India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 16, 2024

Sensex Today Ends 376 Points Higher | Smallcap Stocks Shine | Natco Pharma Zooms 16% Fri, 16 Feb Closing

After opening the on positive note, Indian share markets gained momentum as the session progressed and ended the day higher.

The equity benchmark indices held firm gains on Friday tracking strength in global markets.

At the closing bell, the BSE Sensex stood higher by 376 points (up 0.5%).

Meanwhile, the NSE Nifty closed higher by 129 points (up 0.6%).

Wipro, M&M and L&T were among the top gainers today.

ONGC, Reliance Industries and SBI on the other hand, were among the top losers today.

The GIFT Nifty ended at 22,093 up by 65 points.

Broader markets ended the day higher. The BSE Mid Cap ended 0.7% higher and the BSE Small Cap index ended 0.6% higher.

Sectoral indices are trading mixed, with socks auto sector, realty sector and IT sector witnessing most buying. Meanwhile, stocks in power sector and oil & gas sector witnessed selling pressure.

Shares of Maruti Suzuki, Bajaj Auto and CRISIL hit their respective 52-week highs today.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

The rupee is trading at 83.02against the US$.

Gold prices for the latest contract on MCX are trading flat at Rs 61,683 per 10 grams.

Meanwhile, silver prices are trading 0.2% higher at Rs 71,282 per 1 kg.

Speaking of stock markets, Tata Motors has now gone past Maruti Suzuki to emerge as India's most valuable auto manufacturer.

From a loss of Rs 287 bn in FY19, perhaps its highest ever, Tata Motors has earned record profits of Rs 157 bn in the trailing twelve-month period. And it is this turnaround that has led to investors warming up to the stock and turning it into a 12-bagger since its March 20 lows.

However, when it comes to fundamental parameters like profitability, return ratios and balance sheet strength, Maruti is comfortably ahead of Tata Motors.

Why is it then Tata Motors enjoys nearly the same valuation as Maruti? Why is Mr Market considering Tata Motors at par with Maruti?

Co-head of Research, Rahul Shah answers this in below video.

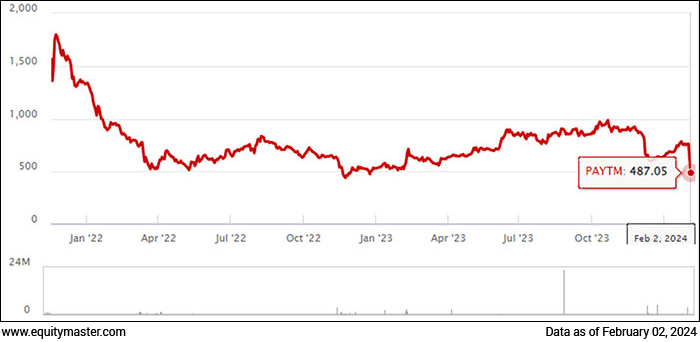

Paytm Hits Upper Circuit. Here's why.

In news from the fintech space, Paytm shares recovered from the record low of Rs 318.05, hit earlier in the day, to trade at 5% upper circuit of 5% in afternoon trade on 16 February.

The rise comes even after the Enforcement Directorate reportedly questioned Paytm company executives and took submission of documents from them following the recent RBI action of barring Paytm Payments Bank Ltd (PPBL) from accepting deposits or top-ups in any customer account.

Paytm has lost about Rs 270 billion (bn) or 57% of its value in the last 11 trading days since the trouble began after the RBI crackdown on the Paytm Payments Bank, which also houses Paytm Wallet over persistent non-compliances and continued material supervisory concerns.

The regulator found major irregularities in KYC, which exposed the customers, depositors, and wallet holders to serious risks. It found that in thousands of cases, the same PAN was linked to more than 100 customers and, in some cases, the number went above 1,000.

The total value of transactions, running into crores of rupees, is much beyond the regulatory limits in minimum KYC pre-paid instruments, raising money-laundering concerns.

For more, check out Paytm Shares Tread Troubled Waters: These Mutual Funds May Feel the Impact.

ITC Sinks to 10-month low.

Moving on to news from the FMCG sector, ITC shares briefly slipped below the psychological Rs 400 mark to a 10-month low as the market worries about the impending 4% stake sale by British American Tobacco (BAT), the largest shareholder in the company.

BAT is looking to raise Rs 210 billion (bn) (US$ 2.5 bn) by selling a 3.5 to 4% stake in the Indian tobacco-to-consumer goods conglomerate.

As of December 2023 disclosures, BAT holds the largest share in ITC, with ownership exceeding 29%

The British tobacco seller has held stakes in India's ITC since the early 1900s and is the largest shareholder in the company, having more than 29% stakes.

The floating stock in the system will increase after the stake sale, as some of the new investors would look to sell the stock at the first opportunity if they get a dent in profit.

A key challenge BAT faces in offloading a 4% stake in ITC is navigating the regulatory hurdles imposed by the Reserve Bank of India on foreign ownership in tobacco firms, which limits who can buy those shares.

Looking ahead, ITC Foods, the branded packaged foods division of ITC, envisions a resurgence in demand for the dairy and beverage sector within the next six to nine months. This optimistic outlook is driven by expectations of a warm summer and favourable dairy conditions.

GAIL Eyes LNG At Competitive Rates

Moving on to news from the energy sector, State-run GAIL (India) is seeking competitive pricing for liquefied natural gas (LNG) as consumers in India are highly price-sensitive.

Affordable gas pricing is the only way to ensure that consumers in India do not switch to other fuels. In the last month, India's largest gas distributor has finalised two long-term LNG import deals, one with UAE's ADNOC Gas and another with global commodity trader Vitol.

The Indian government plans to increase the share of natural gas in the country's energy basket to 15% from 6% now, and the recent deals signed by GAIL and Petronet LNG are expected to boost gas consumption. On 6 February, Petronet LNG, too, extended its LNG deal with Qatar by another 20 years until 2048.

In a big blow to GAIL, LNG supplies from Russia's Gazprom were suspended in 2022 due to the war between Russia and Ukraine.

As a result, GAIL had to cut supplies to its customers and was forced to buy expensive LNG from the short-term market. Though supplies resumed in March 2023, GAIL has initiated arbitration against Gazprom in London.

To know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Ends 376 Points Higher | Smallcap Stocks Shine | Natco Pharma Zooms 16%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!