India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 19, 2017

Sensex Opens Flat; Bharti Airtel Up 0.9% Thu, 19 Jan 09:30 am

Asian markets are lower today as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.94% while the Hang Seng is down 0.47%. The Shanghai Composite is trading down by 0.11%. Stock markets in the US ended their previous session on a firm note.

Meanwhile, Indian share markets have opened the trading day flat. The BSE Sensex is trading lower by 26 points while the NSE Nifty is trading lower by 4 points. The BSE Mid Cap index and BSE Small Cap index both have opened the day up by 0.2%. The rupee is trading at 67.94 to the US$. Sectoral indices have opened the day mixed with capital goods, oil & gas stocks witnessing maximum buying interest. While, banking and realty stocks have opened the day in red.

Telecom stocks have opened the day on a mixed note with Idea Cellular and ITI Ltd witnessing selling pressure. According to an article in a leading financial daily, the Indian government is looking to allocate sufficient spectrum of 40 Mhz to each operator in each of the 22 circles, at par with some international markets. This would help increase the low broadband penetration in India.

Presently, Indian telecom service providers hold close to 25 Mhz of spectrum (per circle). However, this is lesser than needed to offer a gamut of services including government's ambitious digital drive and taking Indian demographics into account.

Further, the government has set a budget of Rs 115 billion for telecom infrastructure development for the next fiscal year after having a drawl of Rs 76 billion in 2016-17. The department is also planning to implement multiple strategies such as putting overhead fiber cables, using satellite bandwidth, last-mile connectivity via Wi-Fi which it aims to bring in all villages by September 2018.

In October 2016, Department of Telecom sold 965 MHz of the 2,354.55 MHz spectrum put up for auction, raising Rs 657.9 billion in India's largest spectrum sale. The government had put up spectrum worth Rs 5.63 trillion at a base price for sale in five spectrum bands.

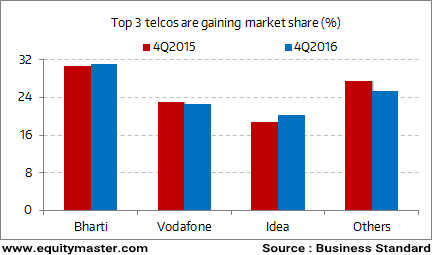

An interesting statistic in the telecom industry shows that Bharti Airtel, Vodafone India, and Idea Cellular garner about 75% of the industry's revenues.

Will Smaller Telcos Survive?

The chart above shows that all other players have been steadily losing market share. In such a fierce competition, whether the small telcos will be able to survive is the key thing to watch out for going ahead.

Moving on to the news from

One must note that, ONGC is currently developing Vashishta and S1 gas fields in KG basin under a deep-water development project with an investment of US$751.65 million. The Vashishta field is estimated to produce 9.56 billion cubic metres (bcm) over a period of nine years

Similarly, the S1 field is located undersea between 250 and 600 meters. It is expected to deliver an output of 6.22 bcm over a period of eight years. While the Vashishta field is a free gas field with estimated reserves of 12.92 bcm, the S1 field lies to the east of G-1 field and is a free gas field with estimated reserves of 10.37 bcm.

Reportedly, Vashishta is the first field in the country to get the premium price of gas. Exploratory/Appraisal drilling is carried out in the identified sub-surface structures to find out if there is presence of hydrocarbons in commercially exploitable quantities.

ONGC share price opened the day up by 0.7%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat; Bharti Airtel Up 0.9%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!