- Home

- Todays Market

- Indian Stock Market News February 21, 2023

Sensex Today Rises 150 Points | Adani Green Energy & Adani Total Gas Down 5% | Metal Stocks Rally Tue, 21 Feb 10:30 am

Asian share markets are lower today as the prospect of the US central bank having to stay on its hawkish path weighed on sentiment.

Investors are now looking to the minutes of the latest Federal Reserve meeting for further monetary policy clues.

The Nikkei is down 0.1% while the Hang Seng is trading lower by 1%. The Shanghai Composite is up 0.1%.

US stock markets were closed on Monday on account of Washington's birthday.

Back home, Indian share markets are trading on a positive note tracking the trend on SGX Nifty.

At present, the BSE Sensex is trading higher by 123 points. Meanwhile, the NSE Nifty is trading higher by 15 points.

NTPC, Tata Steel, and HUL are among the top gainers today.

IndusInd Bank, Axis Bank, and Titan are among the top losers today.

Broader markets are trading on a mixed note. The BSE Mid Cap is trading higher by 0.3% and the BSE Small Cap index is trading flat.

Sectoral indices are trading on a positive note with the exception of oil and gas sector, consumer durables sector and realty sector. Stocks in the FMCG sector, capital goods sector and metal sector witness buying.

Among the top metal stocks in India, Tata Steel and JSW Steel are up more than 1%.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

How to Uncover High Potential Small Caps Opportunities

In This Market

Present market sentiment aside, there's an underlying economic force which could cause the Small Cap Index to soar over the next decade...

And with a few well-placed investments today, you could potentially build life changing wealth over the long term.

Explore this opportunity now

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Shares of Shree Cement and Bosch hit their 52 week high today.

The rupee is trading at Rs 82.76 against the US dollar.

In the commodity markets, gold prices trade lower by Rs 77 at Rs 56,136 per 10 grams.

Meanwhile, silver prices are trading lower by 0.3% at Rs 65,534 per 1 kg.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

Speaking of stock markets, everyone is focused on looking for alternatives of crude oil and petroleum lately. As a result, people are now actively using ethanol and focusing more on electronic vehicles.

However, an important alternative is being missed out.

Green hydrogen is not a fuel everyone talks about. Hydrogen is not just another fuel. Hydrogen is expected to serve as a primary industrial fuel in the 21st century, just as coal drove the 19th century and oil drove the 20th century.

Hence, it's clear that green hydrogen stocks should be an important part of an investor's watch list. In the below video, Co-head of Research at Equitymaster Tanushree Banerjee shares three critical factors that decide if green hydrogen stocks make money.

Tune in to the below video to know more:

Adani Green Energy Capex Plans

India's largest green energy company, Adani Green Energy, has decided to review its capital expenditure (capex) plan of Rs 100 billion (bn) (about Rs 10,000 crore) for financial year 2023-24. In a post-third quarter results call with its bond holders, Adani Green's management said this was a tentative target and was still under review.

This marks a change in the company's stated plans on its capex. Last week, addressing the earnings call, the management had said it has planned a capex of "broadly" Rs 100 bn for financial year 2023-24 and a similar amount for financial year 2024-25.

Short-term capex (12-18 months) is being reviewed. In the near term, there will be a slowdown in our target. The company will revisit our discretionary capex and reduce its capex in the near term, the management said in the call with fixed-income investors on 16 February.

Make: Your Investing Stress-free with Value for Money Stocks

This is the second such move by an Adani Group company since US-based short-seller Hindenburg Research released a report accusing the company of stock manipulation and accounting fraud, charges that the group has denied.

HDFC Bank bond sale

HDFC Bank is planning its 1st US $ denominated bond sale in 1.5 years. Reportedly the bank is planning benchmark-sized senior unsecured note sale. It may start roadshows to meet fixed-income investors this week.

Last time HDFC Bank sold a dollar bond was in August 2021, when the lender raised 1 bn US $ through the sale of perpetual securities. Globally, US $ bond issuance has been showing signs of picking up and the only issue so far was when EXIM bank sold 1 bn dollars in notes.

Note that, HDFC Bank is one that has always adapted to changing times.

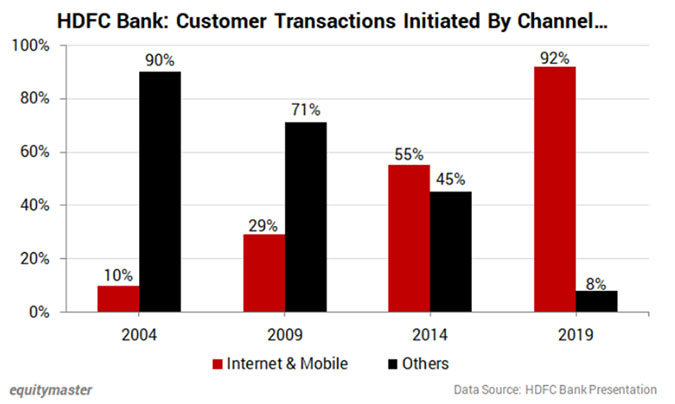

HDFC Bank wanted to transform itself from a leader in the physical banking to a leader in online banking. Since then, HDFC Bank has constantly focused on going digital.

In 2004, only 10% of customer transactions were initiated through internet and mobile. The number has gone up to 92% in 2019.

It is a great example of a company which has taken advantage of its scale and embraced disruption rather than fear it.

These are traits that one should look for in picking stocks. They not only withstand the disruption but also gain from it in the long-run.

Asian Paints enters into an agreement with the Gujarat government

One of the top paints companies in India, Asian Paints on Monday entered into a Memorandum of Understanding (MoU) with the Gujarat government to set up a manufacturing facility in Dahej. The MoU was signed through its newly incorporated wholly-owned subsidiary, Asian Paints (Polymers).

Asian Paints subsidiary will set up the manufacturing facility for vinyl acetate ethylene emulsion (VAE) and vinyl acetate monomer (VAM) at Dahej, Gujarat.

Last month, Asian Paints incorporated Asian Paints (Polymers) with a share capital of Rs 1 bn.

Last year, the company's board of directors approved the setting up of a manufacturing facility for VAE and VAM in India. For this, Asian Paints announced in October that it will invest Rs 21 bn over a period of three years.

The installed capacity of the said manufacturing facility would be 100,000 tons per annum for VAM and 150,000 tons per annum for VAE. VAM is a key input for manufacturing VAE.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Could the Bears Strike During Election Season?

Discover how this Safe Stock Strategy Could Protect Your Wealth & Potentially Lead to Big Long Term Gains

Full details here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Currently, Asian Paints already imports VAE & VAM for its internal consumption. This would be a key backward integration project for the company.

Did you know that Asian Paints is one of the top 3 paint companies in India by growth?

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Rises 150 Points | Adani Green Energy & Adani Total Gas Down 5% | Metal Stocks Rally". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!