India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 12, 2017

Sensex Trades Marginally Higher; Power Stocks Witness Buying Thu, 12 Jan 11:30 am

After opening the day on a flat note, the Indian share markets have continued to trade marginally higher. Sectoral indices are trading on a positive note with stocks in the power sector, capital goods sector and IT sector witnessing maximum buying interest.

The BSE Sensex is trading up 52 points (up 0.2%) and the NSE Nifty is trading up 12 points (up 0.2%). The BSE Mid Cap index is trading down by around 0.1%, while the BSE Small Cap index is trading flat. The rupee is trading at 68.08 to the US$.

A per an article in the Economic Times, the Centre will soon rank states on a digital transaction index. The move is a part of Centre's efforts to make India less-cash economy.

As per the news, government think tank Niti Aayog has started the above exercise by reaching out to states to collate data which will help it assemble the first of its kind index. States will then be ranked on the basis of this index representing digital transactions.

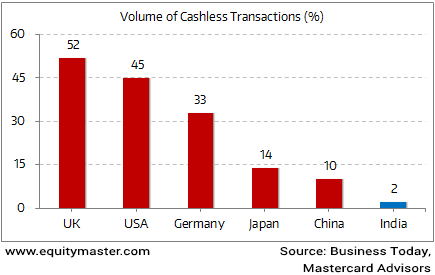

Note that governments and central banks across the globe are on a war footing to uproot physical cash from the financial system. And with the demonetisation saga, India too has joined this rally to become a cashless society.

However, we must question: Will it be in India's best interest to move towards a cashless society?

We don't think so.

The fact is that India is not ready to go digital. A few days ago we pointed out some challenges to India's digitisation. Only 15% of India's one billion wireless subscribers have a broadband connection. Around six lakh villages do not have adequate mobile or internet connectivity. India has only around 15.1 lakh point of sales machines. So unless these issues are sorted out, the road towards a cashless economy will remain a long one.

Is India Ready to Go Digital?

Also, even if the above problems are overcome, there remains a dark side to digital money. When individuals use less cash, they switch to credit cards. And unlike cash, credit cards allow you, even encourage you, to spend more than what you have. People then start spending more by borrowing. And this could mean an increase in debt and decrease in savings.

We don't know how the above trends will play out. The move towards a cashless society could mean a positive development for India. It will lower costs, improve transparency in transactions, save time, and open up opportunities for some companies. However, we must pause to consider the other side of the coin, and be ready to deal with challenges.

In another news update, Finance Minister Arun Jaitley yesterday said the Centre is still aiming to roll out Goods and Services Tax (GST) regime from April 1. As per Mr Jaitley, there are a few critical issues that are pending and expected to be sorted out in the next few weeks.

The minister also said that implementing GST before September 16 is a necessity if it doesn't get implemented in April. Presently, the rollout of GST is stuck because of differences between the Centre and states on its implementation. As per the Constitutional Amendment passed by Parliament for the GST implementation, some of the existing levies would expire after 16 September 2017.

Last year, the government finalised the tax rates for GST. This came as the GST Council decided upon a multi-layered tax rate system. The Council finalised a four-tier tax structure, with the tax rate on items of mass consumption at 5%. Other slab rates are 12%, 18%, and 28%. To get a detailed view on the Goods and Services Tax (GST), you can read Vivek Kaul's report, GST & You: What the Media DID NOT TELL YOU about the GST.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Marginally Higher; Power Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!