India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 6, 2021

Sensex Trades Marginally Lower; Dow Futures Down By 14 Points Wed, 6 Jan 12:30 pm

Share markets in India are presently trading marginally lower.

The BSE Sensex is trading down 27 points, down 0.1% at 48,410 levels.

Meanwhile, the NSE Nifty is trading down by 9 points.

GAIL and ONGC are among the top gainers today. ITC and Reliance are among the top losers today.

The BSE Mid Cap index is trading up by 0.9%.

The BSE Small Cap index is trading up by 0.6%.

On the sectoral front, stocks from the telecom sector are witnessing most of the buying interest.

On the other hand, stocks from the energy sector are witnessing most of the selling pressure.

US stock futures are trading lower today, indicating a negative opening for Wall Street indices.

Nasdaq Futures are trading down by 140 points (down 1.1%) while Dow Futures are trading down by 14 points (down 0.1%).

The rupee is trading at 73.13 against the US$.

Gold prices are trading down 0.3% at Rs 51,548 per 10 grams.

In global markets, gold prices today held firm after hitting a two-month high earlier in the day as investors awaited the outcome of elections in Georgia, US, that will determine control of the Senate.

In Indian markets, gold prices fell today following a sharp surge over the past two sessions. On MCX, gold futures were down 0.3% to Rs 51,546 per 10 grams. In the previous session, gold had jumped 0.6%, tracking a global rally. On MCX, gold futures had surged Rs 1,500 per 10 gram in past two sessions.

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Moving on to stock specific news...

Among the buzzing stocks today is BEML.

BEML, a defence public sector equipment manufacturer under the Ministry of Defence (MoD), has bagged Rs 7.6 billion worth of orders from the MoD for the supply of high-mobility vehicles.

"The equipment will be manufactured at BEML's Palakkad Plant in Kerala. BEML will supply the vehicles to the Indian Army in a span of a year," the company said in a regulatory filing to exchanges.

The high-mobility vehicles will play a key role in the logistics management of the Army, leveraging its exceptional cross-country capabilities. The vehicles will enable armoured fighting vehicles, troops, ammunition and stores to be moved to far-flung, difficult terrains in operational areas.

We will keep you posted on more updates from this space. Stay tuned.

At the time of writing, BEML share price was trading up by 1.7% on the BSE.

Speaking of the stock markets, Brijesh Bhatia, Research Analyst at Fast Profits Report, talks about the best sector for 2021, in his latest video for Fast Profits Daily.

Tune in here to find out more:

Moving on to news from the energy sector...

Credit Suisse Says Aramco May Revive Reliance Deal If Oil Prices Continue to Rise

Foreign brokerage firm Credit Suisse believes that global oil producer and refining giant Saudi Arabian Co, better known as Saudi Aramco, may revive its interest in buying the 20% stake in Reliance Industries (RIL) energy business if global crude oil prices continue their upward trend.The deal is not yet closed and with Saudi Aramco not bidding for BPCL (Bharat Petroleum), it is possible that with recovery in oil prices above US$ 50-55/barrel, the deal could be revived," the brokerage house said in a note.

In 2019, Chairman and Managing Director of RIL, Mukesh Ambani had announced to shareholders that the company had entered into a non-binding memorandum of understanding (MoU) with Aramco for the sale of 20% stake in RIL's oil-to-chemical business at an enterprise valuation of US$ 75 billion.However, the onset of the coronavirus pandemic in March and the crash in global crude oil prices in the first quarter of 2020 lead to Saudi Aramco shelving all capital investment plans for the foreseeable future.

At its end, RIL has prepared the court for an eventual sale of a stake in its energy business as in April it announced that it will be hiving off its oil-to-chemical business to subsidiary Reliance O2C. In late 2020, the company disclosed the scheme of arrangement for the eventual demerger of the energy business.

An improving global crude oil price scenario could potentially allow Aramco to free-up capital as the pressure on its balance sheet eases.

Note that global crude oil prices have risen more than 30% since November on the back of optimism for demand recovery in 2021 due to faster-than-expected normalisation of global economic activity.

How this deal pans out remains to be seen. Meanwhile, stay tuned for more updates from this space.

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

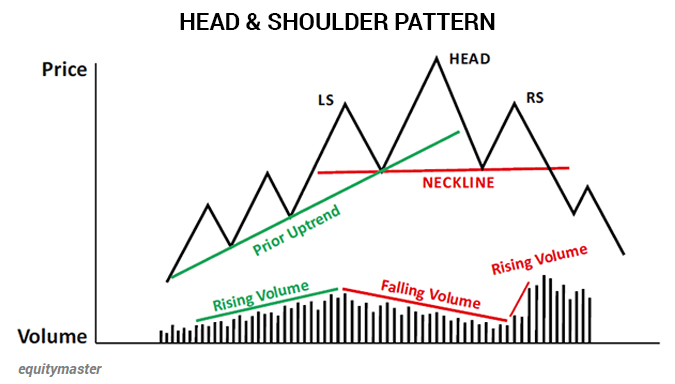

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the recent editions of Profit Hunter here: It's When You Sell that Counts

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Marginally Lower; Dow Futures Down By 14 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!