India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 20, 2017

Sensex Opens in Red, Axis Bank Plummets 6% on Weak Q3 Result Fri, 20 Jan 09:30 am

Asian markets are higher today as Japanese and Chinese shares show gains. The Nikkei 225 is up 0.10%, while the Shanghai Composite is up 0.55%. The Hang Seng is down 0.64%. Stock markets in Europe and the US closed their previous session in negative ahead Donald Trump's inauguration later in the day.

Meanwhile, Indian share markets have opened the day on a negative note. The BSE Sensex is trading lower by 80 points and the NSE Nifty is trading lower by 33 points. Meanwhile, S&P BSE Mid Cap and S&P BSE Small Cap are trading lower by 0.1% respectively. Losses are largely seen in <>bank stocks and IT stocks.

The rupee is trading at 68.18 against the US$.

According to a leading financial daily, HDFC will offer women borrowers home loans at 8.65% and others at 8.70% for loans up to Rs 75 lakh. The company's rates are now competitive with those of large lenders such as State Bank of India and ICICI Bank, which have set their home loan rates at 8.65% and 8.7%, respectively. Bank of Baroda now offers the lowest home loan rate of 8.35% to CIBIL score holders of 760 and above.

HDFC has cut its retail prime lending rate (RPLR) by 15 basis points to 16.15% in a move that will benefit existing customers. The reduction in the RPLR will also be applicable on loans to non-resident Indians (NRIs)/ PIO card holders.

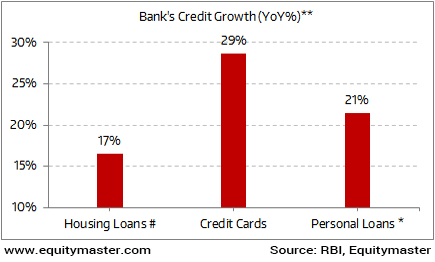

One of the biggest contributors to India's banking loan book growth is housing loans. As per RBI, as of 30th October 2016, it contributed around 54% to the total retail loan book of the banking system.

Now since the contribution of the housing loans to total retail loan portfolio is around 54%, the overall growth of the banking credit largely depends on the growth of the housing sector.

Personal Loans Outperformed Housing Loans

In another development, Axis Bank Ltd's fiscal third quarter net profit fell 73.3% on-year to Rs 5.79 billion, amid rising NPAs and falling margins.

Axis Bank's gross NPAs also expanded higher than expected to 5.22% in Oct-Dec from 4.17% in the preceding quarter, rising by more than a full percentage point. The company's net NPAs in the fiscal third quarter rose to 2.18% from 2.02% in the previous quarter.

Axis Bank share price began the trading day down by 5.6% on the BSE.

Moving on to news from stocks in the steel sector. According to an article in The Financial Express, Care ratings has downgraded close to Rs 322 billion of Tata Steel's various debt instruments by one notch, citing continuing uncertainties related to the disposal/restructuring of its stressed UK business.

These instruments include long-term unsecured rupee loan, unsecured debentures, and unsecured perpetual bonds. The revised rating, however, continues to place the company in stable category.

Tata Steel's gross debt at the end of September 2016 stood at Rs 827 billion. CARE revised the rating of unsecured non-convertible debentures of Rs 71 billion from AA+ to AA, of long-term bank facilities of Rs 228 billion from AA+ to AA, and perpetual bonds issue from AA to AA-.

The rating agency observed that while the performance of European operations has witnessed an improvement in the short term, it has remained volatile over the past few years. The current improvement in performance is in part attributable to the depreciating pound as well as current status quo in trade agreements between the UK and the EU.

Moreover, as per the reports, the gross cash accruals have steadily declined from Rs 82 billion in FY13 to Rs 55 billion in FY16. The increase in debt also deteriorated gearing levels to 2.66 times in FY16 from 1.84 times in FY13.

In another development, British financier Edi Truell renewed an offer to take over Tata Steel giant UK pension scheme in a deal that would allow members to keep benefits in full.

Tata Steel is in talks with stakeholders about spinning off its British Steel Pension Scheme into a standalone entity and cutting benefits for all 130,000 members.

The report further added that the company is under pressure to end its obligations to the 15 billion pound scheme as it is in merger talks with Germany's Thyssenkrupp, which is not prepared to take on Tata's UK pension obligations.

Tata Steel share price opened the day down by 0.8% on the BSE.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens in Red, Axis Bank Plummets 6% on Weak Q3 Result". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!