India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 7, 2017

Sensex Remains Sluggish, Tata Steel Continues to Slide Tue, 7 Mar 11:30 am

After opening the trading day on a flattish note, Indian share markets continue to trade near the dotted line amid mixed Asian markets. Gains are largely seen in consumer durables stocks and power stocks. Meanwhile, metal sector and healthcare sector and banking sector trade in red.

The BSE Sensex is trading lower by 55 points and the NSE Nifty is trading lower by 20 points. The BSE Mid Cap index is trading up by 0.2% while the BSE Small Cap index is trading lower by 0.2%. The rupee is trading at 66.76 to the US$.

Tata Steel share price slipped nearly 2% as the company announced that it remains in "constructive discussions" with Germany's Thyssenkrupp AG for a potential merger of the two companies' steel businesses in Europe. The merger talks had been revealed by the Tata Steel last year as part of a major restructuring of its UK steel business.

Pharma stocks are trading on mixed note with Panacea Biotech and Elder Pharma witnessing majority of the buying momentum. According to a leading financial daily, Lupin is in talks with Sanofi's generic arm, Zentiva, to acquire Pulmojet, its dry powder inhalation brand.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Reportedly, the two companies have been negotiating a deal for the last few months and a final transaction will help Lupin sharpen its global inhalation therapy business. Meanwhile, Lupin is already developing nine compounds in the inhalation segment.

One must note that, Pulmojet was acquired by Zentiva from Siegfried in 2010. The device is known for patient convenience due to its dose feedback mechanism.

Further, Lupin clocked global sales of US$ 2.1 billion in 2016, a CAGR of 19% over the last decade (Subscription required). But like most other top tier Indian companies, Lupin is relying on building a specialty focus in inhalation products, the reports noted.

Infact, as per the reports, the respiratory and inhalation business has the potential to grow in markets like US. But to succeed, Lupin will need a superior product and invest heavily in research of new products and rope in to notch marketing talent.

In this regard, recently, in one of our editions of The 5 Minute WrapUp, we have spoken about the USFDA crackdowns faced by the Indian Pharma in the recent times and how they have been constantly investing towards R&D. We believe pharma companies that are upgrading and keeping facilities compliant, and have niche product pipelines in place will see sustained revenue growth.

Lupin share price is trading down by 1% on the BSE.

Moving on to news from stocks in banking sector. According to an article in The Economic times, Punjab National Bank (PNB) will put on sale four bad assets worth Rs 2.95 billion in a move to shed non-performing assets from its books.

Reportedly, the bank has identified assets worth Rs 18 billion that will be sold by month-end to recover bad loans. The reserve price has been fixed at Rs 1.95 billion on cash basis while on security receipt (SR) basis, it is Rs 2.16 billion.

The highest NPA of Rs 1.12 billion belongs to Ahmednagar-based loss making Tilaknagar Industries. Other accounts include Rs 1 billion from Mumbai-based Om Shiv Estate; Rs 0.56 billion from Bilcare Ltd and Rs 0.26 billion from Anand Distilleries.

Selling of bad loans to assets reconstruction companies, non-banking financial companies, other banks or financial institutions is pertinent for PNB whose gross non-performing assets (NPAs) stood Rs 556.27 billion as on 31 December 2016. In FY 2015-16, PNB posted net loss of Rs 39.74 billion due to high level of stressed assets as well as stringent RBI rules that required higher allocation to cover bad loans.

Notably, the Indian banking system reported the worst NPA levels among Asian economies in 2015. Vivek Kaul has written extensively about the mess in public sector banks in his Diaries.

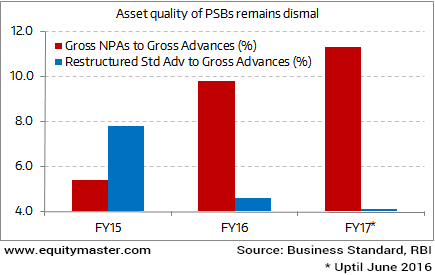

After the mandatory asset quality review by the Reserve Bank of India in the latter half of FY16, PSBs were compelled to recognise risky restructured assets as bad loans and provide for them. This led to a significant amount of restructured advances getting converted into gross non-performing assets (NPAs) or bad loans.

Asset Quality of PSBs Still Below Par

While most corporates blame the economic slowdown for the poor asset quality of banks, Vivek offers an alternative perspective. As per him, the real story behind the bad loans of Indian banks is about diversion of funds and willful defaults...

- "As on December 31, 2014, the top 30 defaulters accounted for nearly one third of the bad loans of close to $47.3 billion, which is clearly worrying. Also, many high value loans have gone bad. And they keep piling up. In fact, in a survey carried out by the EY Fraud Investigation & Dispute Services found that 87% of the respondents that included bankers stated that diversion of funds to unrelated business through fraudulent means is one of the root causes for the NPA crisis".

Punjab National Bank share price is trading up by 0.2%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Sluggish, Tata Steel Continues to Slide". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!