India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 17, 2017

Sensex Trades in the Red; Metal Stocks Witness Selling Tue, 17 Jan 01:30 pm

After opening the day on a positive note, the Indian share markets have slipped below the dotted line and are trading in the red. Sectoral indices are trading on a mixed note with stocks in the metal sector and the oil & gas sector witnessing selling pressure. IT stocks are trading in the green.

The BSE Sensex is trading down 48 points (down 0.2%) and the NSE Nifty is trading down 16 points (down 0.2%). Meanwhile, the BSE Mid Cap index is trading up by 0.1%, while the BSE Small Cap index is trading up by 0.3%. The rupee is trading at 68.06 to the US$.

The goods and services tax (GST) is set to be rolled out from 1 July 2017 after the centre and the states struck a consensus on the contentious issue of sharing of administrative powers. The decision was finalized during the ninth meeting of the GST Council.

At the end of the meeting both sides agreed to work towards meeting the new deadline and sharing administrative control over small and big taxpayers in a fixed ratio.

The road is now clear for the central government to table all the associated bills relating to the GST in the upcoming budget session of the parliament, starting from 31 January.

The council meeting made a major headway in resolving the much-debated issue of administrative power sharing between the states and the center.

Both, but especially the centre, conceded some ground to generate a consensus on this long-pending issue that was threatening to derail the implementation of the singular piece of tax reform which will, for the first time, economically unify the country

However, other issues such as finalizing the tax slabs, and implementation concerns still remain and will be fine-tuned over the coming period.

After 1 July, when the GST rolls out GST, it will bring with it host of regulations to enable transparency in the tax regime. There will be an estimated 8 million taxpayers under GST.

As per the agreement arrived between the centre and the states, small taxpayers with an annual revenue of less than Rs 15 million under GST will be divided between the states and the centre in the proportion of 90:10 for the purpose of scrutiny and audit. This will be done randomly.

Scrutiny and audit will go a long way in reigning in potential offenders, especially in a country where 0.11% of the population pays 80% of the personal income tax.

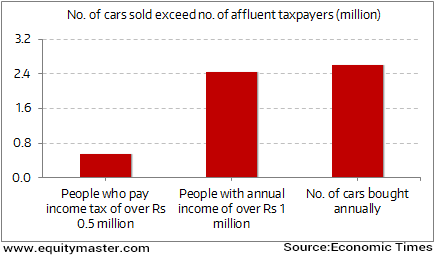

Here's an obvious sign that many Indians may not be paying up their taxes very dutifully. As the chart shows, the number of cars sold in India is actually higher than the number of people declaring annual income of over Rs 1 million.

India Low on Taxpayers, High on Car Buyers

Implementation of the GST will considerably increase the indirect tax collections, and would consequently reduce the burden placed on direct tax collections.

In the next meeting of the GST council on 18 February, the council will finalize the draft laws-the central GST law, the state GST law and the Integrated GST law-after incorporating the changes that have been agreed upon.

Moving on to news from stocks in the power sector. State-run power equipment maker

The unit will be the second 500 MW set to be commissioned at Sagardighi TPS Phase II project in Murshidabad district of West Bengal.

The first unit of the 1000-MW project was commissioned in December, 2015. The project has been set up by West Bengal Power Development Corporation.

As part of the contract signed earlier, BHEL is responsible for the design, engineering, manufacture, supply and erection and commissioning of steam generators, steam turbine generators and auxiliaries, electrical equipment and switchyard.

The contract scope also includes supply of controls and instrumentation, along with associated civil works.

The first phase of the project features two 300MW coal-fired units, which were commissioned earlier.

BHEL manufactured the equipment for the project at its facilities in Trichy, Ranipet, Haridwar, Hyderabad, Bengaluru and Bhopal plants. The company's Power Sector - Eastern Region was responsible for the erection and commissioning of the equipment.

India's largest engineering and manufacturing company earlier said it has been supporting power infrastructure development in the state of West Bengal, and has supplied equipment for 73% of its coal-fired energy stations.

BHEL is currently under contract to supply 3 units of 40MW each for the NTPC's Rammam hydroelectric project in West Bengal.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades in the Red; Metal Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!