India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 12, 2016

A Mixed Week for Global Markets Sat, 12 Mar RoundUp

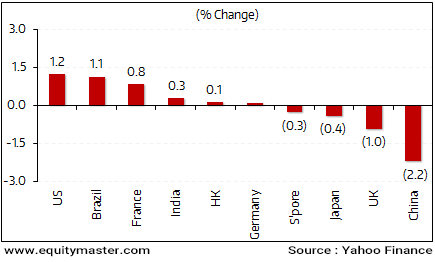

Global markets ended the week mixed. Stocks in the US and Brazil topped the gainers. However, Asian markets were under pressure. The recent economic data from the US is satisfying. The US markets ended higher for the fourth consecutive week. However, markets are worried that positive will cause the US Fed to speed up its's interest rate hikes. The fed will meet this week to decide its next course of action. The US markets have almost erased all their 2016 losses.

The most noticeable event of the week was ECB's decision to cut its benchmark interest rate to zero and its deposit rate further into negative territory to -0.4%. It also, increased its asset purchase program by an additional Euro 20 billion. Surprisingly, the European markets did not respond significantly.

China's equity markets closed lower by 2.2%. Investors seem unconvinced about the Chinese government's new five-year plan which has targeted 6.5%-7% GDP growth.

Back home, the BSE Sensex ended the week up 0.3%. After a sharp run up post the budget, stocks took a breather this week.

Key World Markets During the Week

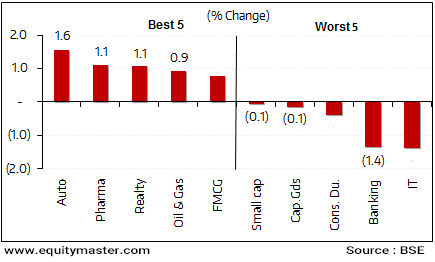

All sectoral indices ended mixed for the week. Buying interest was witnessed in auto, realty, and pharma stocks while IT, and banking stocks led the losses.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

As per an article in Economic Times, the government will shortly launch the Automotive Mission Plan (AMP) 2016-26. The plan is aimed at placing the automobile industry in the league of top three nations in engineering, manufacturing and export of vehicles, and auto components.

The plan aims to propel the Indian auto sector to be the engine of 'Make in India' programme and is said to potentially contribute in excess of 12% of the country's GDP. The government and automobile industry have set an ambitious target of increasing the value of output of the automobile sector to up to Rs 18.89 lakh crore under the AMP 2016-26.

Also, the plan, which has been finalised in consultation with various stakeholders, envisages creation of additional 50 million jobs.

The first AMP was launched for the period of 2006-2016. In the first AMP 2006-16, the auto industry had achieved a target of incremental job creation of 25 million. Further, the country attracted investments topping the target of Rs 1.55 lakh crore from global and local OEMs (original equipment manufacturer) as well as component makers.

We believe that with the above 10-year plan, the Indian automobile sector will be well on its way to take advantage of both the internal as well as external growth opportunities. The plan will foster the growing capabilities of the industry and will mean more capacities in the coming years. Also, it will provide some relief to the exports that have been declining since the past few quarters.

The Union Cabinet has cleared a proposal to amend the mines and mineral law. As per these amendments, the law now allows the transfer of captive mines granted through non-auction route. Earlier the act, allowed transfer of the mining license only for the mines that have been auctioned. Most of the operational limestone mines in India were allotted and not auctioned. This also hindered the mergers and acquisition activities in the cement space.

Amendment of this clause is likely to spur mergers and acquisitions in the cement industry. Given that limestone is a key raw material in the cement-making process, it is difficult to execute the sale of a cement unit without selling the related limestone mines as part of the deal.

Reportedly, cement sector will be the early beneficiaries to the amendment apart from other mining related sectors. Ultratech had recently entered into deal with Jaiprakash Associates for acquisition of 22 million tonne cement capacity. The revised act clears an important hurdle for UtraTech Cement's acquisition of Jaiprakash Associates cement capacity.

The drug price regulator National Pharmaceutical Pricing Authority (NPPA) has sought Rs 45 billion from various pharmaceutical companies for overcharging consumers for drugs. The amount mentioned by the regulator has been sought till February 2016 from 1995, when NPPA was set.

It was noted that there are 1,389 cases where the NPPA has issued notices to pharmaceutical companies for overcharging for medicines. For this, a sum of Rs 49 billion has been demanded as overcharged amount including interest whenever updated. Out of this, Rs 4 billion has been realised till February-end this year.

Minister of State for Chemicals and Fertilisers Hansraj Ahir said that the outstanding amount is Rs 45 billion as on February 29, 2016, and Rs 36 billion, representing about 82% of the total outstanding amount, is under litigation in various High courts and Supreme Court. The NPPA is pursuing these court cases and their settlement would mean a cash outflow for pharmaceutical companies that have been overcharging for medicines.

The ministry of renewable and new energy has offered interest rate rebate and flexibility in the timing of tax payments for small wind power producers. The said offer is given to those producers who will be upgrading their existing plants. Reportedly, the move is in line with the Narendra Modi government's idea of stepping up power capacity by revamping existing projects rather than going for new ones, for which acquiring land and getting green clearances may be time-consuming.

Currently, the power producers that are generating less than one megawatt (MW) of wind power will get an interest rebate of 0.25% from the Indian Renewable Energy Development Agency Ltd. Further, producers will also get the benefit of accelerated depreciation. Beneath accelerate depreciation, 100% of the cost of the plant or machinery can be recognized in one year. The initiative is line with government's commitment to use the renewable sources to generate at least 40% of its power needs by 2030.

Movers and Shakers During the Week

| Company | 4-Mar-16 | 11-Mar-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE A Group) | ||||

| Cairn India | 128 | 147 | 14.9% | 240/107 |

| Unitech | 5 | 5 | 13.5% | 21/3 |

| Torrent Power | 225 | 247 | 10.0% | 253/137 |

| GMDC | 61 | 67 | 9.8% | 120/52 |

| Reliance Infrastructure | 470 | 504 | 7.3% | 622/282 |

| Top Losers During the Week (BSE A Group) | ||||

| Container Corp. | 1,233 | 1,148 | -7.0% | 1,944/1,051 |

| Ipca Labs | 576 | 540 | -6.2% | 888/533 |

| Suzlon Energy | 15 | 14 | -6.0% | 31/13 |

| Emami Ltd. | 1,000 | 943 | -5.7% | 1,378/875 |

| Bank of Baroda | 149 | 141 | -5.4% | 216/109 |

Source: Equitymaster

Now let us move on to some of the key corporate developments in the week gone by.

According to an article in The Economic Times, ONGC Videsh Limited (OVL), an overseas subsidiary of state owned ONGC, along with Indian Oil Corporation (IOC), Oil India (OIL) and Bharat Petroleum is in talks to buy about 35% additional stake in Russia's Vankor oil field in Siberia for close to US$ 3 billion.

OVL had last year agreed to buy 15% stake in Russia's second-biggest oil field of Vankor from Rosneft for US$ 1.26 billion. While the 15% deal is yet to be concluded, Rosneft is reportedly now agreeable to selling a total of 49.9% in Vankor to Indian firms. Of the 49.9% stake offered, OVL will take 26% (including 15% agreed last year) and the rest 23.9% will be split equally between IOC, Oil India and Bharat Petro Resources Ltd (BPRL), a unit of BPCL.

In a separate pact, a MoU for IOC, OIL and BPRL buying a 29% stake in the Taas-Yuriakh oil field in East Siberia is also set to be finalized. The stake in Taas-Yuriakh, which is expected to produce 5 million tonnes of oil annually, may cost around US$ 1 billion, going by Rosneft's deal last year to sell 20% stake in it to BP for US$ 750 million. It is to be noted that Vankor is Rosneft's (and Russia's) second-largest field by production and accounts for 4% of Russian output. It produces around 442,000 barrels of crude oil per day.

The crude oil production from ONGC and joint venture fields during 3QFY16 declined 1.3% YoY, mainly due to lower production from onshore fields. The topline of the company for the quarter declined 1.7% year on year (YoY), while bottomline de-grew by 64% YoY, on a standalone basis. Here is the detailed analysis of the results (Subscription Required).

Tata Power's subsidiary - Tata Power Renewable Energy (TPREL), has signed a Share Purchase Agreement with Indo Rama Renewables (IRRL) to acquire its 100% subsidiary Indo Rama Renewables Jath (IRRJL), which owns a 30 MW wind farm in Sangli District of Maharashtra. The transaction shall be completed within the next few weeks. The wind farm, which is fully operational since July 2013, has executed a long-term power purchase agreement with Maharashtra State Electricity Distribution and is registered under the Generation Based Incentive scheme of Ministry of New & Renewable Energy.

With this acquisition, Tata Power's total generation capacity will reportedly increase to 9,130 MW and its operational wind power generation capacity to 570 MW with wind turbines located across five states - Maharashtra, Rajasthan, Gujarat, Tamil Nadu and Karnataka, which are the leading states in promoting wind power generation in India. TPREL also has 250 MW of wind projects under construction across Gujarat, MP and AP.

Recently, Union Power and Coal minister, Piyush Goyal said he expected an investment of US$1 trillion in the sector by 2030. Additionally, the transmission and distribution sector would see investment worth US$50 billion in the next five years. Industrial equipment would see an investment of US$25 billion over the same period. This comes at a time when the Indian power sector and the companies directly depending on the power industry have been in a mess (Subscription Required).

In news from the engineering sector, Crompton Greaves (CG) stated that it has sold its international transmission and distribution (T&D) business to US private equity firm, First Reserve International. The sale has been agreed at an enterprise value of Euro 115 million (Rs 8.5 billion).

Crompton Greaves stated that it has received and accepted binding letter of offer for the acquisition of the European, North American and Indonesian activities of its power segment division by First Reserve International. The offer is subject to regulatory and shareholder's approvals and the signing of a definitive share purchase agreement.

The sale will allow the company to reduce debt and focus on its faster growing Indian business. Moreover, the company is also actively examining its other international B2B businesses with a view to monetize these businesses to enhance shareholder value.

Crompton Greaves is one of the world's leading engineering corporations. The company's diverse portfolio ranges from transformers, switchgear, circuit breakers, network protection & control gear, project engineering, HT and LT motors, drives, Power Automation Products and turnkey solutions in all these areas. The company has been undergoing a reorganization process of its business across the segments. The company had already announced in the past the demerger of its consumer products business. The Bombay court has approved the scheme to demerge its consumer products business into a separate listed firm. To know our view on the stock of the company, read our analysis of the third quarter results (subscription required).

In the coming week, the big event will be the US Fed's meeting. Markets are eagerly waiting for confirmation that the Fed will go slow with its rate hikes. However, investors would do well to ignore short-term volatility and invest for the long-term in fundamentally strong stocks.

And here's an update from our friends at Daily Profit Hunter...

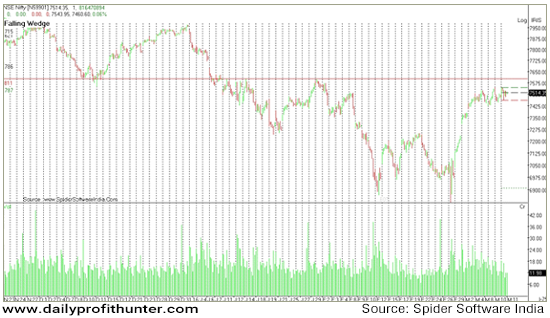

The index consolidated in a tight range for all four trading session of the week. Nifty has restricted itself in boundaries of 7550 and 7440 for most of the time during the week. This range will restrict Nifty's moves on an immediate basis. On a slightly longer timeframe the level of 7,600 will act as strong resistance while 7,200 will act as support. You can read the detailed market update here...

Indian Indices Finish the Week on a Positive Note

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "A Mixed Week for Global Markets". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!