India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 30, 2017

Sensex Trades on a Negative Note; Realty Stocks Gain Mon, 30 Jan 01:30 pm

After opening the day flat, the Indian share markets have continued to trade on a dull note and are currently trading marginally below the dotted line. Sectoral indices are trading mixed, with stocks in the realty sector and the capital goods sector witnessing maximum buying interest. Stocks in the consumer durables and the auto sector are trading in the red.

Both the BSE Sensex and the NSE Nifty are trading flat with a negative bias. Meanwhile, the BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading flat. The rupee is trading at 67.99 to the US$.

Idea cellular share price is leading the gains on the Indian Indices today. As an article in The Economic Times reported that Idea Cellular may be on the verge of a merger with India's second largest telecom operator Vodafone India.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The merger, if it goes through will create India's largest telecom company. The merged company will topple Bharti Airtel's leadership position in terms of both subscribers and revenue, as India's second and third largest telecom companies join hands.

A potential merger between Vodafone India with Idea Cellular would change the industry order. The combined entity would have 43% revenue share in the market by FY19 against 33% of Bharti Airtel and 13% for Reliance Jio.

The entry of Reliance Jio and the fierce tariff war it has triggered have set off brisk activity in the industry for fundraising and consolidation, as the incumbents look for ways and means to fend off the competition.

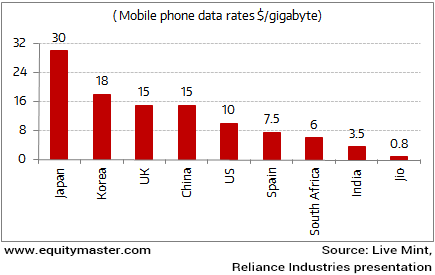

Jio's Data Pricing Disrupts the Telecom Apple Cart

Reliance Jio's disruptive pricing, seemingly hasn't left other market players with much of a choice but to accelerate consolidation moves to sustain the pricing wars.

Vodafone India's financial woes have lately been compounded by the bruising impact of Jio's free voice and data services launched last September that will continue till end of March.

The mix of its recent 4.4 billion Pound write-down, its till now modest on ground 4G spectrum footprint reflected in slower customer adds, and continuing price cuts in response to Jio's free services have further hit revenues and profits, which have all contributed to the consolidation overtures.

Idea Cellular share price has risen over 15% since January 18 on the back of rising speculation of such a merger, which would create India's largest telecom company.

At the time of writing Idea Cellular shares were trading up by 25%.

Moving on to news about stocks in the <>pharma sector. Suven Life Sciences share price surged as much as 1.5% in intraday trade as the company announced the grant of a new patent from the USA.

Leading bio-pharma company Suven, announced that it secured one product patent from the USA 9540321) corresponding to the New Chemical Entities (NCEs) for the treatment of disorders associated with Neurodegenerative diseases. The patent is valid through 2034.

The granted claims of the patents are from the mechanism of action include the class of selective 5HT6 compounds and are being developed as therapeutic agents and are useful in the treatment of neurodegenerative disorders like Alzheimer's disease, Attention deficient hyperactivity disorder (ADHD), Huntington's disease, Major Depressive disorder (MDD), Parkinson and Schizophrenia.

With these new patents, Suven has a total of 25 granted patents from USA. These granted patents are exclusive intellectual property of Suven and are achieved through the internal discovery research efforts. Products out of these inventions may be out-licensed at various phases of clinical development like at Phase-I or Phase-II.

Talking about the healthcare sector, the ValuePro team aims to find selective stocks to its subscribers that are fundamentally strong, and are also trading at a discount to its intrinsic value. One such attractively priced stock from the healthcare industry was recently recommended by the team. If you haven't read the report already, I you can read the complete report here. (Subscription Required).

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades on a Negative Note; Realty Stocks Gain". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!