India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 3, 2023

SGX Nifty Up 74 Points | Titan Q3 Results | Why ITC Share Price is Rising | Top Buzzing Stocks Today Fri, 3 Feb Pre-Open

On Thursday, Indian share markets witnessed volatile trading activity throughout the session and managed to bounce back during closing hours.

Benchmark indices ended on a mixed note with Sensex closing in green due to upbeat global sentiment and tracking positive sentiment following budget 2023.

Meanwhile, the Nifty 50 index ended in the red as Adani Group shares tumbled

At the closing bell on Thursday, the BSE Sensex stood higher by 224 points (up 0.4%)

Meanwhile, the NSE Nifty closed lower by 6 points.

ITC, Britannia, and HUL were among the top gainers.

Adani Enterprises, Adani Ports, and UPL, on the other hand, were among the top losers.

Broader markets settled on a positive note. The BSE Midcap ended 0.2% higher while the BSE SmallCap index rose 0.4%.

Sectoral indices ended on a mixed note with stocks in the FMCG sector, and IT sector witnessing buying.

While stocks in power sector, oil & gas sector and energy sector witnessed selling.

Shares of Britannia, Blue Star, and ITC hit their 52-week high on Thursday.

The rupee was trading at 82.23 against the US$.

Gold prices for the latest contract on MCX were trading higher by 1.5% at Rs 58,783 per 10 grams at the time of Indian market closing hours on Thursday.

At 7:20 AM today, the SGX Nifty was trading up by 74 points or 0.4% higher at 17,710 levels.

Indian share markets are headed for a positive opening today following the trend on SGX Nifty.

Speaking of stock markets, markets have remained under pressure after the American short seller Hindenburg Research issued a report on Adani group stocks.

The top Adani group stocks have taken a hit. However, this is not new ...the same thing happened before with Vakrangee.

In January 2018, Co-head of Research at Equitymaster Tanushree Banerjee observed how the market capitalisation of Vakrangee crossed pharma behemoth Lupin's marketcap. A perfect case of an exciting business gaining dominance over a boring one!

Mind you, Vakrangee was already a 1,000 bagger then!

It was not difficult to see why investors were scampering to get a share of the pie. Nothing about Vakrangee seemed to surprise the streets.

What happened next? Watch the below video to know more...

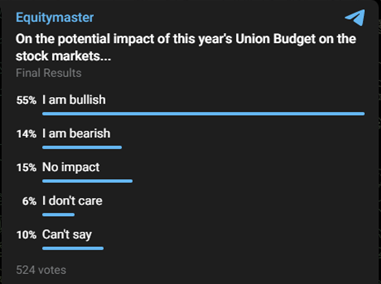

Also, to understand what our readers are thinking about the upcoming union budget and its impact on stock market, we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

With a response from over 500 participants, majority of investors are bullish on the union budget 2023.

Top Buzzing Stocks Today

HDFC will be among the top buzzing stocks today.

Private mortgage lender HDFC (Housing Development Finance Corporation), on Thursday, reported a standalone net profit of Rs 36.9 bn for the December 2022 quarter. This was 13.2% higher than Rs 32.6 bn profit reported in the year-ago period.

ITC will also be in focus today.

Shares of cigarette-to-hotels major ITC hit a 52-week high of Rs 384.4 on Thursday after the hike in duty on cigarettes in Union Budget speech had a limited impact on the company.

Why did Adani Group call off FPO?

Adani Group called off the Rs 200 bn Follow-On Public Offering (FPO) of Adani Enterprises on Wednesday, just a day after it was fully subscribed.

It came as a surprise to the stock market and investors, as such moves are rarely seen.

The decision to pull out of the sale was taken to insulate investors from potential losses since the Adani empire plunged into crisis.

Explaining the reason for withdrawal, Wednesday night, the company said,

- The market has been unprecedented, and our stock price has fluctuated over the course of the day. Given these extraordinary circumstances, the company's board felt that going ahead with the issue will not be morally correct.

Following the statement, Adani conglomerate deepened market losses to exceed US$100 bn.

Last week, Adani group shares were hammered after an American short seller, Hindenburg Research, accused the company of using tax havens and flagged debt concerns in a report. In a 413-page rebuttal, Adani group denied all the charges.

It remains to be seen how the Adani vs Hindenburg battle pans out.

Titan Q3 Results

One of Tata Group's best stock, Titan reported a 12% YoY rise in revenue to Rs 106.5 bn for December 2022 quarter.

While it reported a 3.6% YoY decline in standalone profit December 2022 quarter. The company's net profit for the quarter stood at Rs 9.5 bn compared to Rs 9.8 bn in the corresponding period a year ago.

This drop was due to increasing expenses and 6 times higher gold ingot sales.

The company's total expenses came at Rs 96.9 bn, increasing 13.7% from Rs 85.2 bn in the corresponding period a year ago.

In line with its expansion plan, the business continued to invest in brands and digital capabilities and pursue market share gains through competitive offers and pricing.

The jewellery arm of Titan, Tanishq opened its first boutique store in New Jersey, USA, in December 2022, taking the total international count to 6 stores.

A total of 22 stores (excluding Caratlane) were added during the quarter, taking the total Jewellery store count to 510 spread across 247 cities.

Titan has been investors' favourite stock for a long time now.

Speaking of Titan, here's some interesting data, note that even a tiny investment of Rs 1,000 per month in the stock of Titan, since 2002, would have led to?mouthwatering returns.

Believe it or not Titan was a?Tata group penny stock?two decades ago.

The key lesson here is that it's possible to accumulate a few crores by investing small amounts in good businesses. Especially when the business is in distress and comes with margin of safety in valuations.

To know more, check out?Titan's latest news and analysis.

Bajaj Electricals Q3 profit rises 27%

Bajaj Electricals on Thursday reported an increase of 26.8% YoY in its consolidated net profit to Rs 611.2 m in the December 2022 quarter, helped by growth in the consumer product segment.

The company had posted a net profit of Rs 481.7 bn.

Its revenue from operations rose 12.5% YoY to Rs 14.8 bn during the quarter under review as against Rs 13.2 bn of the corresponding quarter.

From the business segment, its revenue from consumer products segment was up 9.5% YoY at Rs 10.4 bn. While its revenue from engineering, procurement and construction (EPC) was up 86.7% to Rs 17.5 bn.

However, its revenue from the lighting solutions segment was down 2.2% YoY to Rs 2.7 bn from Rs 2.8 bn.

The company is engaged in business of consumer products, EPC, and exports.

To know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "SGX Nifty Up 74 Points | Titan Q3 Results | Why ITC Share Price is Rising | Top Buzzing Stocks Today". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!