India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 28, 2023

Sensex Today Trades Flat as Metal Stocks Fall | Adani Total Gas, Adani Green & Adani Transmission Down 5% | Airtel Crosses 10 million 5G-Users Tue, 28 Feb 10:30 am

Asian share markets edged higher today, tracking similar gains in the US as investors continued to weigh the potential for a soft landing given expectations for higher interest rates.

The Nikkei is up 0.2% while the Hang Seng is trading up by 0.4%. The Shanghai Composite is trading higher by 0.1%.

US stocks eked out minor gains on Monday as investors engaged in some bargain hunting after last week's losses, the biggest percentage declines of 2023 for Wall Street's main benchmarks, as jitters persisted about coming interest rate hikes to tame stubbornly high inflation.

The Dow Jones Industrial Average ended 0.2% higher while the tech heavy Nasdaq Composite edged up 0.7%.

Here's a table showing how US stocks performed on Monday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 90.1 | 0.75 | 0.84% | 90.45 | 89.61 | 144.16 | 83.45 |

| Apple | 147.92 | 1.21 | 0.82% | 149.17 | 147.45 | 179.61 | 124.17 |

| Meta | 169.54 | -0.85 | -0.50% | 173.12 | 169.06 | 236.86 | 88.09 |

| Tesla | 207.63 | 10.75 | 5.46% | 209.42 | 201.26 | 384.29 | 101.81 |

| Netflix | 323.03 | 5.88 | 1.85% | 330 | 322.12 | 397.75 | 162.71 |

| Amazon | 93.76 | 0.26 | 0.28% | 94.78 | 93.14 | 170.83 | 81.43 |

| Microsoft | 250.16 | 0.94 | 0.38% | 252.82 | 249.39 | 315.95 | 213.43 |

| Dow Jones | 32,889.03 | 72.17 | 0.22% | 33,189.28 | 32,814.18 | 35,492.22 | 28,660.94 |

| Nasdaq | 12,057.79 | 88.14 | 0.74% | 12,159.64 | 12,034.61 | 15,265.42 | 10,440.64 |

Back home, Indian share markets are trading on a flat note. Benchmark indices opened in the green but pared gains as the session progressed.

At present, the BSE Sensex is trading lower by 13 points. Meanwhile, the NSE Nifty is trading down by 9 points.

M&M, and Tech Mahindra are among the top gainers today.

ITC and SBI are among the top losers today.

Broader markets are trading on a positive note. Both the BSE Mid Cap index and the BSE Small Cap index are trading higher by 0.3%.

Sectoral indices are trading on a mixed note with stocks in the metal sector, and oil and gas sector witnessing selling.

While stocks in the healthcare sector, consumer durables sector and auto sector witness buying.

Shares of Triveni Turbine and Equitas Small Finance Bank hit their 52 week high today.

The rupee is trading at Rs 82.70 against the US dollar.

In the commodity markets, gold prices are trading down by Rs 126 at Rs 55,374 per 10 grams.

Meanwhile, silver prices are trading lower by 0.2% at Rs 62,853 per 1 kg.

The price of precious metals has remained quite volatile lately. In these uncertain times what should one do? Trade in gold or silver?

Chartist Brijesh Bhatia answers this question in the below video:

Also, now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

The impact of Adani - Hindenburg saga on LIC

In the aftermath of the Hindenburg Research report revelations, Adani Group's stocks took a huge beating on the Dalal Street, but they were not the only ones to bear the brunt.

India's largest insurer LIC has also seen a significant impact for its large exposure towards Adani firms. The insurer's stock has taken a massive blow since the Hindenburg accused Gautam Adani and his port-to-energy empire of stock manipulation and frauds.

In a month, the LIC stock has nosedived by nearly 13% on Dalal Street and its shareholding value in Adani group stocks has declined by more than Rs 486 billion (bn) (about Rs 48,600 crore).

Why LIC was impacted by the Adani-Hindenburg row? The answer is simple it is because of the exposure LIC has in Adani stocks.

Although on 30 January, LIC had stated it has Rs 359.2 bn under equity and debt at the end of December in Adani Group stocks. LIC had said, the total purchase value of equity under all Adani group companies is Rs 301.3 bn.

By end of 24 February, LIC's shareholding value in Adani group stocks was around Rs 326.2 bn. Hence, in total, the shareholding value of LIC in Adani stocks declined by Rs 486.5 bn in a month.

Is it the right time for bargain hunting?

Indian share markets witnessed selling pressure yesterday and started the week with a negative bias.

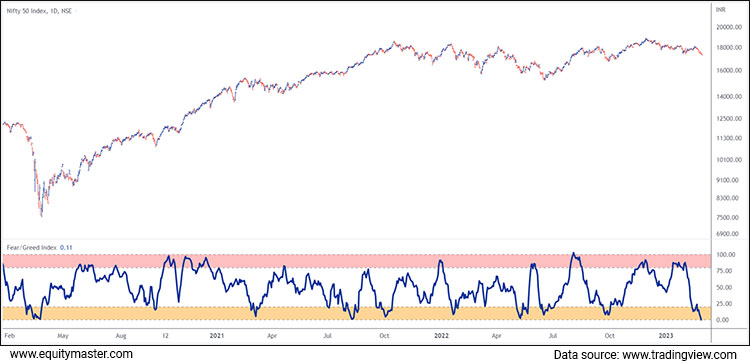

Chartisit Brijesh Bhatia says the best way to check the market's sentiment meter is by Fear and Greed indicator.

The Fear and Greed index is a popular sentiment indicator used by traders to measure the level of fear or greed in the market.

The index ranges from 0 to 100, with values above 50 indicating greed and values below 50 indicating fear.

Extreme greed is a sign of caution when the index goes above 80 while extreme fear is an opportunity to accumulate an oversold stock when the index is below 20.

On the Nifty 50 daily chart, the Fear & Greed index is in an extreme fear zone.

Keeping the opportunity in mind, Brijesh Bhatia shared in his telegram channel a list of stocks which are in the oversold zone on daily as well as weekly chart from the Nifty500 index.

To know more about such oversold shares, check out the 12 best oversold stocks to add to your watchlist.

And to receive more such updates on the stocks market, join Brijesh's telegram channel.

Infosys to rollout 5G as a service

One of the best IT stocks in India, Infosys on Monday announced the roll-out of private 5G-as-a-Service to drive business value for its enterprise clients globally.

Infosys' wireless 5G expertise and its private network management solution ensure high bandwidth, low latency, and reliable wireless connectivity for enterprises.

Infosys' private 5G-as-a-Service incorporates multi-access edge computing (MEC), which reduces network lag by minimising the time required for data processing.

Speaking of Infosys, an Infosys backed drone company, IdeaForge has recently filed its draft red herring prospectus. The IdeaForge IPO has brought back attention on the Indian IPO markets.

10 million unique 5G customers!

One of the best 5G stocks in India, Bharti Airtel announced that it has crossed the 10 m unique 5G user mark on its network. Airtel was the first service provider to roll-out 5G services in the country in October 2022.

Today, Airtel 5G Plus is available across all states in the country. The company is well poised to cover every town and key rural areas with Airtel 5G services by end of March 2024.

In November 2022, Airtel became the first and only operator to have 1 m unique customers on its network within 30 days of its commercial launch.

This might be the good news investors were waiting for because as of late Bharti Airtel share price was falling.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Trades Flat as Metal Stocks Fall | Adani Total Gas, Adani Green & Adani Transmission Down 5% | Airtel Crosses 10 million 5G-Users". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!