India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 13, 2017

Sensex Trades on a Negative Note; PSU Stocks Witness Selling Mon, 13 Feb 01:30 pm

After opening the day on a positive note, the Indian share markets witnessed selling activity and are currently trading below the dotted line. Sectoral indices are trading on a mixed note, with stocks in the PSU sector and the realty sector witnessing maximum selling pressure. Stocks in the IT sector and the metal sector are trading in the green.

The BSE Sensex is trading down by 88 points (down 0.3%) and the NSE Nifty is trading down by 31 points (down 0.4%). Meanwhile, the BSE Mid Cap index is trading down by 0.9%, while the BSE Small Cap index is trading down by 1%. The rupee is trading at 66.93 to the US$.

As per data released by the Central Statistics Office (CSO), India's industrial production contracted by 0.4% in December. The contraction has been directly attributed to the demonetisation of high value currencies in November 2016.

The general Index of Industrial Production (IIP), for the month of December 2016, stands at 183.5, which is 0.4% lower as compared to the level in the month of December 2015. The index contracted a month after recording a 13-month high growth due to a positive base effect.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

IIP grew 5.7% in November. Whereas, the cumulative growth for the period April-December 2016 over the corresponding period of the previous year stands at 0.3%.

IIP is compiled using data received from 15 source agencies, some of them being Department of Industrial Policy and Promotion (DIPP), Central Electricity Authority, Ministry of Steel, Ministry of Petroleum and Natural Gas and the Railway Board.

The data showed while mining and electricity output grew 5.2% and 6.3% respectively in December, manufacturing contracted by 2% during the month.

Capital goods, which is an indicator for investment demand in the economy contracted 3% in December. However, the impact of demonetisation was clearly visible from the 5% contraction in production of consumer non-durables and 10.3% fall in production of durables, signaling that consumption demand in both rural and urban demand has been impacted.

The 76th round of the Reserve Bank of India's industrial outlook survey suggests that financing conditions facing the manufacturing sector have worsened in Q3 of 2016-17 and are expected to remain tight in Q4. This is corroborated by the sharp slowdown in bank credit to industry and continuing sluggishness in the investment climate in some sectors.

The RBI which kept its policy rates unchanged earlier this week said growth is expected to recover sharply in 2017-18 as discretionary consumer demand held back by demonetisation is expected to bounce back beginning in the closing months of 2016-17.

Moving on to news from the banking sector. The government, in an effort to reinvigorate public sector banks, plans to come out with 'Indradhanush 2.0', a comprehensive plan for recapitalisation of public sector lenders, with a view to make sure they remain solvent and fully comply with the global capital adequacy norms, Basel-III.

'Indradhanush 2.0' will be finalised after completion of the asset quality review (AQR) by the Reserve Bank of India (RBI), which is likely to be completed by March-end.

The RBI had embarked on the AQR exercise from December 2015 and asked banks to recognise some top defaulting accounts as non-performing assets (NPAs) and make adequate provisions for them. It has had a debilitating impact on banks' numbers and their stocks. The central bank has set a deadline of March 2017 to complete the AQR exercise.

Asset quality in Indian banks, especially public sector lenders is abysmally low. The low asset quality leads to a high degree of NPAs, which in turn choke the banking sector.

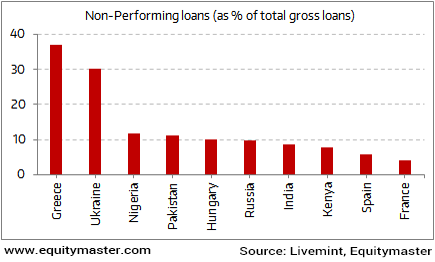

India is Near the Bottom of the Global NPA List

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

Out of the ten major economies facing NPA problems, India is ranked seventh.

Post asset quality review (AQR) exercise by the RBI to clean up the balance sheets of PSBs, the numbers are being re-looked at and a revised programme of capitalisation will be issued as part of 'Indradhanush 2.0'.

Under Indradhanush roadmap announced in 2015, the government had announced to infuse Rs700 billion in state-run banks over four years while they will have to raise a further Rs 1.1 trillion from the markets to meet their capital requirement in line with global risk norms, known as Basel-III.

The government has already announced fund infusion of Rs 229 billion, out of the Rs 250 billion earmarked for 13 PSBs for the current fiscal. Of this, 75% has already been released to them.

While the recapitalization exercise may help in the short run. Public sector banks need to improve on their asset quality and reduce NPAs, to stay afloat in the long run.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades on a Negative Note; PSU Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!