India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 8, 2017

Sensex Trades Flat; Consumer Durables Stocks Gain Wed, 8 Feb 01:30 pm

After opening the day on a flat note, the Indian share markets have continued to trade on a weak note and are currently trading marginally below the dotted line. Sectoral indices are trading on a mixed note, with stocks in the consumer durables sector and the metal sector witnessing maximum buying interest. Stocks in the banking sector and the pharma sector are trading in the red.

The BSE Sensex is trading down 52 points (down 0.2%) and the NSE Nifty is trading down 8 points (down 0.1%). Meanwhile, the BSE Mid Cap index is trading up by 0.2%, while the BSE Small Cap index is trading up by 0.3%. The rupee is trading at 67.31 to the US$.

According to a leading financial daily, state-owned refiner Hindustan Petroleum Corporation Ltd (HPCL) has received environment clearance for expansion of its refinery in Mumbai.

HPCL had recently proposed to expand capacity in its Mumbai refinery at an estimated investment of Rs 38.5 billion.

The proposal is to expand the refining capacity of Mumbai refinery located in Chembur district from 7.5 million tonnes per annum (MTPA) up to 9.5 MTPA including Propylene Recovery Unit (PRU) and revamp of existing Captive Power Plant (CPP).

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

With the proposed expansion, the Mumbai refinery will be able to produce gasoline and diesel meeting Euro IV quality specifications, besides other petroleum products like LPG, Naphtha, Kerosene, ATF, Fuel oil and Sulphur to help meet the current market demands.

The Environment Ministry has given environment clearance to HPCL's expansion project subject to compliance of some conditions. Among conditions specified, HPCL will have to impart training to all employees on safety and health aspects of chemicals handling.

It has also been told to set up a separate environmental management cell equipped with full-fledged lab facilities for carrying out environmental management and monitoring.

Through Mumbai Refinery Expansion Project, production of MS meeting Euro V/VI norms will be made possible.

The proposed project will improve refinery margin and contribute to overall development of the region. The proposed PRU project will facilitate production of chemical grade propylene and revamping of existing CPP will ensure self-sustainability in power.

The proposed expansion comes at a time when the government is mulling consolidating all of the major oil players into an integrated public sector 'oil major'. Our energy sector analyst Richa Agarwal, had written about her view of this development in one of the recent editions of the 5 Minute WrapUp Premium. Give it a read to form a better understanding of the development.

At the time of writing HPCL share price was trading up by 1.7%.

Moving on to news from stocks in the telecom sector. India's third largest telecom player

The Idea bonds will offer 8.12% with a tenure of seven-year proposed to be listed on the National Stock Exchange. The bonds will be allotted on a private placement basis and shall be deemed allotted on 8 February 2017.

The proceeds would be used for capital expenditure as the telecom company is looking to expand in its 4G network. In January 2017 alone, the number three telco has raised Rs 40 billion by issuing corporate bonds.

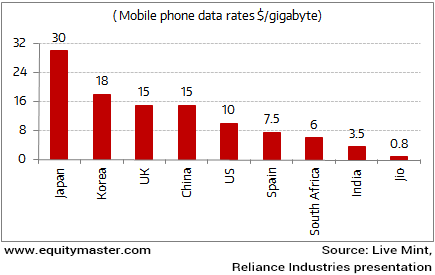

The added push towards capital expenditure comes at a time when the major telecom companies are under pressure by the disruptive pricing of the cash rich Reliance Jio.

Jio's Data Pricing Disrupts the Telecom Apple Cart

Reliance Jio's disruptive pricing, seemingly hasn't left other market players with much of a choice but to accelerate investments in infrastructure to remain profitable in the long run.

A potential merger between Vodafone India with Idea Cellular too is on the cards as the telecom majors look for consolidation in order to remain competitive.

A merger of this scale has potential to change the industry order. The combined entity would have 43% revenue share in the market by FY19 against 33% of Bharti Airtel and 13% for Reliance Jio.

At the time of writing Idea share price was trading up by 1.4%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Flat; Consumer Durables Stocks Gain". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!