India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 27, 2017

Indian Indices Continue Momentum; Telecom Stocks Witness Buying Fri, 27 Jan 11:30 am

After opening the day marginally higher, the Indian share markets have continued their momentum and are presently trading in the green. Sectoral indices are trading on a positive note with stocks in the telecom sector and power sector witnessing maximum buying interest.

The BSE Sensex is trading up 242 points (up 0.9%) and the NSE Nifty is trading up 68 points (up 0.8%). The BSE Mid Cap index is trading up by 1.1%, while the BSE Small Cap index is trading up by 0.9%. The rupee is trading at 68.19 to the US$.

According to a survey by the Reserve Bank of India (RBI), business sentiment in the manufacturing sector in India deteriorated in the October-December quarter. More so, the sentiment is said to further decline in the three months ending March.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The survey showed the level of optimism stood lower on parameters such as order books, capacity utilisation and imports during the second quarter of FY17.

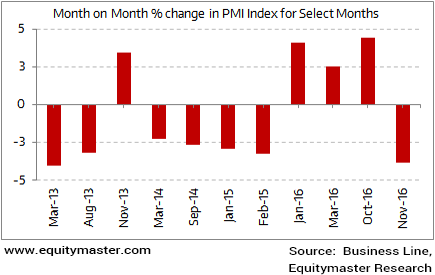

While economic activity was affected after demonetisation, the survey did not have any responses on the impact of the notebandi. The manufacturing Purchasing Manager's Index stood down by 3.9% in November on a month-on-month basis. It was the biggest fall since March 2013. This can be seen in the chart below:

Demonetisation Hits Manufacturing - Biggest Fall Since March 2013

Market participants are looking forward on what changes will the upcoming Union Budget 2017 bring. The budget comes within months of demonetisation and market participants are wondering what measures the government will take to stimulate the economy.

This, along with global economic uncertainty, has led Indian share markets trade on a volatile note of late. The market is expecting depressed earnings for the third quarter (Oct-Dec 2016).

This begs the question: What can one do to sail safely through such times?

Being Buffett-followers and taking to his advice as fish to water, we think the best way to counter the above volatility is to follow a long-term value investing approach.

Also, one could counter the above volatility by having a set process in place. As Rahul Shah, co-head of research at Equitymaster, showed us at the Conference the importance of having a process and the discipline to stick with it. Many of you have already tasted the fruits of Rahul's Microcap Millionaires.

But at the Conference, Rahul asked attendees to mark 10 February 2017 on their calendars. The reason? He will send out his first Profit Velocity report to subscribers.

As you may have guessed, Profit Velocity is a system-based investing approach.

With Profit Velocity, Rahul believes that the system could help subscribers fetch gains several times those of the benchmark index.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Continue Momentum; Telecom Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!