India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 29, 2024

Sensex Today Ends 195 Points Higher | PSB Index Up 2% | Berger Paints Rallies 10% Thu, 29 Feb Closing

After opening the flat, Indian share markets turned positive as the session progressed and ended the day higher.

After staying listless for first half of the session, equity benchmark indices picked momentum and ended up to 0.4% higher on Tuesday.

At the closing bell, the BSE Sensex stood higher by 195 points (up 0.1%).

Meanwhile, the NSE Nifty closed higher by 31 points (up 0.11%).

Adani Enterprises, M&M and Adani Ports were among the top gainers today.

Apollo Hospital, Bajaj Auto and UPL on the other hand, were among the top losers today.

For a comprehensive overview of key players in the financial sector, check out list of Fin Nifty Companies.

The GIFT Nifty ended at 22,209 up by 324 points.

For impact of the Bank Nifty companies and comprehensive overview of the index, check out Equitymaster's Bank Nifty Companies list.

Broader markets ended the day higher. The BSE Mid Cap ended 0.8% higher and the BSE Small Cap index ended 0.4% higher.

Barring healthcare sector all other sectoral indices are trading higher, with socks capital goods sector, power sector and metal sector witnessing most buying.

Shares of Tata Investment, KIMS and Zomato hit their respective 52-week highs today.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

The rupee is trading at 82.92 against the US$.

Gold prices for the latest contract on MCX are trading marginally higher at Rs 62,295 per 10 grams.

Meanwhile, silver prices are trading flat at Rs 70,785 per 1 kg.

Speaking of stock markets, in the latest video, Hidden Treasure, Richa Agarwal shares her views on the road ahead for smallcaps, a prudent strategy to navigate it and alerts on six smallcaps that have witnessed insider buying interest.

These are the smallcaps with decent financial performance and where the current price is almost at par or at a discount from the average price at which insiders have purchased.

Tune in to below video for details.

Sony Withdraws Merger Application

In news from the media sector, Sony Pictures Networks India, on Thursday, withdrew the merger application it had filed with the National Company Law Tribunal (NCLT) for the merger of its business with Zee Entertainment Enterprises.

Sony terminated its two-year-long merger talks with Zee on 22 January, putting an end to the process that would have created a US$ 10 bn media behemoth.

Sony entities Culver Max and Bangla Entertainment had also terminated their merger agreement with Zee on 22 January, citing unfulfilled conditions, and sought a US$ 90 million (m) termination fee from Zee.

On 24 January, ZEEL said that it had moved the NCLT and the Singapore International Arbitration Centre (SIAC) against Sony Pictures Network India's (SPNI) termination of the merger deal.

The company also said that it had approached the Mumbai bench of the NCLT, seeking directions to implement the merger scheme.

Sony Group companies had requested SIAC to prevent ZEEL from seeking legal remedies from the NCLT or other Indian or international courts until the arbitration proceedings are completed.

However, SIAC's emergency arbitrator denied interim relief to the Sony group, stating it has no jurisdiction to prevent Zee from approaching the NCLT.

Zee Entertainment shares are down almost 30% since the termination of the merger.

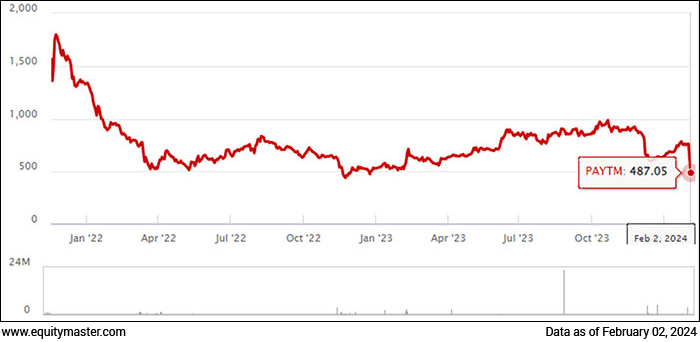

Softbank Pares Stake in Paytm

Moving on to news from the fintech sector, SoftBank sold more than 13.7 million shares, or about 2.2% in Paytm, in the open market over the past month, even as the fintech major's stock price took a beating due to a regulatory crisis.

With the latest sale, the Japanese investor's stake in Paytm's parent, One97 Communications, has been pared down to 2.8%.

SVF India Holdings (Cayman) Limited has disposed of an aggregate of 13,784,787 equity shares of One97 Communication Limited in a series of disposals undertaken between 23 January 2024 and 26 February 2024, with a disposal on 26 February 2024 breaching the 2% threshold.

According to sources, SoftBank was looking to eke out a slim net gain on its Paytm investment, but the drop in the stock's price due to the RBI action has led to a situation where the Japanese investor is now staring at a loss of US$ 100-150 million (m) on one of its biggest India bets.

SoftBank had previously disposed 12,706,807 equity shares between 19 December 2023 and 20 January 2024 at about Rs 9.5 bn, paring its stake to about 5% from 7%.

The Paytm stock took a beating after the RBI crackdown on Payment Payments Bank on 31 January.

It tanked around 60% before recovering a bit by hitting the 5% upper circuit for several sessions back-to-back.

For more, check out Paytm Shares Tread Troubled Waters: These Mutual Funds May Feel the Impact.

Why NBCC share price is rising

Moving on to news from the real estate sector, shares of NBCC traded higher intraday on 29 February after the company executed the e-auction of approximately 61,000 sqft commercial built-up area at Ayurvigyan Nagar in New Delhi.

The basic sale price of the project is Rs 36,000 per sqft, and the total deal is valued at Rs 2.7 bn.

Grid Controller of India Ltd (a PSU under the Ministry of Power) participated in the auction and secured the deal.

The commercial space sold through e-auction is part of a redevelopment project being executed by NBCC for AIIMS Delhi.

The proceeds received from the sale will be utilised for the construction of houses for faculty and staff members of AIIMS Delhi.

The project, popularly known as Grande Rue, has 3 levels of basement adequate for parking 150 cars and consists of ground+3 storeys of commercial built-up spaces.

In another development, a wholly owned subsidiary HSCC (India) has been awarded the work of 600 Bedded General Hospital, 250 Bedded Govt. of 459.7 Cancer Hospital, 250 Bedded Super Maharashtra Specialty Hospital at Kolhapur, DMER, Maharashtra. The approximate value of the order is Rs 4.6 bn.

Earlie this month, the company obtained the in-principle approval of Greater Noida Authority for the development of unused and purchasable FAR in furtherance of existing projects of Amrapali valuing Rs 100 bn.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Ends 195 Points Higher | PSB Index Up 2% | Berger Paints Rallies 10%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!