India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 13, 2017

Sensex Opens Flat; Tata Power Gains 1.1% Fri, 13 Jan 09:30 am

Asian markets are higher today as Japanese and Hong Kong shares show gains. The Nikkei 225 is up 0.73% while the Hang Seng is up 0.43%. The Shanghai Composite is trading up by 0.12%. Stock markets in the US & Europe ended their previous session on a weak note.

Meanwhile, Indian share markets have opened the trading day on a flat note. The BSE Sensex is trading higher by 80 points while the NSE Nifty is trading higher by 12 points. The BSE Mid Cap index and BSE Small Cap index have opened the day up by 0.3% & 0.2% respectively. The rupee is trading at 68.09 to the US$. Barring auto stocks, all sectoral indices have opened the day in green with IT, oil & gas stocks witnessing maximum buying interest.

Pharma stocks were among the worst hit on Thursday following US President-designate Donald Trump's strong remarks on the pricing of medicines. Thereby indicating a tougher working environment for Indian drug (Subscription Required) firms in the US, going forward. Trump said that the US will create new drug-bidding procedure.

The US is a big export market for many Indian drug companies. Dr Reddy's Laboratories, Sun Pharmaceutical Industries and Lupin were the most hit, suffering losses of up to 3%.

However, Indian companies are unlikely to be impacted due to pressure on bringing down prices of innovative drugs. Indian Pharma companies provide low cost generic drugs, keep the prices of drugs low in the US. But what could hurt Indian companies are issues such as Medicare negotiating, bidding for government contracts, the reports noted.

If Indian pharma companies are supplying these products to the US markets and if there are no US suppliers, which is mostly the case, this doesn't affect the Indian pharma companies. With Trump officially taking charge as the 45th President of the United States on 20 January, will the pharma stocks recover or continue to be in the pressure will be the key thing to watch for going ahead.

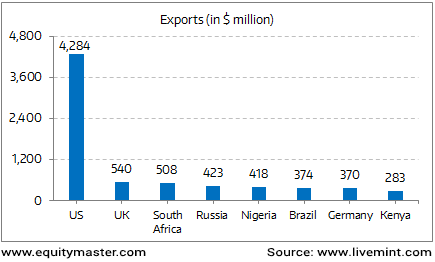

Surging Exports to the US

The above chart illustrates the data for India's exports of drugs, pharmaceuticals and fine chemicals for the period ending April 2015. India has always had an advantage due to its strong generic pharmaceutical industry (70% of the market share in terms of revenue), which supplies drugs at prices that are among the lowest in the world.

Moving on to the news from stocks in power sector. According to an article in a leading financial daily, Tata Power Renewable Energy Ltd (TPREL), Tata Power's wholly-owned subsidiary, has commissioned 36 MW wind capacity of a 100 MW wind farm at Nimbagallu in Andhra Pradesh and a 49 MW solar plant at Kayathar, Tamil Nadu, under Welspun Renewable Energy Pvt Ltd (WREPL).

Following this project, the operating renewable energy capacity of TPREL goes up to 1,876 MW, comprising 841 MW wind, 915 MW solar, and 120 MW waste heat recovery capacity currently.

In 2016, TPREL won 320 MW of solar bids, which are under development and will be commissioned in 2017. The company also added 304 MW wind capacity last year, which are under development and construction in Gujarat, Andhra Pradesh, Madhya Pradesh and Karnataka.

Notably, this strategic approach is in line with Tata Power's aim to expand its clean energy portfolio up to 35-40% by 2025. Going ahead, whether Tata power continues to fortify its position of being the largest renewable energy company in the country will be the key thing to watch out for.

Rahul Shah, Co-head of Research, pointed out that a few of the renewable energy projects are already running into financial troubles. Can we rule out a similar fate for the other projects? In his view, investors should not get carried away by the hoopla surrounding renewable energy projects. It's a much-needed initiative to reduce the pollution levels across the country. However, investors in this space must be extremely cautious.

Tata Power's share price opened the day up by 1.1%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat; Tata Power Gains 1.1%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!