India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 20, 2017

Sensex Trades Marginally Higher; Telecom Stocks Witness Buying Mon, 20 Feb 11:30 am

After opening the day on a flat note, share markets in India witnessed choppy trades and are presently trading marginally higher. Sectoral indices are trading on a positive note with stocks in the telecom sector and metal sector witnessing maximum buying interest.

The BSE Sensex is trading up 45 points (up 0.2%) and the NSE Nifty is trading up 13 points (up 0.2%). The BSE Mid Cap index is trading up by 0.6%, while the BSE Small Cap index is trading up by 0.7%. The rupee is trading at 66.99 to the US$.

The Goods and Services Tax (GST) Council on Saturday formally approved a law to compensate states for any loss of revenue they might have to suffer in the first five years in the GST regime.

The council also resolved to make some clarificatory changes in the model GST Bill. The bill is decided to be replicated as the central and state GST bills with a view to amplifying their legal tenability.

The model GST and integrated GST drafts are likely to be endorsed by the Council at its next session to be held in New Delhi on March 4-5.

As per Finance Minister Arun Jaitley, the Centre is hoping to introduce all the three crucial bills in Parliament in the second half of the Budget session, which will commence on March 9.

The government has set July 1st as the deadline for implementing the GST regime.

The implementation of GST must be a high priority for the government in order for it to be effective. The government will have to address some issues and ensure that GST proves to be a boon and not bane for the country.

To get a detailed view on the Goods and Services Tax (GST), you can read Vivek Kaul's report, GST & You: What the Media DID NOT TELL YOU about the GST

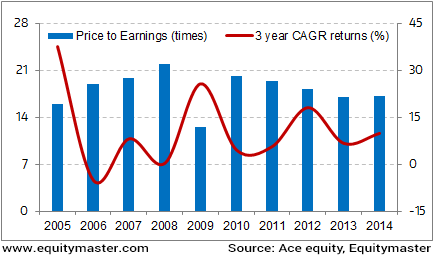

As far as stock markets are concerned, GST should not change one's perception about businesses and the way they're valued. In other words, looking out for value and following a long-term investing approach could prove to be the best play.

As Rahul Shah, co-head of research, noted in in one of the recent editions of the 5 Minute WrapUp:

- Be it the Union Budget, GST or a great monsoon, you always got to ask the all-important question: Everything said and done, am I paying too much for the stock in relation to its intrinsic value?

It is the Valuation That Counts

Indian stock markets are likely to witness volatility amid derivatives expiry in the week ahead. Also, the ongoing UP assembly elections are said to weigh on stock market sentiments.

Along with that, cues from the Fed indicating an interest rate hike in its upcoming meet has made global stock markets trade on a volatile note. But as per Asad, the Fed's promise of more interest rate increases will lead to the end of easy money and will create big trends that traders can profit from.

Speaking of trading, Apurva Sheth has released a detailed report on what he believes could be an extremely effective four-step stock trading strategy. Get your hands on this report right now.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Marginally Higher; Telecom Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!