India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 28, 2017

Sensex Opens Flat, Idea Cellular Plummets 4% Tue, 28 Feb 09:30 am

Asian stock markets edged up in morning trade, supported by gains on Wall Street as investors awaited a speech by US President Donald Trump for signals on tax reform and infrastructure spending. US$ has surged since Trump's election win in November on expectations his planned measures will fire the US economy and fuel inflation, forcing the Federal Reserve to lift interest rates. The Shanghai Composite is up 0.14% while the Hang Seng is up 0.04%. The Nikkei 225 is up 0.69%.

Meanwhile, Indian share markets have opened the day on a flat note. BSE Sensex is trading higher by 25 points and NSE Nifty is trading higher by 10 points. Meanwhile, S&P BSE Mid Cap and S&P BSE Small Cap are trading higher by 0.3% respectively.

Sectoral indices have opened the day on a positive note with capital goods sector and consumer durables sector witnessing buying momentum. While, oil & gas and FMCG stocks are among the top losers on the BSE.

The rupee is trading at 66.72 against the US$.

ONGC share price opened up by 1.2% on the BSE after it was reported that the company may acquire the government's 51.11% stake in India's third-biggest fuel retailer HPCL. This will be followed up with an open offer to acquire additional 26% from other shareholders of HPCL.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Steel stocks began the trading day on a strong note with Tayo Rolls & Jindal Steel & Power being the most active stocks in this space. According to an article in The Financial Express, SAIL plans to ramp up production at couple of its new facilities including at Burnpur, Bokaro and Rourkela and will also add new products to suit customer needs.

The company plans to stress upon higher level of customer engagement, increased proportion of value added and ready-to-use steel materials as part of company's product basket. Currently, SAIL has a diverse product basket having 500 grades and in 5,000 dimensions from its five state of the art integrated steel plants.

Meanwhile, the government is likely to take a final call on strategic disinvestment of three SAIL units by September this year, and due diligence is already on for the same.

The government had earlier said it would not go in for distress sale of the three SAIL subsidiaries and rather look for a management that will turn around the units. While, SAIL had earlier said the government will hold auction to identify strategic buyers for SAIL subsidiaries -- Bhadravati, Salem and Durgapur.

SAIL share price opened the trading day up by 0.3%.

In related news, India's steel exports registered a three-fold increase to 0.889 million tonnes in January this year, compared to the year-ago month.

The massive jump in exports comes amid government providing extensive support to the domestic steel industry by way of various trade remedial measures including anti-dumping.

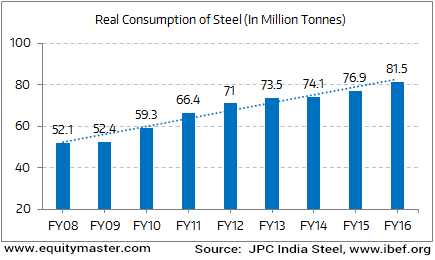

Steel Demand has Outpaced Supply Over the Last 5 Years in the Country

The Ministry of Steel is taking a three-pronged approach to support the domestic steel industry, which has faced low demand and the influx of cheap imports. It is also trying to lower input costs.

According to steel secretary, efforts are under way to mandate the use of 'Made in India' steel in government tenders to boost consumption. Also, the government is in the final stages of General Financial Rules (GFR) which decide all government tenders.

The Center is bringing the concept of lifecycle cost in GFR. So, if the desired quality is available, 'Made in India' or locally produced steel will get preference for big-ticket infrastructure projects.

Moving on to news from stocks in telecom sector. Idea Cellular share price plunged 4% in early trade after it was reported that private equity fund Providence is set to sell it's 3.33% holding in the company for over Rs 12.67 billion.

This marks the equity fund's complete exit from the Aditya Birla Group company that is planning to merge with larger rival Vodafone.

In another development, Vodafone Group of the UK and Aditya Birla group of India may hold equal stakes at 37% each in the proposed merged entity to be formed after the merger of Vodafone India and Idea Cellular. Public may hold the remaining 26% stake in the company.

As per the reports, Birla group may trim its financial services portfolio to fund the deal. Also, Idea Cellular is looking to sell its tower business to trim acquisition cost. Selling the tower assets would help Idea Cellular reduce debt and boost valuations ahead of the merger.

It can be noted that the Idea Cellular stock has had a rally for over a month now, ever since speculation and a confirmation of talks for a merger with second biggest telco Vodafone came out. The stock gained 53% since January.

Meanwhile, Bharti Airtel share price began the trading day on an encouraging note (up 0.4%) after the company dropped domestic roaming charges, matching rival Reliance Jio Infocomm Ltd, as chairman Sunil Mittal urged regulators to encourage consolidation.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat, Idea Cellular Plummets 4%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!