India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 25, 2021

Sensex Trades Marginally Lower; Dow Futures Up by 90 Points Mon, 25 Jan 12:30 pm

Share markets in India are presently trading marginally lower.

The BSE Sensex is trading down by 34 points, up 0.1% at 48,844 levels.

Meanwhile, the NSE Nifty is trading down by 21 points.

Grasim and UPL are among the top gainers today. Reliance and Eicher Motors are among the top losers today.

The BSE Mid Cap index is trading down by 0.7%.

The BSE Small Cap index is trading down by 0.9%.

On the sectoral front, stocks from the energy sector, are witnessing most of the selling pressure.

On the other hand, stocks from the banking sector, are witnessing most of the buying interest

US stock futures are trading higher today, indicating a positive opening for Wall Street.

Nasdaq Futures are trading up by 99 points (up 0.7%) while Dow Futures are trading up by 90 points (up 0.3%)

The rupee is trading at 72.91 against the US$.

Gold prices are trading down by 0.4% at Rs 48,960 per 10 grams.

Gold prices in India continued to be weak for the third day in a row. On MCX, gold futures dipped 0.02% to Rs 49,131 per 10 grams despite positive global cues. In the previous session, gold had slipped 0.5%. Hopes of big US fiscal measures continue to support gold prices on the downside.

In global markets, gold prices edged higher on optimism that US lawmakers will soon pass the massive economic stimulus to revive the world's largest economy. Spot gold rose 0.3% after dropping 0.9% in the previous session.

Note that gold is considered a hedge against inflation and currency debasement, likely from widespread stimulus.

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Speaking of stock markets, India's #1 trader, Vijay Bhambwani, talks about what happens behind the scenes in his trade recommendations, in his latest video for Fast Profits Daily.

In the video below, Vijay shares details of what he actually looks at when recommending and monitoring a trade.

Tune in here to find out more:

Moving on to stock specific news...

Among the buzzing stocks today is Tata Motors

Tata Motors has raised prices of its passenger vehicle (PV) range to maximum Rs 26,000 depending upon the variant. The new price hike has come into effect from January 22, 2021.

Tata Motors said, "Rising input costs and material costs of steel, precious metals and semiconductors have compelled the company to pass on a part of the cost to customers."

"Continuing its commitment towards customers, the company will also offer protection from the price increase to customers who have booked Tata passenger vehicles on or before January 21, 2021," Tata Motors said.

On the company's Q3FY21 results, Tata Motors said that its PV business has witnessed strong demand for its 'New Forever' range of cars & SUVs and that the segment grew by 39% year-on-year (YoY) in FY21 over FY20.

In Q3FY21, Tata Motors also registered the highest ever sales in last 33 quarters and continues to work on debottlenecking the supply chain and ramp up its output to meet the increased demand."

We will keep you posted on more updates from this space. Stay tuned.

At the time of writing, Tata Motors share price was trading down by 2.2% on the BSE.

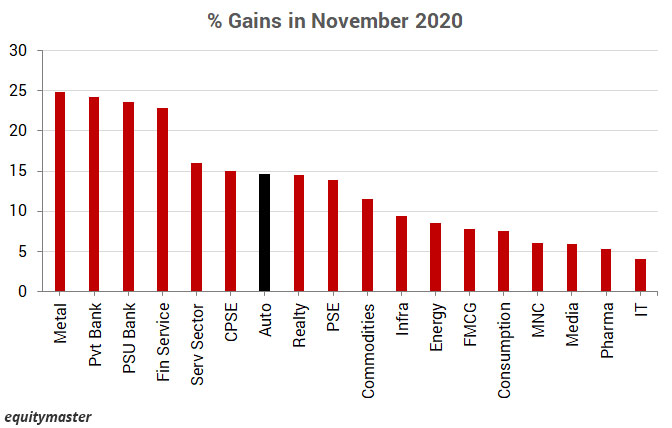

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The auto index entered the greed phase in September 2019 and is expected to stay there until December 2021. This means there is still a lot of fuel left for automobile stocks.

How automobile stocks perform in the coming months remains to be seen.

Moving on to news from the energy sector...

Reliance Q3FY21 Results: Profit After Tax Rises. 12% YoY

India's largest listed company Reliance Industries (RIL) reported a 12.5% year-on-year (YoY) rise in its consolidated net profit to Rs 131 billion. The oil-to-telecom conglomerate reported consolidated revenues of Rs 1,200 billion which were up 21.1% YoY. The weak topline performance of the company was attributable to the continued struggles of the refining business and retail business of the company due to the Covid-19 pandemic.

"At a time when the Indian economy is poised for a confident recovery, we at Reliance are humbled that we have been able to contribute to it with our company's impressive performance in the third quarter of FY21," Chairman and Managing Director, Mukesh Ambani said.

We have delivered strong operational results during the quarter with a robust revival in O2C and retail segments, and a steady growth in our digital services business. I am proud that Reliance has employed 50,000 more people since March 2020," he added. RIL said that it created more than 50,000 new jobs during the pandemic-impacted period of April-December in its consumer businesses and last mile delivery.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Marginally Lower; Dow Futures Up by 90 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!