India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 9, 2017

Sensex Trades on a Flat Note; IT Stocks Witness Buying Thu, 9 Feb 01:30 pm

After opening the day on a positive note, the Indian share markets witnessed selling and are currently trading on a flat note with a negative bias. Sectoral indices are trading on a mixed note, with stocks in the IT sector and the realty sector witnessing maximum buying interest. Stocks in the banking sector and the metal sector are trading in the red.

The BSE Sensex is trading down 24 points (down 0.1%) and the NSE Nifty is trading down 7 points (down 0.1%). Meanwhile, the BSE Mid Cap index is trading flat, while the BSE Small Cap index is trading up by 0.2%. The rupee is trading at 67.03 to the US$.

The Reserve Bank of India, in its sixth bi-monthly policy for FY17 made some key economic decisions and announcements.

Apart from leaving the key interest rates unchanged, the central bank's deputy governor said that the RBI will look at all options, including setting up a so-called bad bank - as suggested in the Economic Survey this year - for resolving the banking industry's bad loans.

The Deputy governor's comments come in the wake of the Economic Survey's suggestion for setting up a bad bank, or public sector asset rehabilitation agency, to be funded by government securities, equity infusion from the private sector, or by using RBI's excess capital to tackle the Rs 6.7 trillion of bad loans choking the banking system.

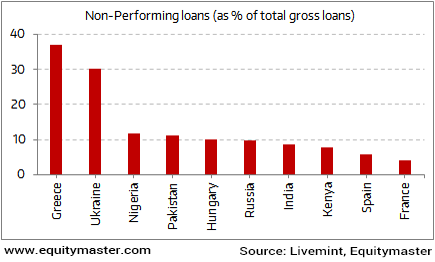

India is Near the Bottom of the Global NPA List

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

Out of the ten major economies facing NPA problems, India is ranked seventh.

If the RBI does consider a bad bank, this would represent a reversal of its views. Former governor Raghuram Rajan argued against this concept.

The Deputy Governor, Viral Acharya himself is a firm supporter of the idea of a bad bank to clean up the toxic loans on the books of Indian banks.

It remains to be seen how the creation of a 'bad bank' will help the ailing banking sector. One of the major challenges in the implementation will be ensuring that banks sell the stressed assets to either asset reconstruction companies or private investors at the right price.

If the concept is adopted, it will have a significant impact on India's banking sector. We will be sure to keep an eye out.

Moving on to news from stocks in the steel sector. According to a leading financial daily, the country's largest steel maker

The company outlined its plans to invest the amount throughout its plans on improving processes and adopting innovative technology.

SAIL's management plans to fund the capital expenditure through debt.

In 2015-16, the public sector undertaking (PSU) had spent Rs 45 billion as capital expenditure.

Crude steel production of SAIL, which was at 14.3 million tonnes (MT) in FY16, would increase to 21.4 MTPA post expansion in FY17.

The PSU's saleable steel production, which was at 12.4 MT in 2015-16, would augment to 20.2 MTPA post expansion in 2016-17. The hot metal production, which stood at 15.7 MT in FY16, would reach 23.5 MT post expansion.

SAIL also plans to ramp up capacity further to 50 million tonnes per annum (MTPA) by 2025.

The proposed capacity expansion to 50 mtpa is in line with government's vision of enhancing India's steel-making capacity to 300 mtpa by 2025.

Increased capacity expansion and added investments in modernization augurs well for the steel major. This could help the SAIL stock price reach new heights. Currently, the stock is trading close to its 52-week high. However, it too has seen significant downturns during the year amid depressed global steel demand.

This tells us one thing - stock markets are extremely volatile. A period of upheaval may be followed by an unprecedented downturn. We think the best way to counter this volatility is to follow a long term value investing approach.

Along with keeping an eye on valuations, it's also important that you have a process in place. Many of you have already tasted the fruits of one of Rahul Shah's processes with his Microcap Millionaires service.

However, Rahul is not resting on his laurels. A couple of years back, Rahul stumbled upon a cousin of Value Investing going by the name momentum investing. So in the last 18 months, he has been working hard at back testing a market strategy to benefit from it.

Profit Velocity is Rahul Shah's new service that aims to exploit Mr Market using a momentum-based strategy. And the first report goes live on 10th February 2017.

With Profit Velocity, Rahul has created a system to help subscribers potentially fetch gains several times those of the benchmark index. Our Founder Member opportunity, which closes at midnight of 10th February, offers a whopping 60% discount on the usual membership fees for Profit Velocity.

So don't miss out. Act now to get your own system in place.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades on a Flat Note; IT Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!