector witnessing maximum selling pressure.

The BSE Sensex is trading down 219 points (down 0.7%) and the NSE Nifty is trading down 70 points (down 0.8%). The BSE Mid Cap index is trading down by 0.9%, while the BSE Small Cap index is trading down by 0.5%. The rupee is trading at 65.48 to the US$.

As per a leading financial daily, the government has made a fresh proposal to limit cash transaction at Rs 2 lakh. The intention here is in line with the proposed Budget measure aimed at discouraging black money through restriction on cash transactions to Rs 2 lakh from Rs 3 lakh.

The above proposal was among 50 amendments moved by the government yesterday to give effect to Budget announcements as Parliament took up discussion on the Finance Bill.

It also forms a part of the government's fight against black money, of which Notebandi formed a key element.

The above move also comes in line with the government's push to boost digital transactions and to make them attractive than cash transactions.

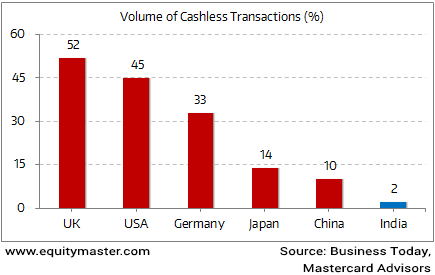

The government expect India to move in the direction of becoming a cashless economy. However, we must question: Will it be in India's best interest to move towards a cashless society?

We don't think so.

The fact is that India is not ready to go digital. We had pointed out some challenges to India's digitisation. Also, Vivek Kaul, in his recent entry in the diary, explains how digital transactions have fallen since December 2016 and why Indians are going back to cash after the demonetisation exercise.

Is India Ready to Go Digital?

We don't know how the above developments will play out. The move towards a cashless society could mean a positive development for India. It will lower costs, improve transparency in transactions, save time, and open up opportunities for some companies. However, we must pause to consider the other side of the coin, and be ready to deal with challenges.

In other news, the government is looking to set up a mechanism for faster resolution of stressed assets in public sector banks.

The government is aiming to come up with a mechanism which will allow state-run lenders to take a bigger haircut on their bad loans without fear of vigilance action.

As per the news, this process is expected to be initiated with the top 50 non-performing assets (NPAs) in the banking sector.

Please note that bad loans of PSU banks have risen at an alarming rate over the past one year.

Rising to the menace of bad debts, the Reserve Bank of India is pondering over initiating tough measures against willful defaulters. While RBI's proactive measure to tighten NPAs is proactive, banks need to take their share of blame. In one of our recent editions of The 5 Minute WrapUp, we had highlighted how the banks' return ratios had deteriorated due to their profits written off on account of NPA provisions.

The RBI has done well to focus its attention on the willful defaulters. However, this seems to be a curative measure than a preventive one. For the bad loans problem to be solved, the root cause i.e. the initial lending process of banks needs to be put in order.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Continues Downtrend; Telecom Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!