India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 14, 2017

Sensex Opens Strong After BJP's Landslide Victory Tue, 14 Mar 09:30 am

Asian equity markets are trading lower today with investors anticipating a near-certain rate hike from the Federal Reserve on Wednesday. The Shanghai Composite is off 0.06% while the Hang Seng is down 0.03%. The Nikkei 225 is trading down by 0.07%. Stock markets in the US & Europe finished their previous session on a firm note.

Meanwhile, Indian share markets have opened the day strong as investors cheer the ruling BJP's clean sweep in the Uttar Pradesh assembly elections, along with victories in three other states that went to polls. The BSE Sensex is trading higher by 522 points while the NSE Nifty is trading higher by 150 points. The BSE Mid Cap index and BSE Small Cap index both have opened the day up by 1.7% & 1.3% respectively.

All sectoral indices have opened the day in green with banking stocks and realty sector leading the pack of gainers. The rupee is trading at 66.69 to the US$.

Banking stocks are witnessing buying interest today with ICICI Bank and Bank of Baroda being the most active stocks in this space. State Bank of India (SBI) has announced incorporation of SBI Infra Management Solutions (SBIIMS) to manage its premises and estate-related matters. SBIIMS will be a wholly owned subsidiary of SBI.

The newly formed subsidiary will mainly deal with functions such as project management, transaction management, facility, implementation of policies and advisory services. SBIIMS will mainly look into work related to the premises and estates of the SBI Group only.

Further, SBIIMS will have its circle office in each local head office centre of the bank and about 100 zonal offices at administrative office centre of the bank on pan India basis.

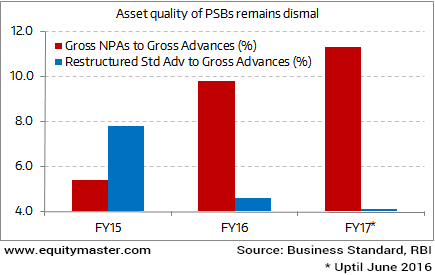

The move is seen as public sector banks' efforts to exit non-core activities to improve balance sheet as they have piled up huge bad assets over the past few years. With strict guidelines from government, many state-owned banks are exiting their non-core activities as well as selling their bad loans to asset reconstruction companies and other financial entities.

Notably, the Indian banking system reported the worst NPA levels among Asian economies in 2015. Vivek Kaul has written extensively about the mess in public sector banks in his Diaries.

Asset Quality of PSBs Still Below Par

While most corporates blame the economic slowdown for the poor asset quality of banks, Vivek offers an alternative perspective. As per him, the real story behind the bad loans of Indian banks is about diversion of funds and willful defaults...

- "As on December 31, 2014, the top 30 defaulters accounted for nearly one third of the bad loans of close to $47.3 billion, which is clearly worrying. Also, many high value loans have gone bad. And they keep piling up. In fact, in a survey carried out by the EY Fraud Investigation & Dispute Services found that 87% of the respondents that included bankers stated that diversion of funds to unrelated business through fraudulent means is one of the root causes for the NPA crisis".

However, given the scale of the bad loan problem, the bankers may remain cautious in granting new loans and approving new projects. This may delay India's investment cycle.

SBI share price opened the day up by 1.3%.

Moving on to the news from stocks in automobile sector. According to an article in a leading financial daily, Mahindra & Mahindra (M&M) announced its decision to divest 7.5% stake from its hospitality and travel wing, Mahindra Holidays & Resorts India Limited (MHRIL) for a value close to Rs 2.74 billion. Based in Chennai, MHRIL is a part of the infrastructure and realty vertical of the Mahindra Group.

Reportedly, the company sold 66,58,565 shares, constituting 7.5% of MHRIL's total share capital, post the approval from the board of directors of M&M.

Further, the sale has been executed at an average gross price of Rs 412.05 per share. Following the sale, the shareholding of the company in MHRIL would come down from 75% to 67.5% of its share capital.

Speaking of the hospitality industry, Bhavita Nagrani, our Research Analyst has compared the financial performance and fundamentals of the companies in this space (Subscription Required). She is of the opinion that most companies in this space do not have healthy financials and even the biggest players have poor return ratios and high debt on their books.

To know more about the company's financial performance, subscribers can access to M&M's latest result analysis and M&M stock analysis on our website. M&M share price opened up by 2.3%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Strong After BJP's Landslide Victory". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!