India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 6, 2017

Indian Indices Trade Near the Dotted Line; Banking Stocks Witness Buying Fri, 6 Jan 11:30 am

After opening the day on a flat note, the Indian share markets registered marginal gains and continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the banking sector and metal sector witnessing maximum buying interest. Stocks in the realty sector and IT sector are trading in the red.

The BSE Sensex is trading down 7 points (down 0.03%) and the NSE Nifty is trading flat. The BSE Mid Cap index is trading up by 0.2%, while the BSE Small Cap index is trading down by around 0.1%. The rupee is trading at 67.89 to the US$.

The German Purchasing Managers' Index (PMI) for manufacturing rose to 55.6 from 54.3 in November. This was seen as its highest level in 35 months. The uptrend here was driven by rising demand from Asia and the US.

Data showed that manufacturers in Germany raised their output at a quicker pace. The output expansion was seen on back of improvement in domestic demand and new business overseas.

Another set of data for Germany showed that inflationary pressures increased in December. Input costs rose at the fastest pace due to weaker euro. German Inflation jumped closed to ECB's target of 2%, hitting the highest level in more than three years.

The ECB has been pouring money into the euro zone economy in an attempt to boost inflation from a near-deflationary level. However, the strong inflation data will lead ECB to reserve the stimulus.

In our view, a big crisis is brewing within the eurozone. And this is going to have major consequences for the global financial markets, including the Indian stock markets. While the above data comes as a relief for the eurozone, the area's still a mess. First came the Grexit saga. Then there was Brexit. Now it's Italexit. In a recent referendum, the Italians voted to reject constitutional reforms, leading Prime Minister Matteo Renzi to resign. One of the recent issues of Vivek Kaul's Inner Circle (requires subscription) presents an insight on Italexit from our global team of experts in London and other major world centres. We strongly recommend you to read it. Also, if you want to know what's really happening in the world of man and money, you can claim your free copy of Bill Bonner's latest book, Hormegeddon.

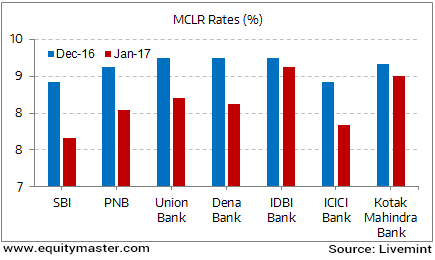

Moving on to news from the banking space... Many banks haves pared their lending rates. The State Bank of India (SBI) slashed lending rates by a whopping 0.9% across all loan products. Also, other banks including ICICI Bank, Union Bank of India, Punjab National Bank, and IDBI Bank have followed suit and cut their lending rates. This is seen on the back of deposit surge post demonetisation.

Furthermore, some banks have announced a significant cut in their MCLR rates. The MCLR rate is used as a benchmark rate for new loans.

Interest Rates Finally Headed Down South?

Essentially the banks are now aggressive on the rates cut in the hope of riding on some credit growth. The Reserve Bank of India data suggest a slowdown in India's credit growth. This is languishing at 5.8% YoY.

However, some points in inquiry are- Will rate cuts alone be a panacea for the economy? Can low lending rates kickstart investments and put the economy back on the high-growth path?

We don't think so. The prevailing economic conditions do not seem to favor the investment scenario. The tepid investment climate in the country has, in fact, deteriorated further post the demonetisation move.

As one of our editions of The 5 Minute WrapUp states:

- The overall impact of this rate cut on stimulating credit growth remains to be seen. However, one important aspect that is over looked by everyone is the impact of chasing growth on the bank's bottom-line. An aggressive cut on the lending rates while keeping the deposit rates relatively higher would impact banks profit margins. The present drive though seems firmly towards boosting credit growth and bringing more business to the banks.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Trade Near the Dotted Line; Banking Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!