India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 17, 2023

Sensex Today Falls 200 Points | Nifty Below 18,000 as Nestle Shares Fall 3% | Adani Power & Adani Wilmar Surge 5% Fri, 17 Feb 10:30 am

Asian share markets slipped today as economic data and hawkish comments from Fed officials revived fears that the US central bank will stick to its monetary tightening path.

The Nikkei is down 0.7% while the Hang Seng is trading lower by 0.6%. The Shanghai Composite is down by 0.2%.

Wall Street's major indices ended sharply lower on Thursday after unexpectedly strong inflation data and a drop in weekly jobless claims added to fears that the US Federal Reserve will keep raising interest rates to tame inflation.

The Dow Jones ended 1.3% lower while the tech heavy Nasdaq Composite ended lower by 1.9%.

Here's a table showing how US stocks performed yesterday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 95.78 | -1.32 | -1.36% | 97.88 | 94.97 | 144.16 | 83.45 |

| Apple | 153.71 | -1.62 | -1.04% | 156.33 | 153.35 | 179.61 | 124.17 |

| Meta | 172.44 | -4.72 | -2.66% | 175.85 | 171.79 | 236.86 | 88.09 |

| Tesla | 202.04 | -12.2 | -5.69% | 217.65 | 201.84 | 384.29 | 101.81 |

| Netflix | 350.71 | -10.71 | -2.96% | 361.5 | 350.31 | 402.87 | 162.71 |

| Amazon | 98.15 | -3.01 | -2.98% | 100.63 | 98.1 | 170.83 | 81.43 |

| Microsoft | 262.15 | -7.17 | -2.66% | 266.74 | 261.9 | 315.95 | 213.43 |

| Dow Jones | 33,696.85 | -431.2 | -1.26% | 34,041.16 | 33,686.59 | 35,492.22 | 28,660.94 |

| Nasdaq | 12,442.48 | -245.41 | -1.93% | 12,653.40 | 12,440.00 | 15,265.42 | 10,440.64 |

Back home, Indian share markets are trading on a negative note tracking the trend on SGX Nifty.

At present, the BSE Sensex is trading lower by 183 points. Meanwhile, the NSE Nifty is trading lower by 52 points.

UltraTech Cement and L&T are among the top gainers today.

Nestle and IndusInd Bank are among the top losers today.

Broader markets are trading on a negative note. The BSE Mid Cap is trading lower by 0.4% and the BSE Small Cap index is trading flat.

Sectoral indices are trading on a negative note. Stocks in the realty sector, and banking sector witness most of the selling.

Shares of UltraTech Cement and Polycab India hit their 52 week high today.

The rupee is trading at Rs 82.78 against the US dollar.

In the commodity markets, gold prices trade lower by Rs 397 at Rs 55,831 per 10 grams.

Meanwhile, silver prices are trading lower by 0.9% at Rs 65,021 per 1 kg.

Speaking of stock markets, everyone is focused on looking for alternatives of crude oil and petroleum lately. As a result, people are now actively using ethanol and focusing more on electronic vehicles.

However, an important alternative is being missed out.

Green hydrogen is not a fuel everyone talks about. Hydrogen is not just another fuel. Hydrogen is expected to serve as a primary industrial fuel in the 21st century, just as coal drove the 19th century and oil drove the 20th century.

Hence, it's clear that green hydrogen stocks should be an important part of an investor's watch list. In the below video, Co-head of Research at Equitymaster Tanushree Banerjee shares three critical factors that decide if green hydrogen stocks make money.

Tune in to the below video to know more:

Adani group's huge debt repayment plans

The Adani Group will seek to refinance about US $ 1.2 billion (bn) (about Rs 99.3 bn) worth of foreign-currency bonds ahead of maturity and prune discretionary capital expenditure, key finance executives at the conglomerate told investors during a conference call late Thursday.

Further, the group will prepay all loans against shares over the next few weeks.

Adani Group's chief financial officer Jugeshinder 'Robbie' Singh and head of group corporate finance Anupam Misra told investors that they are working on a full finance plan to refinance Adani Green Energy's US $ 750 m (about Rs 62,058.4 m), 4.375% bond due in September 2024 one year ahead of maturity.

The infrastructure conglomerate also plans to fully finance Adani Green Energy's US $ 460 m (about Rs 38,064.5) restricted group 1 bond due in December 2024 with a 15-year fully amortising privately placed paper, the management told investors.

- "The discussions are in advanced stages and will reach completion shortly," Singh said during the late-evening call.

Furthermore, Adani plans to completely pre-pay all loans against shares over the next 20 days to ensure that after debt repayment, borrowings are not linked to the value of the share, potentially triggering margin calls.

The debt repayment plans come after the whole Adani Hindenberg saga. Adani is fighting tooth and nail for the group's reputation.

It remains to be seen how the above developments pan out.

HDFC successfully raises funds

Housing Development Finance Corp (HDFC) raised its target of Rs 250 bn in the country's largest privately placed corporate bond issue on Thursday.

The issue received 92 bids worth 278.6 bn rupees, of which the company retained 55 bids worth 250 bn rupees.

The participation was from across investor categories, LIC (Life Insurance Corp) being one of the largest ones, along with other insurance companies, provident funds, banks, mutual funds and pension trusts.

The country's largest housing financier, soon to be merged with private lender HDFC Bank, sold 10-year bonds at a coupon of 7.97% coupon.

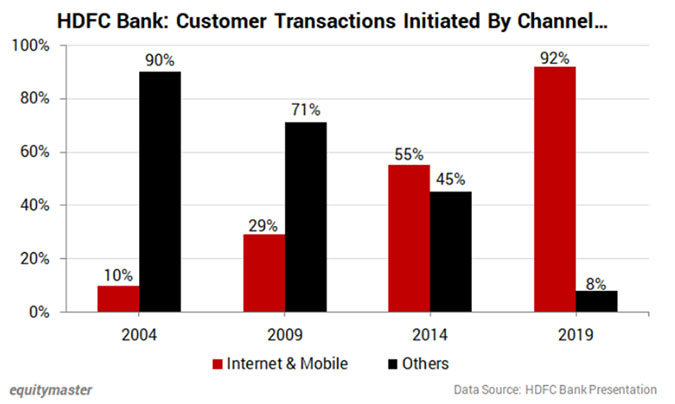

Speaking of HDFC and HDFC Bank, note that HDFC Bank is one that has always adapted to changing times.

HDFC Bank wanted to transform itself from a leader in the physical banking to a leader in online banking. Since then, the private sector bank has constantly focused on going digital.

In 2004, only 10% of customer transactions were initiated through internet and mobile. The number has gone up to 92% in 2019.

It is a great example of a company which has taken advantage of its scale and embraced disruption rather than fear it.

These are traits that one should look for in picking stocks. They not only withstand the disruption but also gain from it in the long-run.

Vedanta declared as preferred bidder in e-auction

Vedanta on Thursday said it has been declared as the preferred bidder for nickel, chromium and associated platinum group elements block in Chhattisgarh.

In October last year, the Chhattisgarh government had conducted an auction for grant of composite license for the said block.

Under the composite licence (prospective-cum-mining), preliminary exploration of the areas is done but further exploration is required by mining companies.

The company had submitted its bid in electronic auction for grant of composite license.

The grant of composite license in respect of the block will be subject to making of necessary payments and getting necessary clearances. Vedanta is a diversified global natural resources company.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Falls 200 Points | Nifty Below 18,000 as Nestle Shares Fall 3% | Adani Power & Adani Wilmar Surge 5%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!