India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 30, 2016

Global Markets Continue to Rally Sat, 30 Jan RoundUp

Global markets continued their rally this week. Sentiment received a huge boost when the Bank of Japan (BoJ) announced a surprise decision to implement Negative Interest Rate Policy (NIRP). Markets around the world were up on the hopes that central banks would maintain accommodative monetary policy. The US Fed, as expected, maintained the status quo at their meeting this week.

The stock market in Brazil was the top gainer. The Dow Jones Industrial Average was up by about 3.7%. In Europe, the European central bank (ECB) president stated that further stimulus measures could be on the cards. The British FTSE, the German DAX, and the French CAC indices were up 3.3%, 0.7%, and 2.1% respectively for the week. However, stock markets in China remained under pressure as investors continue to exit the country.

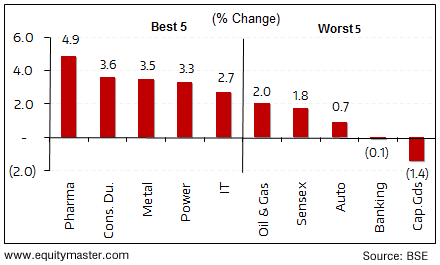

Back home, Indian Indices also gained in line with global peers. However, the up move has been muted compared to the global rally. The BSE Sensex was up 1.8% for the week.

Key World Markets During The Week

Majority of the sectoral indices ended the week on a positive note. Stocks in the pharma and consumer durables sectors were the biggest gainers. However, stocks in banking and capital goods sectors were the biggest losers.

Bse Indices During The Week

Now let us discuss some key economic and industry developments during the week gone by.

As per an article in Economic Times, the Coal Ministry will seek the nod of CCEA (cabinet committee of economic affairs) for coal supplies to power projects that have a total capacity of 30,000 MW (megawatt). This comes as some of these plants are likely to get commissioned in this fiscal, while some are likely to go on stream in 2016-17.

Power projects with a capacity of 30,000 MW were given LOAs (letter of assurances) in 2009, 2010 and 2011. The Coal Ministry will be seeking approval for conversion of these LOAs into fuel supply agreements (FSAs).

Historically, power companies in India have been unable to meet the electricity demand on account of inadequate coal supplies (subscription required). Supply of coal is made through legally enforceable fuel supply agreements (FSAs). Here, the new consumers need to approach the existing Standing Linkage Committee under the Coal Ministry for recommendation for issue of LOAs by coal companies. Further, LOA is issued on furnishing a Commitment Guarantee which is followed by execution of the FSA on fulfillment of the LOA conditions in a stipulated period of time.

Earlier, power producers with 30,000 MW had approached the ministries for early signing of FSAs. This was in order to do away with uncertainty and bring in some clarity to the entire process. However, these projects were not covered as part of the list of 78,000 MW of capacity for FSAs through a directive issued after the CCEA's nod during the UPA rule.

The above nod for coal supplies assumes significance as the government aims to provide round-the-clock power to everyone across the country. Moreover, the initiative will also aid the power companies that are facing a myriad of challenges and setbacks.

Coming to the power sector, states with financially sound power distribution companies and undivided electricity departments are lining up to be part of the Centre's Ujwal Discom Assurance Yojana (UDAY). The drive behind joining the UDAY scheme for these companies is incentives like concessional coal, power and finance, which reduce their costs.

Gujarat and Madhya Pradesh, whose discoms do not have accumulated loans, have shown interest in joining the scheme. Rajasthan, Chhattisgarh and Jharkhand have signed agreements with the Union power ministry to be a part of the scheme. Uttar Pradesh, Bihar and Haryana too will be signing similar memoranda of understanding. Apart from this, a dozen other states have conveyed in-principle approvals to be part of the scheme.

Rajasthan, which became part of the debt recast scheme, is expected to derive benefits to the tune of Rs 210 billion in the next three years. Rajasthan's discoms have debt of Rs 805 billion. The benefit of 210 billion will come as the state is expected to save Rs 70 billion interest cost annually. This comes as the state government takes over 75% of the debt as part of UDAY. As per the MoU, the three power distribution companies of Rajasthan will have to curb commercial losses to 15% and transmission losses to 3.5%, upgrade technology and deploy energy efficient equipment.

The UDAY scheme was brought up by the government to bring a turnaround in the State Electricity Boards (SEBs) that have been caught up in a vicious cycle of high debt and operational losses. The scheme allows power distribution companies (discoms) in select states to convert their debt into state bonds. Further, the part of debt not taken over the DISCOMs shall be converted by banks into bonds with a cap on the interest rates.

This rescue package for discoms bodes well for health of SEBs. By looking at the above developments and interest shown by various states, the scheme can have said to be gotten successful response. Having said that, one shall watch out further steps that government takes to make the scheme successful.

As per an article in Economic Times, the coffee board has stated that coffee production is expected to increase by 25,000 tonnes during this financial year. By this the total production is said to reach 3,80,600 tonnes, of which 1,00,000 tonnes will be Robusta and the rest will be Arabica variety.

Further, the board stated that it will be working towards strengthening high-value export markets like the European Union, the US, Canada, Japan, Australia, New Zealand, South Korea and Scandinavian countries.

Commenting on the domestic markets, the board said that the domestic production is also growing by 5-6% annually since 2000. Most of this growth is due to coming up of large number of coffee bars and cafes in India. It is heartening to note that about 35% of the Indian coffee exports during the year 2014-15 came in by value added products.

All of the above developments can bring up many opportunities in the food sector. The board stated that this can also attract investments in the sector, adding that the 12th Plan has a comprehensive avenue, through which subsidies can also be availed for export of high-value green coffee and value-added coffee as India brand.

Movers And Shakers During The Week

| Company | 22-Jan-16 | 29-Jan-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top gainers during the week (BSE-A Group) | ||||

| Shriram Transport Finance | 752 | 842 | 12.0% | 1,286/737 |

| Power Grid | 133 | 148 | 10.8% | 159/121 |

| Vedanta Ltd | 65 | 72 | 10.7% | 233/62 |

| Sun Pharma | 790 | 873 | 10.5% | 1,201/706 |

| Hindustan Zinc | 145 | 161 | 10.5% | 190/177 |

| Top losers during the week (BSE-A Group) | ||||

| Max (I) | 460 | 365 | -20.6% | 586/359 |

| United Spirits | 2,760 | 2,488 | -9.9% | 4,080/2,433 |

| Engineers India | 212 | 193 | -9.1% | 252/158 |

| Syndicate Bank | 74 | 68 | -8.7% | 128/67 |

| Reliance Communications | 67 | 62 | -6.8% | 92/46 |

Source : Equitymaster

Now let us move on to some of the key corporate developments in the week gone by.

Sun Pharmaceuticals has put a bundle of Ranbaxy brands on the block. These include brands that are either low priority in its domestic market strategy or may overlap with its own products. The brands, that the company is looking to sell, generates about Rs 1,150 million in annual sales with their expected valuation to be around 2.5x or Rs 2,500-2,700 million.

The deal has been in the market for over two months. However, the response for the same was tepid as some drugs on offer are witnessing declining sales. Moreover, as per the company's management, the bigger hurdle to the deal is that the products belong to a wide range of segments. Among the products on Sun Pharma's sale list are Fortwin, Romilast and Insucare.

It should be noted that Sun Pharmaceuticals acquired Ranbaxy last year as a part of a US$ 4 billion all-stock deal. Broadly, Ranbaxy's brands in the cardiovascular and diabetes segment saw sales of Rs 210 million last year, while orthopedic drugs brought in Rs 520 million. Sale of drugs in the respiratory, urology, oncology and dermatology segments stood at Rs 190 million, Rs 80 million, Rs 90 million and Rs 35 million, respectively. We believe that the restructuring in Ranbaxy's operations by exiting from low margin and loss making businesses will prove out as a key performance driver for the Sun Pharma in the long run.

Moving on to the news from Information Technology sector. Infosys Ltd has bought a minority stake in Waterline Data Science Inc., for US$ 4 million. Waterline Data Science is a start-up based in Delaware, US, which helps companies make sense of large data sets.

The deal, which marks the company's seventh investment from its US$ 500 million innovation fund, could help generate revenue from its clients who want to make sense of data sets which are held in Hadoop, a large open source big data repository.

Infosys has spent US$ 29.4 million to buy stakes in six start-ups and invested an undisclosed amount in September to become a limited partner in Vertex Ventures, a Palo Alto-based venture capital firm. Infosys also bought three firms in 2015, spending $390 million to purchase automation technology provider Panaya. Infosys has started picking minority stakes in start-ups focused on new age technologies under the new chief Vishal Sikka's 'New and Renew' strategy. The company recently reported a 1.7% QoQ growth in sales and a 2% QoQ growth in the net profit. Here is our analysis of the results (subscription required).

India's leading two and three-wheeler maker, Bajaj Auto will launch a 150-cc motorcycle on February 1 christened 'V'. It is built from the metal used in the country's most celebrated aircraft carrier INS Vikrant. INS Vikrant was commissioned in 1961 as the first aircraft carrier of the Indian Navy.

This will be the eighth product launched by Bajaj Auto this financial year and the first in 2016. 'V' is a new brand by the company supplementing five of its other brands in production. To be positioned in the executive segment of the motorcycle market, the company is hoping to ride on 'V' to boost sales volumes. Bajaj hopes to triple its sales in the segment from 20,000 a month to around 70,000.

Cipla has announced the completion of the sale of its entire holding in Hong Kong-based Biomab Holding to Biomab Brilliant for US$ 2.5 million. The company has completed the transfer formalities in relation to the divestment of its entire 25% stake in Biomab Holding Ltd.

Last year, Cipla had entered into an agreement to sell its entire 25% stake in Biomab Holding to Biomab Brilliant Ltd to focus on biological segment under its arm Cipla BioTec. Post this divestment, the company's biological business would be consolidated under Cipla BioTec that would focus on research, development, manufacturing and marketing of biosimilars, in the field of cancer, auto-immune diseases, respiratory diseases and diabetes.

Now let us have a look at some quarterly results that were announced in the week gone by.

ICICI Bank reported its results for the quarter ended December 2015. The bank has reported lowest profit growth in the past four years. The bank's performance was impacted on the back of sharp rise in bad loans. Subsequently this resulted in higher provisioning, that is setting aside money to cover the risk of default.

The bad loans increased by a third to Rs 211.4 billion on a sequential basis. The Gross Non-Performing Assets (GNPAs) increased by 0.95% QoQ in the December 2015 quarter.

Subsequently, provisions grew 200% QoQ to Rs 28.4 billion. The increase in bad loans and provisions was largely on account of RBI's directive to set aside money against visible stressed assets. RBI had asked lenders to identify accounts which showed clear signs of stress and make provisions to cover them in the second half of fiscal 2016. Reportedly, the bank has also stated that the bad loans were exacerbated by a large steel company's account getting reclassified as NPA. In spite of this, the net interest margins improved by 0.07% to 3.53%. Further, net interest income, difference between interest earned on loans and that paid on deposits grew by 13% YoY to Rs 54.5 billion.

Further, things do not seem to improve at least in the near term. The company has only recognized half of the entire NPAs as per RBIs directive to recognize visible stressed assets. The remaining half will be recognized in the last quarter. Asset quality issues will be the key thing to watch out for going forward.

HDFC Ltd reported its results for the quarter ended December 2015. The company's standalone net profits grew 6.6% YoY to Rs 15.2 billion. Reportedly, lower income from sale of investments coupled with a higher base in the same quarter of last year led to marginal growth in the net profits.

On the positive side, it is imperative to note that during this phase when major banks are facing several challenges, HDFC's loan book grew by 19% YoY. Reportedly, company is well capitalized to meet any growth spurt in the loan demand. Going forward too, growth in the demand for home loans will be the an important factor to watch out for.

Maruti Suzuki too reported its results for the quarter ended December 2015. The net sales grew by 20.4% YoY to Rs 147.6 billion. The volumes of car sold increased by 13.8% YoY to 374,182 units during the quarter. Exports too grew by 8% YoY to 31,187 units.

However, the disappointment came in on the margins front. The operating margins declined by 2% to 14.5%. The margins were impacted on the back of higher advertisement costs coupled with higher employee expense. There was a sharp rise in the advertisement expense on account of launch of new models such as Baleno, WagonR AGS and a facelift edition of Ertiga. Advertising expenses went up by Rs 700 million on a sequential basis. Further, employee cost shot up on the back of one-time bonus payment. The net profits grew by 27.1% YoY to Rs 10.2 billion.

Maruti will unveil a new compact sports vehicle (SUV) named Vitara Breeza to widen its line of models. Pick up in sales from the new models coupled with operating margins will be the key things to watch out for going forward. The stock is trading down by 2.6%.

ITC reported its results for the quarter ended December 2015. The revenues of the company declined 2.6% YoY to Rs 91.7 billion. The pressure on cigarette volumes coupled with sluggish demand environment in the fast moving consumer goods segment (FMCG) dragged down the revenues. Further, exports were impacted on the count of weak demand for wheat, soya, coffee and Indian tobacco leaf. The management stated that the taxation and regulatory headwinds facing the cigarette business impacted its sales growth.

However, gross margins improved across segments backed by falling input costs and a better product mix. The net profits of the company grew marginally by 0.68% to Rs 89.4 billion.

HDFC Bank Ltd reported its results for the quarter ended December 2015. The net profits grew 20% YoY to Rs 33.5 billion during the quarter. Net Interest Income (NII), recognized as a core income earned by banks grew 24% YoY to Rs 99.4 billion. A surge in the NII was on the back of strong loan disbursals that grew by 25.7% YoY.

The Gross Non-Performing Assets (NPA) stood at 0.97% for the quarter ended December 2015. The gross NPAs reported a marginal increase of 0.6% from the previous quarter. The rise was mainly due to slippages from the loan disbursals in the agriculture sector and default on credit card payments.

We believe global markets are now slaves to stimulus measures. Markets have divorced themselves from economic reality. However, long-term investors should be focused only on investing in fundamentally strong stocks. These are the stocks that will outperform during these difficult times.

And here's an update from our friends at Daily Profit Hunter...

The Nifty saved the firecrackers for Friday. After trading on a subdued note for most of the week, the index hit a century on Friday. The index is bouncing back from the lows and the momentum could push the index to 7,675 and 7,725 in the coming week. You can read the detailed market update here…

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global Markets Continue to Rally". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!