India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 11, 2024

Sensex Today Trades Higher | Bajaj Auto & Reliance Industries Top Gainers | Polycab Slumps 10% Thu, 11 Jan 10:30 am

Asian equities opened higher on Thursday as investors looked ahead to a US consumer price report for possible clues on when the Federal Reserve could begin cutting interest rates, while Japanese stocks continue to ride the crest of an increasingly bullish wave.

The Nikkei index surged 1.9%, while Hang Seng was trading 1.6% higher. Meanwhile Shanghai index was trading flat.

US stocks closed higher Wednesday, with investors awaiting the release of fresh U.S. inflation data and earnings.

Here's a table showing how US stocks performed on Wednesday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 143.8 | 1.24 | 0.87% | 144.53 | 142.46 | 144.53 | 86.7 |

| Apple | 186.19 | 1.05 | 0.57% | 186.4 | 183.92 | 199.62 | 128.12 |

| Meta | 370.47 | 13.04 | 3.65% | 372.94 | 359.08 | 372.94 | 127.15 |

| Tesla | 233.94 | -1.02 | -0.43% | 235.5 | 231.29 | 299.29 | 114.92 |

| Netflix | 478.33 | -3.76 | -0.78% | 487 | 472.95 | 500.89 | 285.33 |

| Amazon | 153.73 | 2.36 | 1.56% | 154.42 | 151.88 | 155.63 | 87.29 |

| Microsoft | 382.77 | 6.98 | 1.86% | 384.17 | 376.32 | 384.3 | 227.33 |

| Dow Jones | 37695.73 | 170.57 | 0.45% | 37740.77 | 37524.4 | 37790.08 | 31429.82 |

| Nasdaq | 16793.04 | 114.34 | 0.69% | 16827.37 | 16654.74 | 16969.17 | 11050.68 |

At present, the BSE Sensex is trading 182 points higher and NSE Nifty is trading 54 points higher.

Bajaj Auto, Reliance Industries and Bajaj Finserv are among the top gainers today.

Infosys, Sun Pharma and Nestle on the other hand are among the top losers today.

Broader markets are trading on a positive note. The BSE Mid Cap is treading 0.6% higher and the BSE Small Cap index is trading 0.7% higher.

Barring IT sector and media sector, all other Sectoral indices are trading positive, with socks in auto sector and power sector witnessing most buying.

The rupee is trading at Rs 82.98 against the US dollar.

In commodity markets, gold prices are trading 0.3% higher at Rs 62,154 per 10 grams today.

Meanwhile, silver prices are trading 0.3% higher at Rs 72,153 per 1 kg.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

Speaking of stock markets, arriving at a reasonable estimate of a stock's intrinsic value is easy. However, there are errors that can creep in and even the most astute analysts can fall prey to them.

So, what exactly are these errors and how are they associated with a stock like Titagarh Rail Systems.

Tune into below video for more

Maruti Suzuki to Expand Plant Capacity

Japan-based Suzuki Motor announced investments worth about Rs 350 billion (bn) in Gujarat on the opening day of the 10th edition of Vibrant Gujarat, which was inaugurated by Prime Minister Narendra Modi, on Wednesday.

Maruti Suzuki India will invest about Rs 320 bn to establish an automobile plant in Gujarat that will eventually produce about 1 million vehicles every year.

The plant is expected to begin operations in FY2028-29.

Maruti Suzuki will invest another Rs 32 bn to set up a fourth production line at its wholly-owned subsidiary Suzuki Motor Gujarat to increase the production of electric vehicles.

Suzuki Motor also plans to export new models of Jawa bikes that are made in India to Japan and European countries.

Maruti Suzuki said it plans to have a production capacity of about 4 million vehicles by FY2030-31.

To mitigate the impact of carbon emissions, the Japanese firm announced it is establishing biogas plants in Gujarat, and will produce compressed natural gas, bio-ethanol and green hydrogen.

Maruti Suzuki is at the forefront of the electric vehicle (EV) megatrend.

The revolution has taken the auto sector by storm. All segments of the sector are ripe for disruption, and India's top EV stocks are set to benefit from this shift.

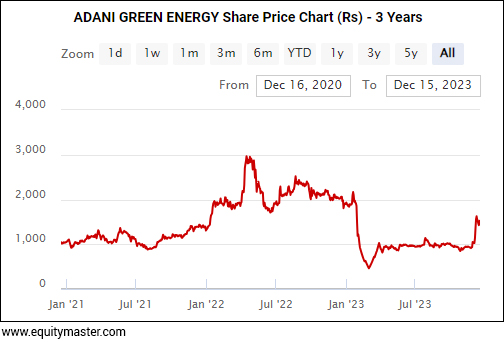

IiAS Opposes Adani Green's Preferential Issue

Proxy advisory firm Institutional Investors Advisory Services ( IiAS ) has recommended investors vote against Adani Green Energy's proposed preferential issue worth Rs 93.5 bn, saying it does not support the choice of warrants instead of equity brought upfront for the fund infusion.

On December 26, during market hours, Adani Green announced a preferential issuance of 63.14 million (m) of warrants to its promoters for Rs 93.5 bn at a per share price of Rs 1,480.8.

The company is seeking shareholder approval for this proposal through an extraordinary general meeting (EGM) scheduled for 18 January and through e-voting between 14 January and 17 January.

The company had said that the funds were to be utilised for deleveraging and accelerated growth capex in Adani Green to deliver 45 GW capacity by 2030.

This transaction follows a successful debt raise of Rs US$ 1.4 billion (bn) earlier in December 2023 and takes the total capital raised to US$ 3 bn.

IiAS, in its report, said it does not support the issue of warrants to promoters because it allows them to ride the stock price for 18 months.

As part of its announcement, Adani Green had said each warrant will be convertible into, or exchangeable for, one fully paid-up equity share of the company, which may be exercised in one or more tranches during 18 months commencing from the date of allotment.

The minimum amount of Rs 370.19 (per warrant), which is equivalent to 25% of the Warrants Issue Price shall be paid at the time of subscription and allotment of each warrant.

One of the best-performing stocks in the market, AGEL saw a steep decline in its value from its 52-week high in January 2023 due to Hindenburg allegations and premium valuation.

All this while its fundamentals remained weak. Back then, the company made losses in 4 of the past 5 years with a balance sheet loaded with debt.

For more, check out the Top 5 Growth Stocks That Could Bounce Back in 2024.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Trades Higher | Bajaj Auto & Reliance Industries Top Gainers | Polycab Slumps 10%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!