India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 18, 2024

Sensex Today Ends 105 Points Higher | IT Stocks Drag | Macrotech Developers Rallies 13% Mon, 18 Mar Closing

After opening the day marginally lower, Indian share markets reversed the trend as the session progressed and ended the day higher.

Equity benchmark indices turned rangebound after a tepid start on Monday.

At the closing bell, the BSE Sensex stood higher by 105 points (up 0.1%).

Meanwhile, the NSE Nifty closed higher by 28 points (up 0.1%).

Tata Steel, JSW Steel and Tata Motors were among the top gainers today.

UPL, Infosys and TCS on the other hand, were among the top losers today.

Further, Tata Group is steering a transformative journey into the electric vehicle (EV) sector. For more details, check Tata EV sector stocks in India.

For a comprehensive overview of key players in the financial sector, check out list of Fin Nifty Companies.

The GIFT Nifty ended at 22,130 up by 34 points.

For impact of the Bank Nifty companies and comprehensive overview of the index, check out Equitymaster's Bank Nifty Companies list.

Broader markets ended the day mixed. The BSE Mid Cap ended 0.1% higher and the BSE Small Cap index ended 0.1% lower.

Sectoral indices are trading mixed, with stocks in auto sector, metal sector and realty sector witnessing selling pressure. Meanwhile stocks in IT sector and FMCG sector witnessed selling pressure.

Shares of solar industries, Crisil and TCS hit their respective 52-week highs today.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

The rupee is trading at 82.9 against the US$.

Gold prices for the latest contract on MCX are trading marginally lower at Rs 65,47 per 10 grams.

Meanwhile, silver prices are trading flat at Rs 75,550 per 1 kg.

Speaking of stock markets, does back of the envelope calculation work in a field like investing as well? Or is it a field where one is required to apply scientific rigor and precision?

Well, if you look at all the great investors like Ben Graham, Warren Buffett, and Peter Lynch, I don't think any of them applied complex mathematical formulae to evaluate their investments.

Co-head of Research at Equitymaster, Rahul Shah show how you can use a simple back-of-the-envelope calculation to decide whether a stock can be considered for investment or whether it should be rejected, in his latest video.

Tune in to the below video:

DroneAcharya Jumps 5%. Here's why

In news from the drone sector, DroneAcharya Aerial Innovations' share price rose 5% in the early trade on 18 March after the company secured a contract to supply IT hardware for the Indian Army's drone lab in Jammu and Kashmir.

The provision of IT hardware, including CPUs, monitors, keyboards, and mice, for the drone lab will contribute significantly to the establishment and operation of this state-of-the-art facility.

This contract represents a significant milestone for DroneAcharya, and we are proud to support defence initiatives that contribute to national security and technological advancement.

The company has also bagged an order for the supply of a Precision Mapping System from Earthtree Enviro and secured a supply order of drone controllers from the Northern Command.

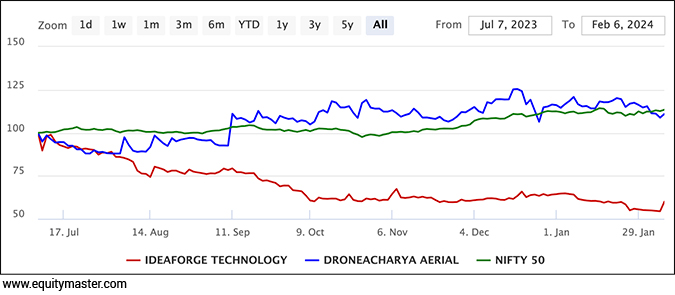

Droneacharya Aerial gave a return of 11% in the last six months, its peer while Ideaforge fell by 40%.

For more details, check out Best Drone Stock: Ideaforge Technology vs Droneacharya Aerial.

Why Tata Steel Share Price is Rising

Moving on to news from the steel sector, Tata Steel's share price jumped nearly 5% on 18 March amid heavy volumes and multiple large deals, buoyed by China's robust industrial output growth.

Nearly 100 m shares of Tata Steel have been traded today, which is more than double the last month's average. As many as 23 m shares have been sold in bunches of large trades.

Other metal stocks were higher too, after China's January-February industrial output expanded 7%.

China's industrial output grew 7% year-on-year in the January-February period, data showed on Monday, accelerating from the 6.8% witnessed in December. This topped analyst estimates by a healthy margin who expected a 5% increase.

The industry expects a restriction on steel imports after it touched a six-year high in the first 10 months of this financial year, led by Chinese shipments, according to provisional government data seen by Reuters on 2 March.

India was a net importer of finished steel, the data showed. The steel demand was strong as the country remained a bright spot globally with robust demand from its construction and automotive sectors.

China, the world's top steel producer, exported 1.75 million metric tons of finished steel to India in the first 10 months of the financial year, a six-year high and an increase of 80% from the same period last year.

In September, India enacted a five-year anti-dumping duty targeting specific types of Chinese steel. In such a case, a domestic government imposes on imports that it believes are priced below fair market value.

LIC Slips below IPO Price

Moving on to news from the insurance sector, shares of Life Insurance Corporation of India (LIC) fell 2.5% to hit a day's low of Rs 902.5 on Monday, 18 March, after witnessing selling pressure for the fifth consecutive session. The scrip opened at Rs 916.5 and plunged 1.5%. In the last five sessions, the insurance player's stock has tanked about 10%.

The stock of India's largest insurer fell on plans to raise wages by around 17% for its 1.10 lakh employees. The hike is set to substantially impact LIC, with an estimated annual implication of over Rs 40 bn. Once the increments are implemented, LIC's annual wage bill will swell to over Rs 290 bn.

In the current financial year, however, inclusive of arrears, the financial implications for the corporation will be higher at Rs 70 bn, taking FY24's total wage bill to Rs 320 bn.

The National Pension System (NPS) contribution is enhanced from 10% to 14% for nearly 24,000 employees who joined after 1 April 2010.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Ends 105 Points Higher | IT Stocks Drag | Macrotech Developers Rallies 13%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!