India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 22, 2017

Sensex Opens Marginally Up; Axis Bank Shares Rise on Merger Rumors Wed, 22 Feb 09:30 am

Asian equity markets are lower today as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.19% while the Hang Seng is down 0.78%. The Shanghai Composite is trading down by 0.15%. Stock markets in the US ended their previous session on a firm note.

Meanwhile, share markets in India have opened the trading day marginally higher. The BSE Sensex is trading higher by 110 points while the NSE Nifty is trading higher by 29 points. The BSE Mid Cap index and BSE Small Cap index both have opened the day up by 0.1% & 0.3% respectively.

Sectoral indices have opened the day on a mixed note with information technology stocks and consumer durables stocks witnessing selling pressure. While, oil & gas stocks and PSU stocks are among the top gainers on the BSE. The rupee is trading at 66.98 to the US$.

Axis Bank share price began the trading day up by 2%, after the bank described reports of a merger with Kotak Mahindra Bank as 'baseless'. The clarification came even as there was speculation that other private banks, including ICICI Bank, might show interest in the government stake in Axis Bank.

Oil & gas stocks have opened the day on a positive note with Suzlon Energy and Reliance Industries being the most active stocks in this space. The Oil and Natural Gas Corporation (ONGC) may take over either Hindustan Petroleum Corporation Ltd (HPCL) or Bharat Petroleum Corporation Ltd (BPCL) if the Centre's idea of an 'integrated oil major' materialises.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The Economic Times reported that the actual intention behind the Budget announcement by Arun Jaitley is not to create one huge oil firm. Under the plan, explorer ONGC will control HPCL or BPCL, which are refining and distribution companies.

Currently, HPCL and BPCL have the government as the majority shareholder. The plan is to transfer the government's holding to ONGC, which will become the holding firm of one of these companies (HPCL or BPCL). The Centre holds 51.11% stake in HPCL, and 54.93% in BPCL.

The merged entity will span the spectrum of activity from exploration to retail sale. The logic is that when crude oil prices are high, the exploration business does well and when they drop, the distribution business benefits. By combining the two in a single company, the overall profit of the undertaking becomes more stable. Investors benefit from reduced volatility of profits, the reports noted.

Moving on to the news from power stocks. As per an article in The Economic Times, Tata Motors and Volkswagen Group are at an advanced stage of finalising a partnership that can have a wide-ranging impact on India and other emerging markets.

Reportedly, the companies are looking at sharing modular platforms for India and emerging markets. It includes the advanced modular platform (AMP) being developed by Tata Motors. While, Volkswagen may offer technical knowhow on producing multiple models based on modular architecture.

The main idea is to share architectures and capacities and bring in quicker returns on investment through economies of scale.

Moreover, Both the companies are stretched financially (Subscription Required), yet they have no way out but to invest for the future, so partnership was the only way out. Further, with large auto makers already investing in these emerging technologies, it is clear that Tata Motors needs to make the move quickly to avoid losing out the race particularly when also technologically assisted driving can soon become a reality.

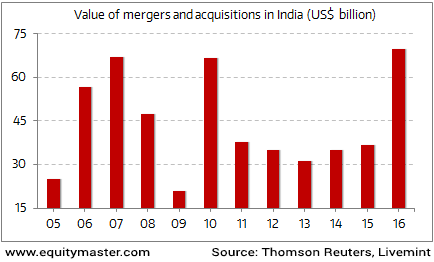

Indian M&A activity at an All Time High in 2016

Merger and acquisition activity in India is on a high. The value of M&As that have taken place in 2016 - at US$ 69.75 billion - are the highest on record for the country. This even beats the previous record of US$ 66.96 billion set in 2007.

To know more about the company's financial performance, subscribers can access to Tata Motor's latest result analysis (subscription required) and Tata Motors stock analysis on our website.

Tata Motors share price opened the day up by 0.9%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Marginally Up; Axis Bank Shares Rise on Merger Rumors". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!