India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 6, 2017

Sensex Remains Strong; Energy Stocks Gain Mon, 6 Mar 01:30 pm

After opening the day firm, share markets in India have continued the momentum and are trading comfortably above the dotted line. Sectoral indices are trading on a mixed note with stocks in the energy sector and stocks in the power sector leading the gains, while stocks in the IT sector are trading in red.

The BSE Sensex is trading up by 132 points (up 0.5%), and the NSE Nifty is trading, up by 36 points (up 0.4%). Meanwhile, the BSE Mid Cap index is trading up by 0.4%, while the BSE Small Cap index is trading up by 0.5%. The rupee is trading at 66.74 to the US$.

Coal India share price rallied over 2% and was one of the top percentage gainers in the morning trade today. The surge comes as one of its fully owned subsidiaries approved a share buyback plan.

State-run Coal India's stock climbed as the company's fully owned arm Central Coalfields Ltd (CCL) approved a share buyback plan worth Rs. 10 billion, following a government directive.

This comes in only a few days after another one of Coal India's fully owned subsidiaries South Eastern Coalfields Limited (SECL) approved a share buyback plan worth Rs 12 billion.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The CCL board considered and approved a buyback of 521,000 fully paid equity shares of face value of Rs 1000 each from the members of CCL through a tender offer. The shares are proposed to be bought back at a price of Rs 19,230 per share, totaling Rs 10 billion.

The equity shares proposed to be bought back by CCL stand for 5.5% of its existing paid up share capital. The maximum permissible limit for the same is up to 25% of the company's paid up share capital.

According to an article in the Economic Times, a government directive has asked profit-making subsidiaries of Coal India to undertake share buybacks this year in addition to the regular dividends they pay to Coal India. As part of this directive, the profit-making subsidiaries of Coal India have committed around Rs 60 billion.

The government remains the biggest stakeholder in Coal India, with a shareholding of almost 80%, and stands to benefit the most from the share buyback by its wholly owned subsidiaries.

The government is exploring ways at shoring up its revenues and is leaving no stone unturned in exhausting its options through buybacks, steep dividends from PSUs, and other instruments.

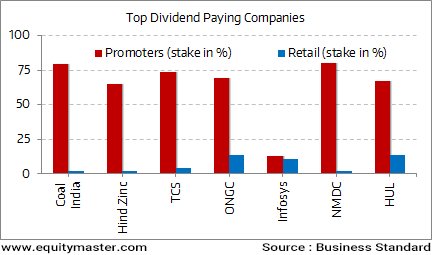

Promoters Get the Major Chunk of the Dividend Pie

Earlier this fiscal, the government had raised about Rs 7.9 billion through share buyback of MOIL. The government has so far raised about Rs 300 billion through minority share sale by way of offer for sale, share buyback and CPSE ETF so far in the current fiscal.

Moving on to news from stocks in the pharma sector. Cipla share price was in focus today, with the stock rallying over 1% in the morning trade as the company entered into an agreement to sell its animal health business in South Africa and sub-Saharan Africa.

Cipla entered into agreements, through its wholly owned subsidiary Inyanga Trading 386 Proprietary with the group companies of Ascendis Health, South Africa for divesting its animal health business for 375 million rand (about Rs 1.9 billion).

The total consideration of 375 million South African rand, comes with a potential revision linked to FY17 performance along with customary adjustment (within the price band of 250-500 million rand) in relation with working capital and net debt/cash adjustments.

Cipla has taken the strategic decision to divest and sell its veterinary division. In line with this new strategy, Cipla will have a more intensive approach to grow the portfolio of pharmaceutical products in the South African healthcare sector.

In the quarter to December, the company's South African business clocked a revenue of Rs 4.9 billion, accounting for 14% of the total sales of Rs 36 billion.

The company has been working to rationalize its markets and portfolio, and exit non-core, low-profit businesses. As part of this strategy, it plans to sell its consolidated animal health business, under Cipla Vet, which supplies products to over 100 countries.

Cipla does not provide specific financial details for its veterinary business and has classified this segment under the 'others' category in its earnings presentation.

The category accounted for 2-3% of the company's total consolidated sales of Rs 136 billion in 2015-16.

At the time of writing, Cipla share price was trading up by 0.4%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Strong; Energy Stocks Gain". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!