India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 22, 2016

Global Markets Remain Volatile Fri, 22 Jan RoundUp

Global markets reacted positively to hints of more policy stimulus in Europe and Japan, prompting a robust rally in the battered oil and equity markets on Thursday.

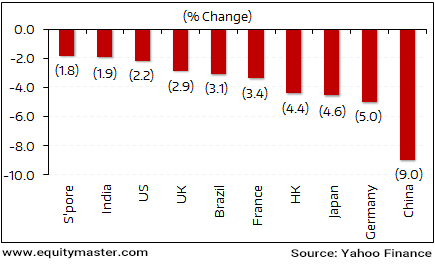

At the time of writing, stock markets in Brazil and the US ended the week lower by 2.2% and 0.7% respectively. However, stock markets in China have come under pressure as a raft of economic indicators has confirmed the country's declining growth, putting China at the top of global investors' worry list along with plunging crude oil prices.

China has jolted global markets twice in the last six months by allowing sudden, sharp slides in the yuan and then intervening aggressively to stabilise it, sparking confusion over its policy. Central bank action to temper the depreciation has brought China's foreign reserves down to about $3.3 trillion from nearly $4 trillion in the middle of 2014. The stock markets in Hong Kong and Singapore ended the week lower by 2.3% and 2% respectively.

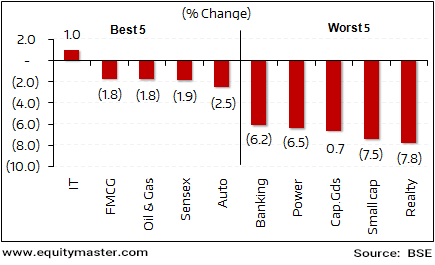

Back home, Indian Indices moved towards a bear market territory and was trading at 20.6% off its peak before it recovered marginally. BSE Sensex was marginally down by 0.1% during the week.

Key World Markets During The Week

Majority of the sectoral indices ended the week on a mixed note. Stocks in Oil & gas and FMCG sector were the biggest gainers. However, stocks in banking and capital goods sector were the biggest gainers.

Bse Indices During The Week

Now let us discuss some key economic and industry developments during the week gone by.

As per an article in Economic Times, India will resume its unrestricted import of oil from Iran with international nuclear sanctions on Iran being lifted on Sunday.

The lifting of sanctions came after the US secretary of state John Kerry issued a statement confirming the International Atomic Energy Agency has verified that Iran has fully implemented its required commitments. With this development, Iran is expected to increase its exports of 1.1 million barrels of oil per day by 5,00,000 barrels per day. Indian currently imports 2,60,000 barrels of oil a day from Iran. Mangalore Refinery and Petrochemicals (MRPL), Indian Oil Corporation, and Essar Oil are the primary buyers of the Iranian oil.

And as per sources, Tehran is targeting India besides its traditional European partners as one of its top destinations. Further, Tehran is not considering increasing its oil exports to China, South Korea or Japan due to the dampened demand witnessed there.

On the other hand, the Indian car market is growing faster than China and the country's economic growth rate is picking up. Going forward, India could be an important demand driver for oil.

Exports contracted for the 13th month in a row during the month of December. Tepid global demand coupled with volatile global currency dragged the exports down. However, exports from China contracted just by 1.4% in the same month. Depreciating yuan have partially supported the exports in China.

Further, exports of drugs & pharmaceutical, chemicals and readymade garments reported a growth of 8.2%, 1.1% and 5% respectively for the month of December. However, petroleum products and engineering goods witnessed a contraction of 47.7% and 15.7% respectively.

Non-Oil imports picked up 7.6% in December. On the other hand, machinery equipment, transport equipment and project goods witnessed a contraction of 1.1%, 38.8%, 29.1% respectively indicating poor signs of pick up in the investment demand.

Movers And Shakers During The Week

| Company | 14-Jan-16 | 22-Jan-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top gainers during the week (BSE-A Group) | ||||

| Axis Bank | 391 | 425 | 8.8% | 655/367 |

| Hero Motorcorp | 2,433 | 2,600 | 6.9% | 2,937/2,252 |

| JSW Steel | 1,003 | 1,066 | 6.3% | 1,096/807 |

| IRB Infrastructure | 226 | 235 | 4.0% | 276/197 |

| UltraTech Cement | 2,627 | 2,731 | 4.0% | 3399/2531 |

| Top losers during the week (BSE-A Group) | ||||

| Aditya Birla Nuvo | 2,052 | 890 | -56.6% | 2,364/865 |

| Jet Airways | 753 | 618 | -18.0% | 796/249 |

| Vedanta Ltd | 79 | 65 | -18.0% | 233/62 |

| Gujarat Mineral Development Corporation | 74 | 62 | -16.7% | 137/60 |

| IFCI | 26 | 22 | -14.3% | 42/18 |

Source : Equitymaster

Now let us move on to some of the key corporate developments in the week gone by.

As per an article in leading financial daily, India's leading PSU bank State Bank of India has declared that it will be cautiously opting for the Strategic Debt Restructuring (SDR) plan going forward. This scheme was recently proposed by RBI governor Raghuram Rajan. The SDR scheme allows the banks to convert a part of the debt given to corporates into equity. Post conversion of this debt into equity, banks need to find a buyer for the asset within a period of 18 months. Presently, banks are increasingly finding problems to get buyers for these assets within the specified time. There have been slew of companies, where banks have converted debt into a controlling equity stake, that belonged to companies in the stressed sectors such as steel and infrastructure. Here buyers are not easy to find. Reportedly, the top management of SBI has asked its officials to invoke SDR only in cases where there is clarity on a potential buyer.

While announcing the monetary policy on 1 December, RBI governor Raghuram Rajan had said that the central bank is in constant dialogue with banks and is insisting that the facilities provided to them in relation to SDR to clean up their balance sheets are used in the right way.

Kotak Mahindra Bank Ltd declared its results for the quarter ended December 2015. The company's net profit grew by 36.5% YoY on account of higher interest income and increased commissions and fees. However, figures are not comparable on a YoY basis as the December quarter figures also represent the financials of the acquired ING Vyasya Bank Ltd.

Net Interest Income increased by two-third led by growth in advances and deposits boosted from the acquisition of ING Vyasya Bank Ltd. Reportedly, banks's corporate loan and retail loans witnessed a jump of 84% each, largely helped by the merger. Further, loan portfolio was dominated by disbursements to small and medium enterprise.

Gross Non-Performing Assets for the quarter stood at 2.3% as compared to 1.87% in the year ago period. Asset quality came under pressure after merger with ING Vysasya Bank. Provisions for the quarter stood at Rs 2.35 billion as compared to 0.30 billion in the year ago period. Provisioning too witnessed a sharp surge, owing to the merger.

As per an economic daily, Zee Entertainment Enterprises will expand operations to Germany to launch a free-to-air TV channel by mid - 2016. This new channel will be showing Bollywood movies, Indian series, entertainment and general interest programmes. The core target groups are women between 19 and 59 years of age. The 24-hour service aims for distribution on all major cable and satellite platforms.

Meanwhile, in its results for the quarter ended December, the company posted 17% YoY increase in income to Rs 15.9 billion. This rise was mainly driven by higher advertisement revenue, which grew 27% on a YoY basis. However, a sharp increase in tax expenses, which were up by 51% YoY, and a fall in other income weighed on profits. After four consecutive quarters of growth, the company's net profit fell 11% YoY to Rs 2,750 million in the December quarter.

Zee Entertainment Enterprises is one of India's leading television media and entertainment companies. It is amongst the largest producers and aggregators of Hindi programming in the world, with an extensive library housing over 120,000 hours of television content.

HCL Technologies reported its results for the quarter ended December 2015. The company's net profits grew by 11% QoQ to Rs 19.20 billion. Further, revenues posted a growth of 2.4% QoQ to Rs 103.4 billion.

Revenues from the Americas, accounting for roughly two-thirds of the total business, grew at a pace of 5.5%. However, revenues from Europe and rest of the world declined by 2.4% and 3.4% respectively. The quarter did not witness any addition to client, which would generate more than US$ 100 million in revenues. However, company added three clients, which would generate more than US$ 40 million in revenues.

Growth from engineering, infrastructure services and research and development (R&D) are the key things to watch out for going forward.

As per an article in Livemint, profitability of public sector banks is set to take a hit owing to Reserve Bank of India's (RBI) decision to clean up the bank's books by the end of March 2017. Recently, RBI took an assessment of the asset quality of banks and asked them to stop delaying the recognition of the visibly stressed assets. The decision will drag down the profitability of banks, as they would start recognizing bad loans which inturn will increase their provisioning requirement.

Reportedly, public sector banks like Bank of India, Central Bank of India, IDBI Bank, Dena Bank and Indian Overseas Bank are more vulnerable to take a hit on their profits as compared to others as 20-25% of their loan book is exposed to the stressed sectors.

As per RBI rules, an account is classified as an NPA when payments are overdue for more than 90 days. Once this is done, banks need to set aside money to cover 25% of the loan amount in the first year. Previously, assets restructuredwere attracting a lower provisioning of 5%. The higher provisioning percentage will also put a drag on the company's profitability.

We believe global markets are likely to remain under pressure going forward. None of the concerns of global investors are likely to go away anytime soon. Indian markets too will continue to experience the fallout of this turmoil. However, long term investors need not be too concerned. Times like these could offer good opportunities to enter good quality stocks at reasonable valuations.

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global Markets Remain Volatile". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!